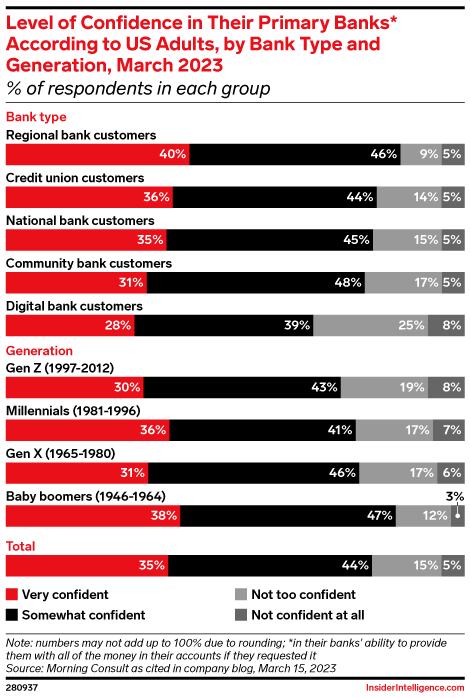

As the Q1 financial reports of the banking industry gradually come out, the liquidity crisis in the banking industry represented by Silicon Valley Bank (SIVBQ) in March will also bring more clues in performance disclosure. Core factors such as deposits, liquidity, and balance sheets that have caused recent market volatility will become the core focus of the US banking industry.

Large banks: Most performances are good and stock prices rise but are also affected by other macroeconomic factors.

Net profit increased 52% year-on-year to $12.6 billion;

Revenue reached a record high of $38.3 billion, a year-on-year increase of 25%, higher than market expectations of $36.2 billion.

New loans amounted to $37 billion, while market expectations were for a decline.

Investment bank business was sluggish with revenue down 24% to $1.6 billion;

* JPMorgan Chase's Q1 earnings report released on April 14 left a deep impression on investors because its profits exceeded expectations and interest income offset weak performance from trading departments, causing its stock price to soar by 7%. Similar large banks followed suit because their size can provide security for customers amid increasing uncertainty. In addition, commercial real estate loans overall have low risk at JPMorgan Chase; office buildings only account for 10% of its commercial real estate exposure and are concentrated in densely populated urban markets.

Net income increased by 15% year-on-year to $8.2 billion, while revenue increased by 13% year-on-year to $26.3 billion.

Net interest income increased by 25% year-on-year to $14.4 billion.

Investment bank fees decreased by 20% year-on-year to $1.2 billion.

Deposits decreased by 7.8%.

* Wealth management accounts performed relatively poorly due to trends where funds flowed from low-yield accounts to high-yield accounts, as well as the dual impact of low deposit balances and non-interest-bearing deposits turning into interest-bearing ones. Net interest income in Q1 decreased slightly compared to Q4.

Revenue increased by 12% year-on-year to $21.4 billion, while net profit increased by 7% year-on-year to $4.6 billion.

Personal banking revenue increased by 18% year-on-year, with deposits at around $1.3 trillion, roughly flat compared to the same period last year but down 3% quarter-over-quarter.

Investment bank business revenue decreased by 25% year-on-year to $774 million.

* Citigroup attributed its growth to strong consumer spending and higher rates but consumer deposits stagnated compared with some competitors. Meanwhile, since its investment portfolio is mainly composed of highly liquid US government bonds, institutional bonds and other sovereign debt securities that are evenly distributed between available-for-sale and held-to-maturity portfolios with an average bond duration of less than three years, it can benefit from higher rates. The company's guidance for full-year revenue and expenses remains unchanged; rates may stabilize after Q2.

Revenue increased by 17% year-on-year to $20.73 billion while net profit rose by 32% YoY to $4.99 billion

Net interest income grew faster than expected up 45%, reaching $13.34bn

Deposits fell by two percent month-over-month or seven percent YoY

Reserves worth USD1.bn were set aside for credit losses related commercial real estate loans , credit cards & auto loans - a rise of26%.

