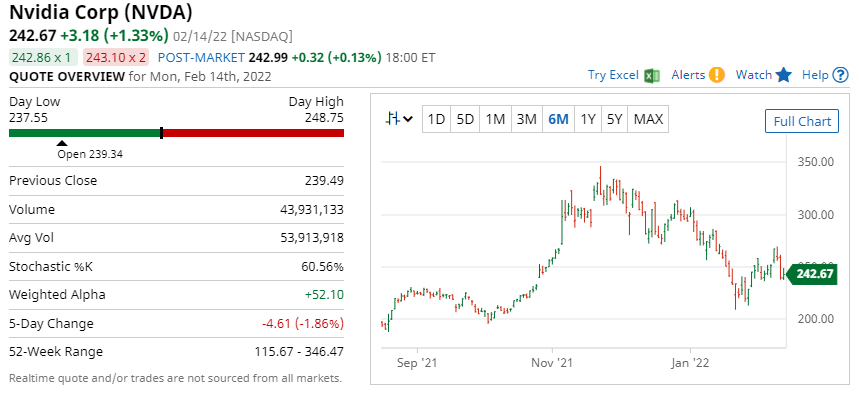

Nvidia(NVDA$:NVIDIA Corp(NVDA)$ ) is due to report earnings this Wednesday after the market close. The Barchart Technical Opinion rating is an 8% Buy with a Weakening short term outlook on maintaining the current direction.

Nvidia rates as a Strong Buy according to 21 analysts with 1 Moderate Buy rating and 3 Hold ratings. Implied volatility is 69% which gives NVDA and IV Percentile of 99% and an IV Rank of 80%

Today, we will analyze three different ideas:

- A Short Iron Condor

- A Bull Put Spread

- A Short Strangle

Short Iron Condor

The first strategy is a short iron condor. An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range. When implied volatility is high, the wider the expected range becomes.

The maximum profit for an iron condor is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Using the February 18 expiration, traders could sell the 220-strike put and buy the 215-strike put. Then on the calls, sell the 270 call and buy the 275 call. Earlier today, that condor was trading around $1.70 which means the trader would receive $170 into their account. The maximum risk is $330 for a total profit potential of 51.52%. The profit zone ranges between 218.30 and 271.70. This can be calculated by taking the short strikes and adding or subtracting the premium received.

Let’s take a look at another potential option strategy.

Bull Put Spread

Trade thinking that NVDA might move higher after earnings could just trade the bull put spread side of the iron condor. Trading just the bull put spread side would involve selling the Feb 18th 220 call and buying the 215 call. This spread could be sold earlier today for around $1.00 or $100 in total premium. The maximum gain is $100 with total risk of $400 for a potential return of 25% with a breakeven price of 219.

The final idea we will look at is a short strangle.

Short Strangle

Short Strangles involve naked options so are not recommended for beginners, but let’s take a look at how we might set one up for NVDA earnings.

A short strangle could involve selling the 220-strike put and 270-strike call. Unlike the iron condor, with a short strangle, there is no protection via the bought options. As such, short strangles have unlimited risk and are therefore not suitable for beginners. Selling this short strangle would generate around $640 in premium. The breakeven prices for the trade would be 213.60 and 276.40. These call the calculated by taking the short put strike and subtracting the total premium. Then taking the short call strike and adding the total premium.

Conclusion And Risk Management

There you have three different trade ideas for Nvidia’s earnings. The iron condor and bull put spread are risk defined trades, so you always know the worst case scenario even if NVDA makes a bigger than expected move. Short-term trades over earnings such as these ones are almost impossible to adjust. Either the trade works, or it doesn’t so position sizing is vital. Short strangles involve naked options and should be avoided by beginner traders.

Short-term trades also have assignment risk, so traders need to be aware of that possibility.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

Comments