Risk events came in European and American banks recently. Both the Federal Reserve and the Swiss National Bank took immediate measures to deal with it. Although the market is questioning the methods appropriate, there are no obvious signs of system risk for now.

Banking pressure increased

Interest rate hike in the past year has caused the problems of short-term borrowing and long-term mismatch in the banking industry to break out intensively. Recently, the capital outflow pressure of banks, especially small and medium-sized banks, is relatively high. However, from the overall situation, the pressure is still within the controllable range.

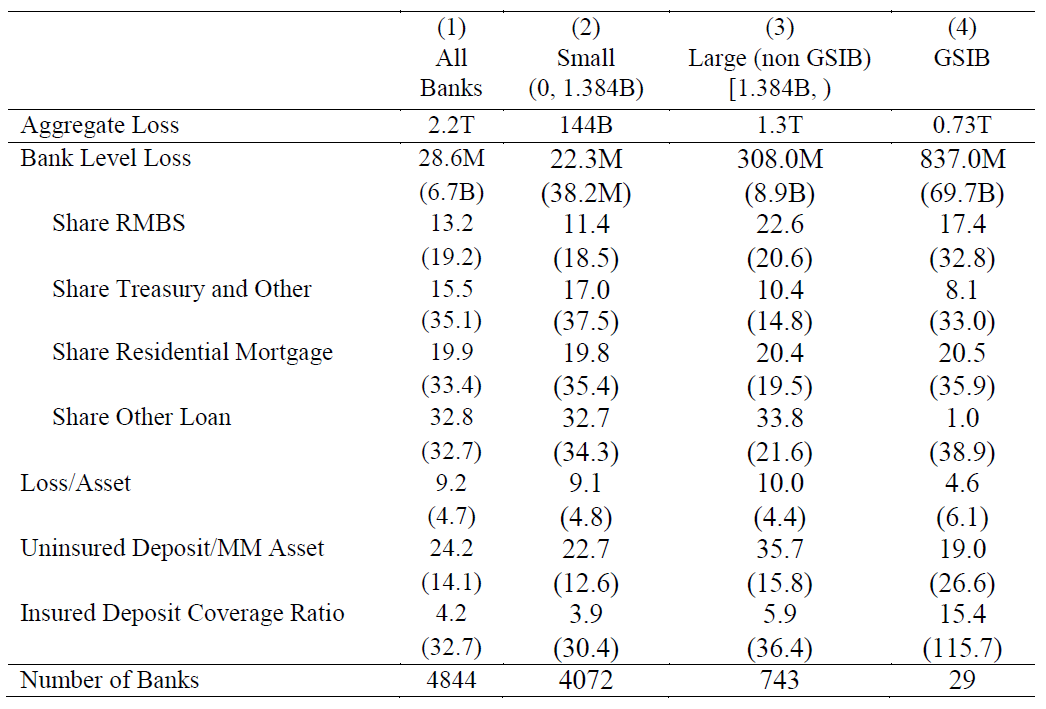

According to the Fed's 2022 stress test results, under the extreme stress scenario, the total CET1 ratio of 33 major US banks will drop from 12.4% of 4Q21 to 9.7%, still higher than the 4.5% stipulated by Basel III. According to NBER's calculations, almost all but two banks have enough assets to pay their deposits that are not guaranteed by the FDIC, even if the bank assets are calculated in terms of market-to-market after taking into account unpaid losses.

However, if all unsecured depositors (deposits greater than 250,000 US dollars) will withdraw money and cash, the repayment ratio of guaranteed deposits of 1,619 banks (33%) will be negative, totaling about 2.6 trillion US dollars of guaranteed deposits (15% of total deposits) or affected; If 50% of unsecured depositors withdraw money, a total of about $300 billion of guaranteed deposits in 186 (4%) banks will be at risk.

At the same time, more banks would be at risk if the withdrawal of uninsured deposits led to a small sell-off.