*The bank's customer activity remained relatively strong with delinquency rates still at low levels but businesses that could pose risks such as commercial real estate loans are being reduced while the company is also actively exiting some higher-risk mortgage loan businesses.

Revenue decreased by 5% YoY to $12.22 billion, worse than expected; profit plummeted by 18% to $3.23 billion, including a loss of about $470 million from the sale of Marcus loan portfolio.

Investment banking fees were $1.58 billion, down 26% year-on-year.

Net interest income was $1.78 billion, down 14% year-on-year and is expected to further decline this year.

* Goldman Sachs' profits shrank due to disappointing consumer banking business and weak trading that hurt growth.

Profit fell by 19% YoY to $2.98bn while revenue slid by two percent YoY to $14.52bn;

Investment bank business revenue declined by 24% YoY to USD1.bn which was slightly higher than market expectations;

Wealth management is a bright spot with net new assets attracting worth USD110 bn;

The bank also set aside reserves worth USD234mn for credit losses compared with an increase of only USD87.

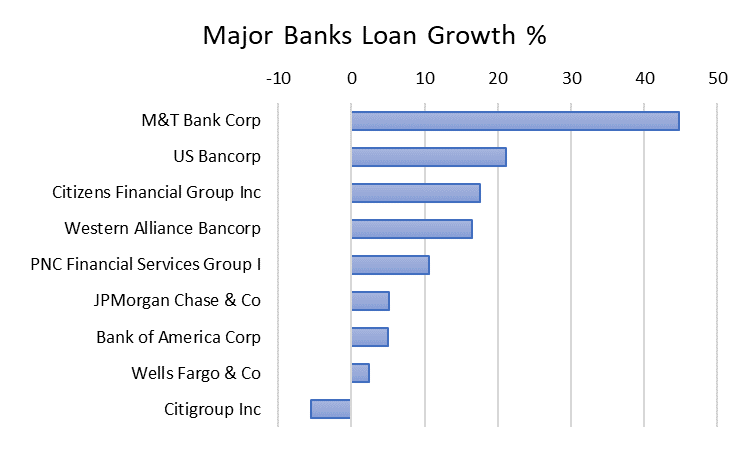

Overall, major US banks have generally been immune to the run on regional banks but have also been affected by other macroeconomic factors.

Large US banks experienced deposit inflows during the banking crisis in March, but they did not raise savings account rates, meaning they could earn more excess interest income. Net interest profit in Q1 exceeded expectations.

Consumers may turn to credit to maintain their livelihoods amid anxiety about potential runs, geopolitical tensions, sustained high inflation, continued quantitative tightening policies by the Federal Reserve and growing expectations of a US economic recession. All banks including large ones may continue to increase loan loss reserves thereby reducing profits.

The impact of continued rate hikes remains. Although there has been a turning point in CPI growth since October 2022 with slight decreases in inflation, core inflation remains stubborn and it is highly probable that there will be another 0.25% rate hike in May which means that bank balance sheets will continue to face liquidity challenges.

Fed May Target rate high pro over80%

Investor confidence has changed. On one hand, slowing economic activity has significantly reduced investment bank business activity which may continue to be affected by decreased trading volume and slower transactions; on the other hand investors demand higher returns on investments due to current high-interest environment which means more deposits are likely flowing into wealth management departments with higher requirements for transaction capabilities and risk control levels from US banks. Recently Apple and Goldman Sachs launched accounts similar to change management accounts with interest rates as high as 4.15%.

Regional Banks: Deposit outflows evident but overall Q1 performance was not necessarily fully impacted under expected full-year guidance adjustments.

Amongst banks with assets between $50 billion USD - $100 billion USD only First Horizon National Corporation $First Horizon National(FHN)$ , $Western Alliance(WAL)$ , $Zions(ZION)$ and $Wintrust(WTFC)$ released financial reports so far; only WTFC's net profit margin exceeded expectations while all four had lower than expected net interest income.

