An analysis on SPY500/SPX500 movements based on recent events.

Many reputable analysts and hedge fund managers have deemed the U.S. market to be over-extended - a direct consequence of the overprinting of money to counteract the pandemic that broke out in Q1 of 2020, resulting in inflation. To make things worse, the Consumer Price Index (CPI) has risen a further 0.6% over the past week, driving up the annual inflation rate to 7.5% (source: CNBC, 2022).

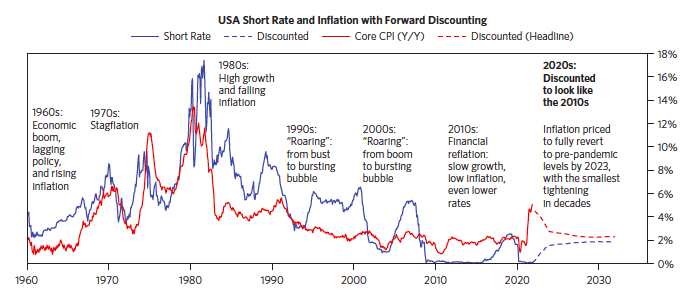

In a recent interview, Central Bank Chairman, Jerome Powell, admitted that he made a mistake in thinking that inflation is transitory, therefore deciding to end the QE in March 2022 - resulting in an immediate market correction of about 10%. He also spoke on his new philosophy - raising interest rates at a minimal level over a long period of time to contain inflation (for e.g. not more than 2% over a lengthy period) and to ensure price stability in the market.

In detail, this new philosophy targets an average rate of inflation over time without clear time frames or metrics. This supports delayed action by the Feds and gives them flexibility in containing inflation in its early stages while still complying with its mission of price stability.

However, I believe this new philosophy may create a deeper correction in the event that interest rates exceed 2% - a likely scenario if the CPI were to rise further resulting in a higher annual inflation rate.

Why? - The markets are discounting a smooth transition to non-inflationary growth without the need for aggressive tightening.

Founder of the world’s largest hedge fund firm - Bridgewater Associates, Ray Dalio, mentioned that the feds did not account for any inflationary growth when they decided to implement interest rate slowly over time to reduce inflation during its infancy, as opposed to the general measure of counteracting high inflation - increasing interest rates rapidly (aggressive tightening).

The Feds were forced to opt for a less aggressive tightening due to a pandemic-ridden economy and asset markets (especially in the US) being more sensitive to rate rise than in the past - caused by high valuations and long durations, driven in large by low interest rates and plentiful liquidity (excessive stimulus).

This in turn creates two unique risk situations - firstly, asset values may fall due to a sustained rise in inflation. Secondly, central banks may fall further behind the rising inflation and will be forced to aggressively catch up.

Dalio also believes that if both the CPI and rate of inflation were to rise higher, the Feds may be forced to counteract by aggressively raising interest rates by well over 2% in the near term, which may more than likely result in a deeper correction.

Technical Analysis

Based on technical analysis alone, how may the general market react?

In my opinion, these are the two scenarios that may unfold when the interest rates are actually raised:

Black Path Arrow: The four separate forecasted rate hikes and QE halt have been priced in, resulting in a consolidation before an upward trajectory towards 4700 or new all time highs(ATH).

Red Path Arrow: Neither the QE halt nor the four separate occasions of forecasted rate hikes has been priced in, resulting in further correction of at least 10-12%.

Conclusion

When this happens, expect a repeat of the dot.com and 2008 financial crisis. Some of the companies that were caught on the wrong end of these financial events are now either out of business or taken over by other entities.

For value investors, this will be a fantastic opportunity to buy fundamentally good businesses at a discount, as most of them may be at their intrinsic value or less, depending on the sector. It will be foolish to not buy them up, unless your funds are insufficient. If you are not confident, do not use margin to purchase your securities, you might end up losing it all.

Therefore, only invest with calculated risks and use a margin of safety to cushion unsuspecting blows.

As always, stay safe, and may the market be ever in your favour~

$SPDR S&P 500 ETF Trust(SPY)$$DJIA(.DJI)$

Credits: @rafiquartz

Comments