The post of last two weeks told everyone that crude oil has the possibility of forcing positions. "Forcing positions" is a major feature of commodity futures, Because commodities are different from stock indexes, physical delivery is ultimately needed (although the delivery volume is small, it is the anchor of futures pricing). In the world, there is more money than goods. Once the supply of certain commodities is in short supply, it will lead to capital hoarding and forcing the demander to take over at a high price. However, this process often leads to forced positions in commodity futures.

Forcing positions can be either rising (shortage of supply) or falling (oversupply), but generally speaking, there are more forcing positions in short supply. At present, the situation of crude oil has sufficient reasons for forcing positions. First, the increment of OPEC in oil-producing countries is limited, the increment of shale oil in the United States is uncertain and slow, and the demand side is difficult to decline like a cliff with the recovery of the epidemic, which causes a large amount of funds to form a consensus and expects oil prices to keep rising.

The height of the forced market is difficult to predict, and with the emergence of some major bad news, the reversal will be very rapid. Therefore, how to deal with the forced market safely needs to use the following ways.

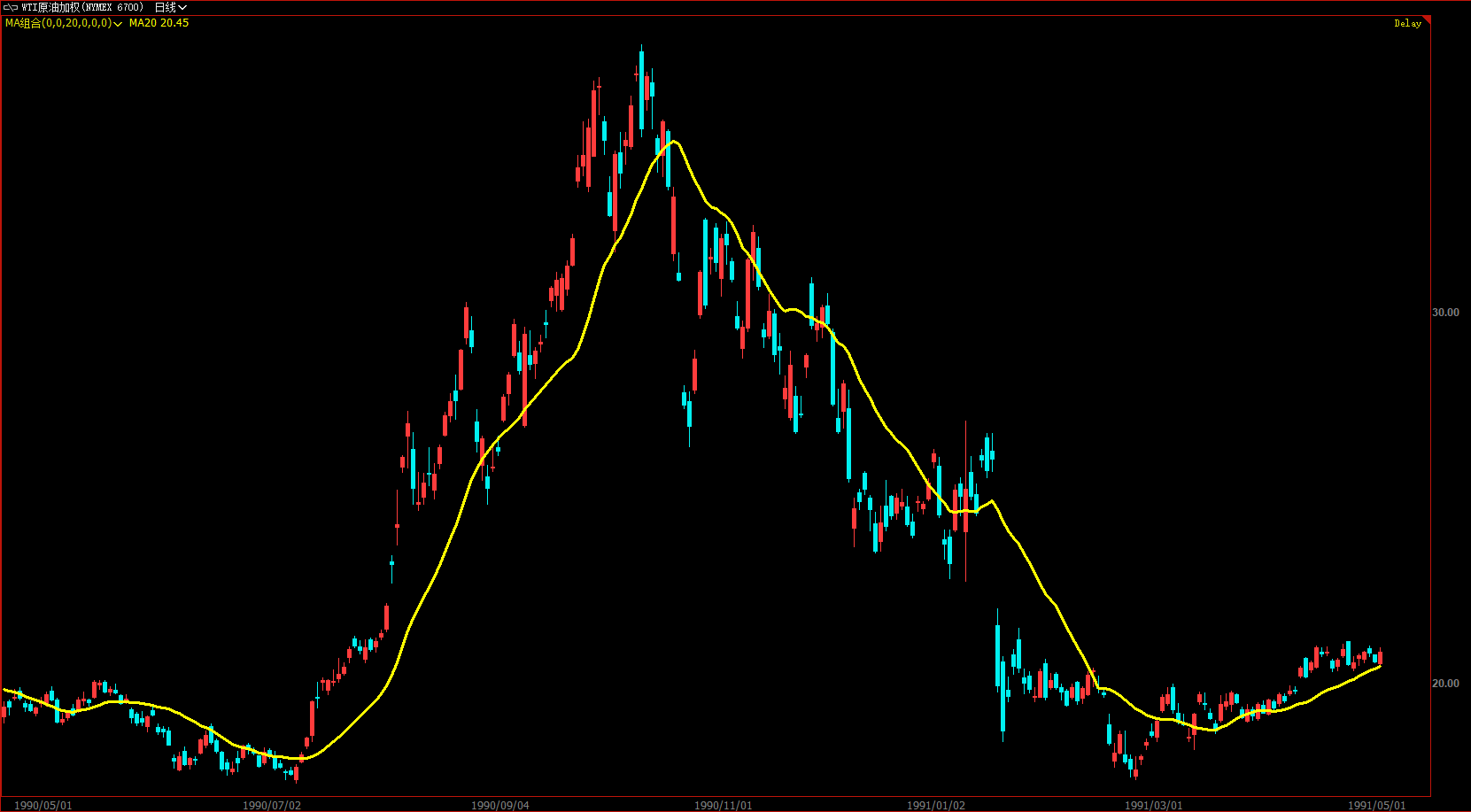

(Where to rise and go back is the characteristic of forcing the market)

Coping method 1: Buy imaginary call options

Since it is a forced market, the natural market is excited, and no one can tell where it will rise, but it is afraid that the sudden reversal of oil prices will cause uncertain losses. At this time, the best way to chase up is to calculate the amount of risk losses and buy virtual call options.The characteristic of call options is to lose money, so in the face of excited market, the only thing you can be sure of is the amount of loss you expect. If the market continues to rise, options will bring multiple returns. If it is not as expected, the losses will be fixed, and sleeping at night will be relatively reassuring. In the current market, since so many institutions expect WTI to exceed $100, they will not buy the call option with the strike price of $100 to see if it can be fulfilled in the short term.

Coping method 2: Make long contracts in recent months and short contracts in far months

The rising market is generally caused by the recent shortage, so the more out-of-stock the price rises more severely. Therefore, the price increase of futures contracts in recent months is often larger than that of futures contracts in far months. The maximum contract price difference in crude oil history can reach 20%-30%, while the current contract price difference is about 10%, so there is still room for further widening.

The risk of this strategy is that once the shortage expectation is reversed, the decline of contracts in recent months will be greater than that of futures contracts in far months, resulting in strategic losses, but it is much smaller than the unilateral decline.

Coping method 3: EMA stop loss (counter-technique)

If you don't want to use the aforementioned strategies, you can only strictly implement stop loss to trade futures. The peak of a forced market is usually a V-shaped reversal, so once the top is determined, the probability of backhand shorting is quite high. So which moving average is the most suitable? This depends on the rising speed. But generally speaking, the smallest parameter is the 5-day moving average, and the safest parameter is still the 20-day moving average. Bulls who fall below the 20-day moving average must leave the market, while short sellers try their best to take the new high position as the stop loss position, and keep short positions below the 20-day moving average.

$Light Crude Oil - main 2203(CLmain)$ $Natural Gas - main 2203(NGmain)$ $Gold - main 2204(GCmain)$ $E-mini Nasdaq 100 - main 2203(NQmain)$

Comments