Although $PNC Financial Services Group Inc(PNC)$ Financial Services Group's Q1 profit was better than expected mainly due to increased service fee income and lower reserves and expenses, it lowered its one-year revenue guidance given the increasing uncertainty. Banks may also be unwilling to provide long-term prospects.

In addition, banks with assets between $20 billion USD - $50 billion USD are expected to report higher quarterly earnings per share. Similar to larger peers, most companies are expected to see year-on-year growth in earnings per share.

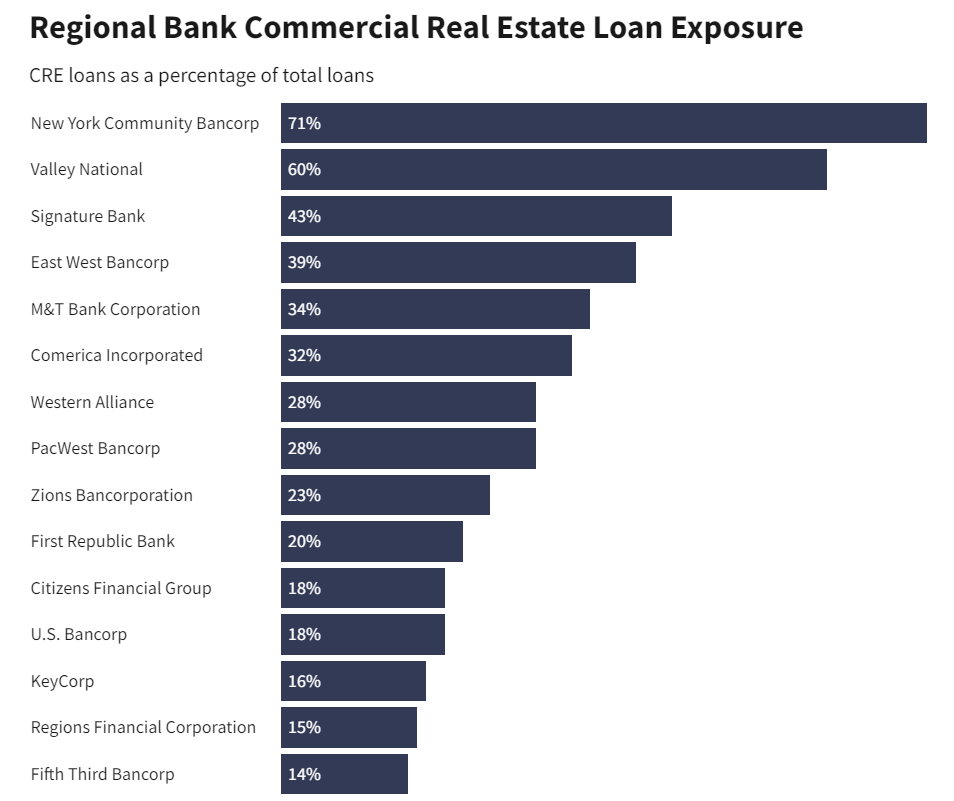

It should be noted that a large exposure of commercial real estate (CRE) loans could exacerbate the plight of regional banks already suffering from unrealized losses. Commercial real estate accounts for 44% of total loan portfolios for 27 small and medium-sized banks.