According to the data of EPFR, a data provider, as of March 26th, more than US $286 billion had flowed into money market funds in March, the largest inflow since the beginning of the epidemic. The surge in funds pushed the total assets of the money fund to a record high of $5.1 trillion.

How's Fed's reaction?

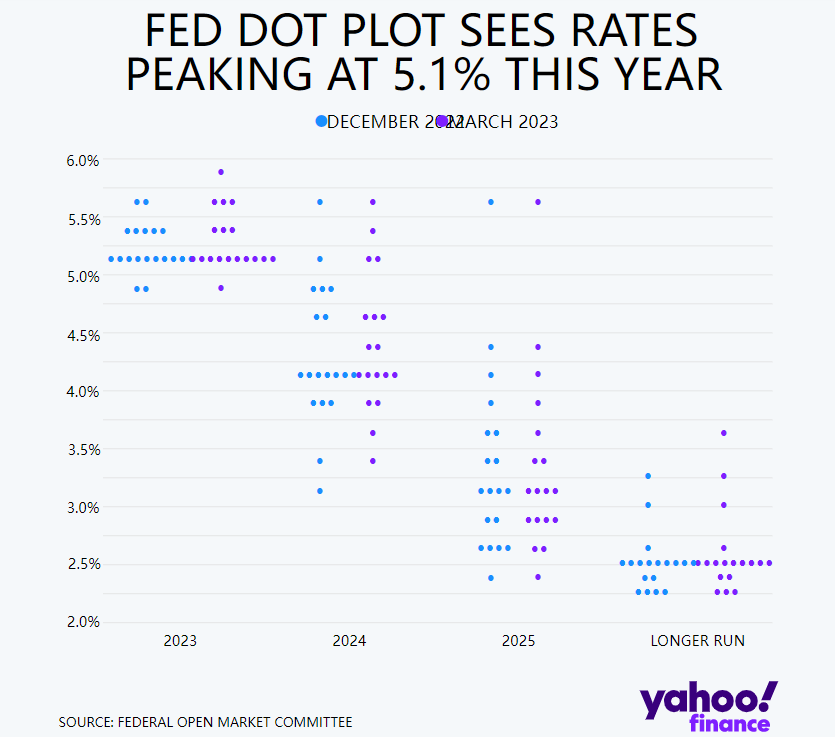

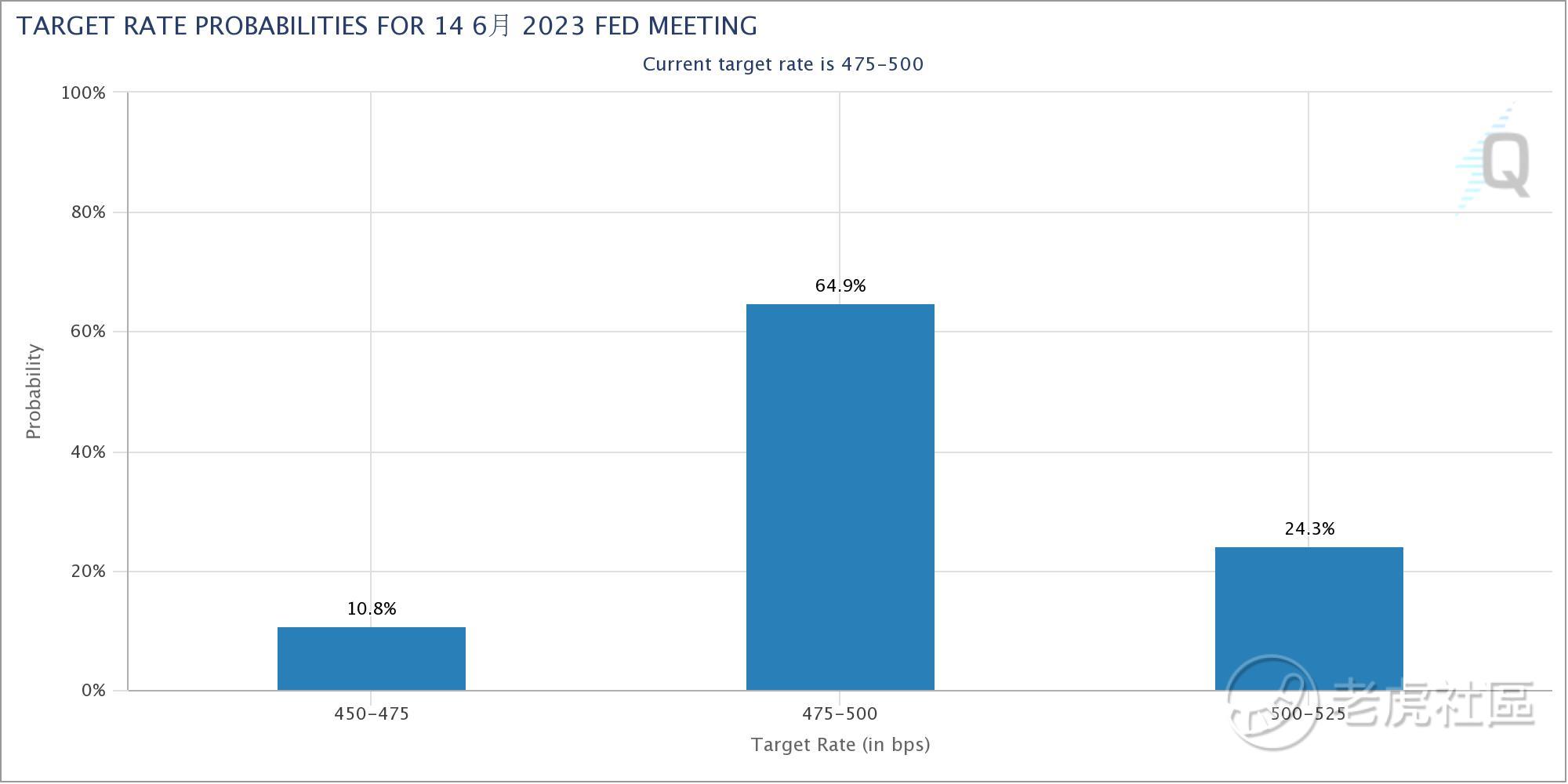

At the March FOMC meeting, the Federal Reserve carefully chose a "compromise" plan, that is, to continue the rate hike by 25 basis points to 4.75 ~ 5%. At the same time, some changes in wording suggested that the rate hike might gradually come to an end. The bitmap has not changed much, probably because the Fed needs to see more changes in data.

Therefore, for the "interest rate cut" expected by the market, I'm afraid the Federal Reserve has not stated that it will start in 2023 for the time being. On the one hand, it depends on inflation, on the other hand, it depends on how the risks in the financial system will develop now.

On March 24th, Nick Timiraos, the nearest person to Federal Reserve, answered questions on Reddit. He said that the Federal Reserve would not consider abandoning the "2% inflation target" at present, because it might reduce its "credibility". But the Fed wants to slow economic activity, most notably in the form of reduced demand for labor-or higher unemployment. The Fed is nervous about easing rate hike prematurely because they don't want the economy to accelerate again and the price pressure to intensify or last longer.

That is to say, the Federal Reserve will not cut interest rates easily. At present, inflation in the United States is still high, and bank risks have not yet developed to the point of systemic risks. The Fed hopes to start the process of cutting interest rates or easing after economic activity begins to weaken.

The Fed is more likely to guard against financial risks while maintaining high interest rates, and provide liquidity to troubled banks through discount windows, bank term financing programs (BTFP) and other tools to help them cope with the risk of a run.

According to the Fed's policy observation tool, the market expects the Fed to cut interest rates in June, but the market expectations often change and are too optimistic for a long time.

Comments

这篇文章不错,转发给大家看看

https://tigr.link/1tUHHZ