Investment Highlights

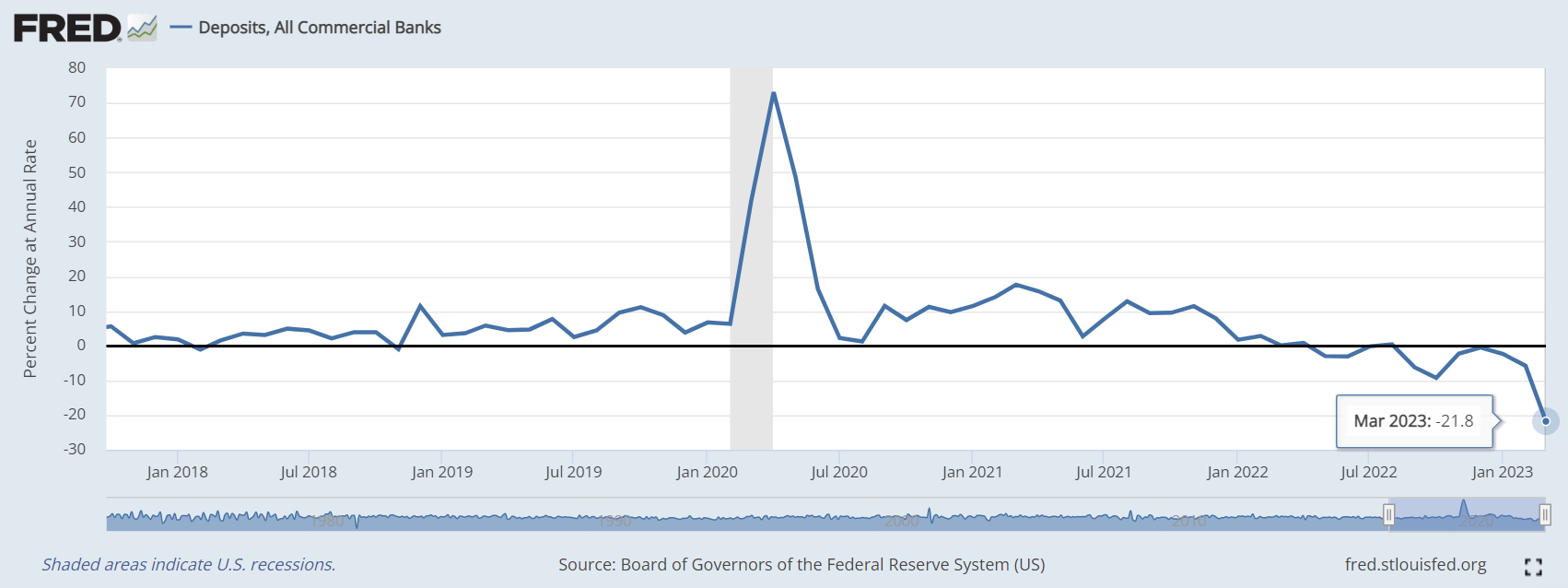

Liquidity pressure has temporarily eased, and deposit and loan activities have shown signs of recovery.

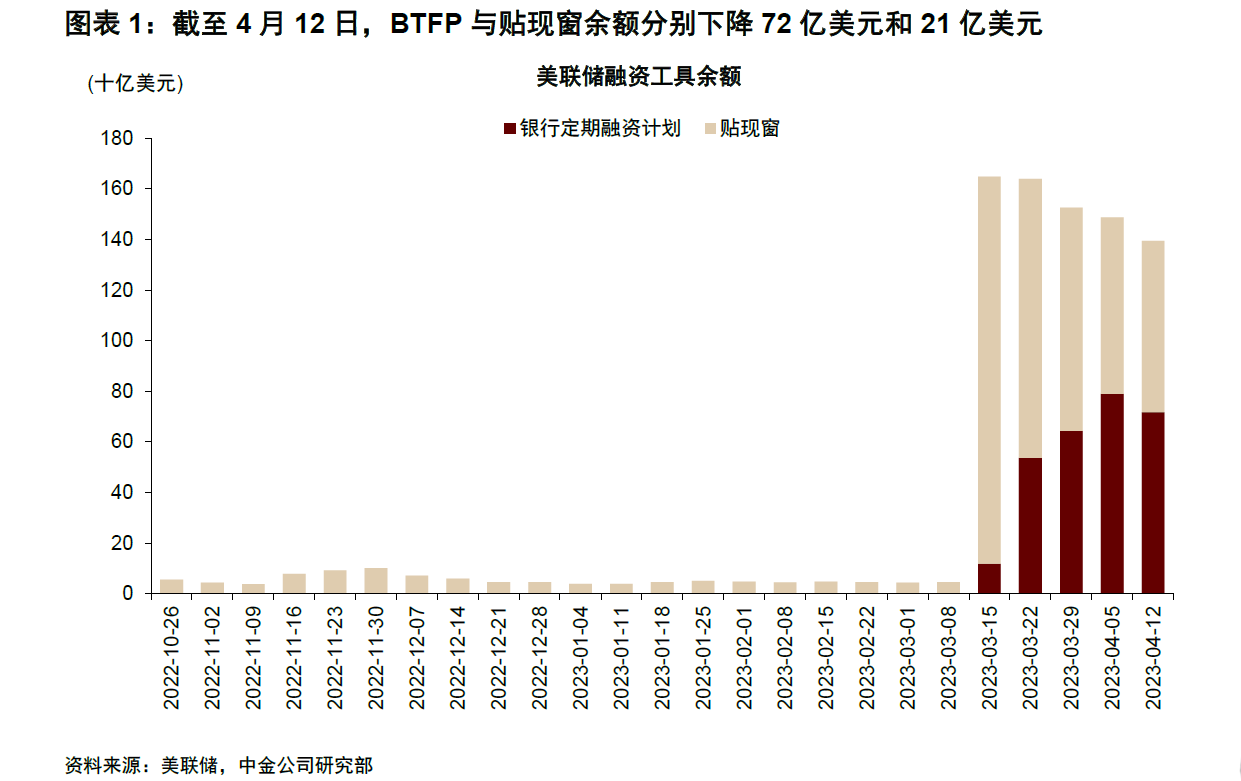

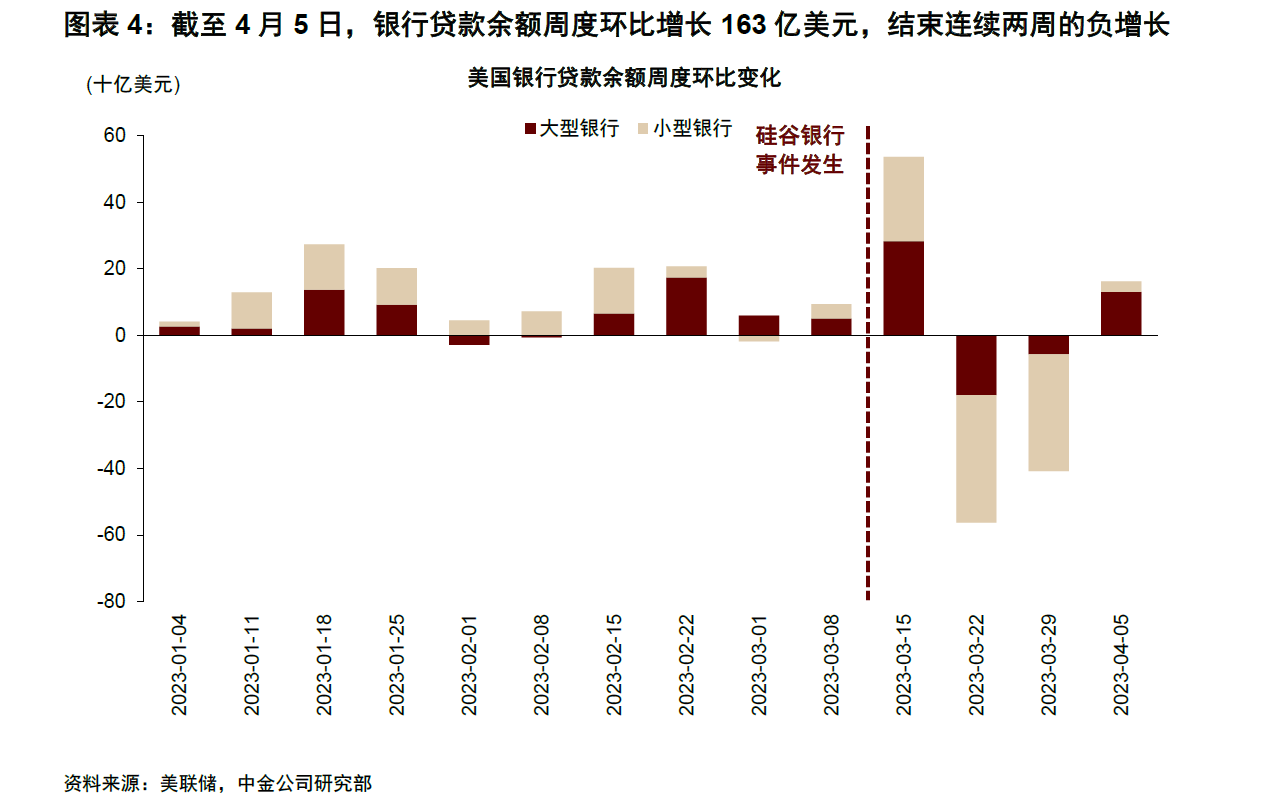

The balance of the US Federal Reserve's BTFP tool has decreased for four consecutive weeks, with deposit growth at both large and small banks turning positive. Since the Fed launched two financing tools on March 15th, its balance has fallen from a high point of $164.8 billion to $139.5 billion on April 12th, continuously improving liquidity in the banking industry. At the same time, bank deposits have increased week-on-week since March 15th, with large banks increasing by $21.1 billion and small banks increasing by $23.6 billion; loan balances also showed an increase compared to the previous week.

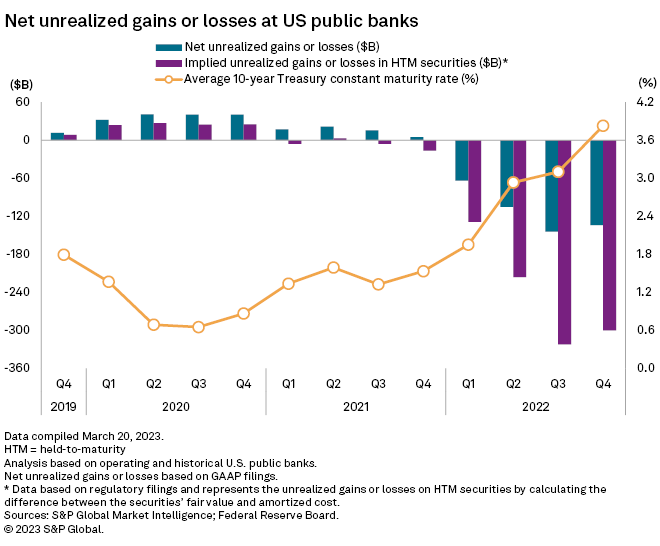

Banks are adjusting their investment portfolios and paying attention to changes in small- and medium-sized bank balance sheets.

Due to rising benchmark interest rates, most US banks' investment portfolios (mainly bonds and MBS) are experiencing significant losses that may continue due to higher financing costs. Meanwhile, after the liquidity crisis, "credit tightening" has further increased pressure on the banking industry.

Currently, industrial loans, consumer loans and commercial real estate loans have seen a significant decline in year-on-year growth rate. As smaller banks' assets are more related to commercial credit lines than larger ones', they invested 80% of their total assets into commercial real estate loans by Q4 2022 - making them more vulnerable if risks arise in this area. This is why JPM stated during its Q1 conference call that it did not believe there was currently any reason for "credit tightening," but admitted that future lending standards would tighten especially in some property-related areas.

Credit tightening could further increase recession risk as current delinquency rates for commercial real estate remain historically low but show signs of rising along with continued interest rate hikes - which will affect smaller banks more than larger ones.

As the era of low interest rates passes, banks will pay more attention to profit indicators.

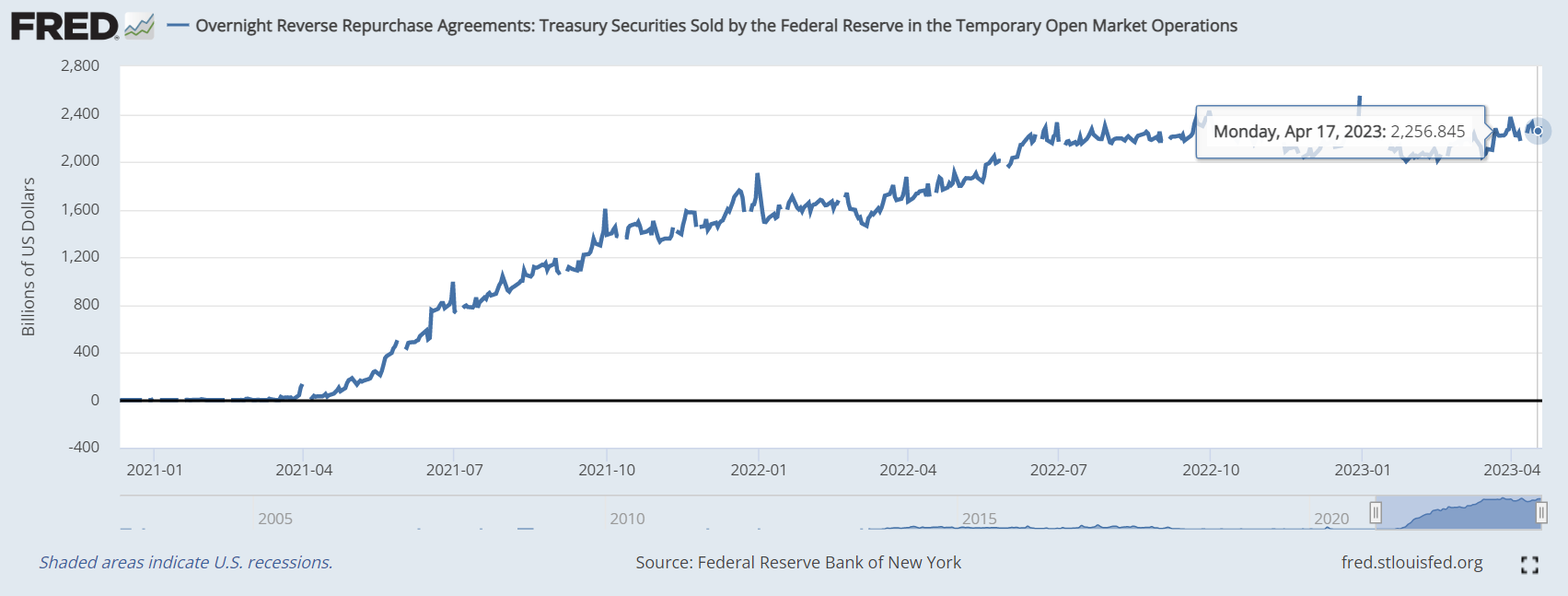

Bank deposits are flowing into the Fed's overnight reverse repurchase tool, and many customers are withdrawing their deposits to invest in other higher-yielding financial products. Ironically, large banks offer lower interest rates to depositors than smaller ones - which forces them to withdraw from more high-yield money market products. Money market funds and short-term debt provide depositors with richer returns. Regional banks have also begun raising deposit interest rates while actively expanding their business in large-denomination certificates of deposit (CDs) to increase attractiveness for depositors.

In addition, corporate deposits have stronger stickiness relative to retail ones because small- and medium-sized enterprises often choose to place their deposits at the same bank where they receive preferential loan rates. Therefore, small- and medium-sized bank deposits are expected to rebound somewhat in Q2.

Comments

Great ariticle, would you like to share it?