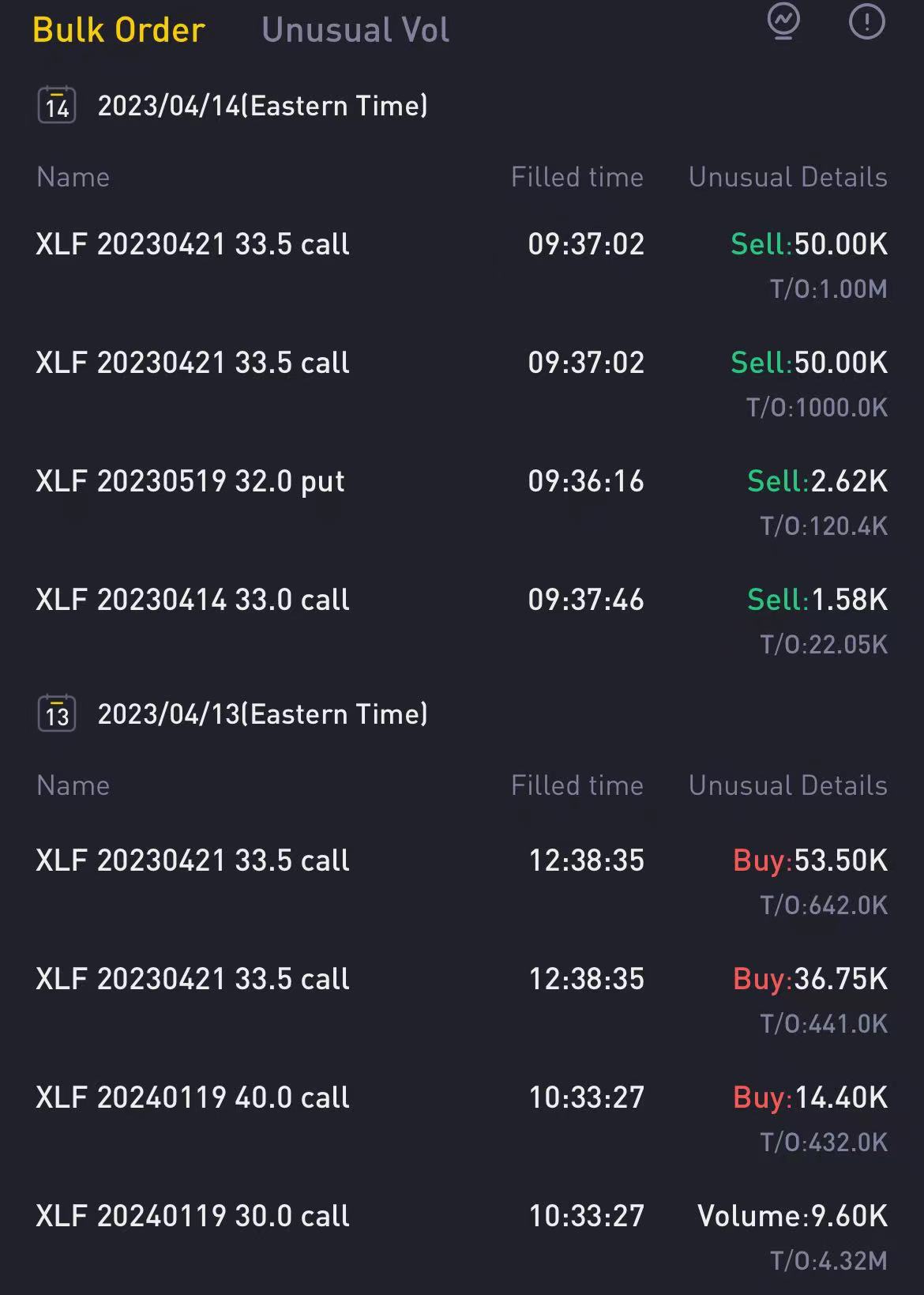

Here's how this bizarre option strategy was discovered: $JPMorgan Chase(JPM)$ soared last week on bank earnings, but I didn't see a significant move in JPM options, which I shouldn't have. Then I checked the move in the $Financial Select Sector SPDR Fund(XLF)$ :

Institutions placed 10, 000 lots of near-term options expiring next week on the day before the JPM's earnings report, closed the next day and doubled the price at a rough estimate. It's a list you can't find unless you keep an eye on it.

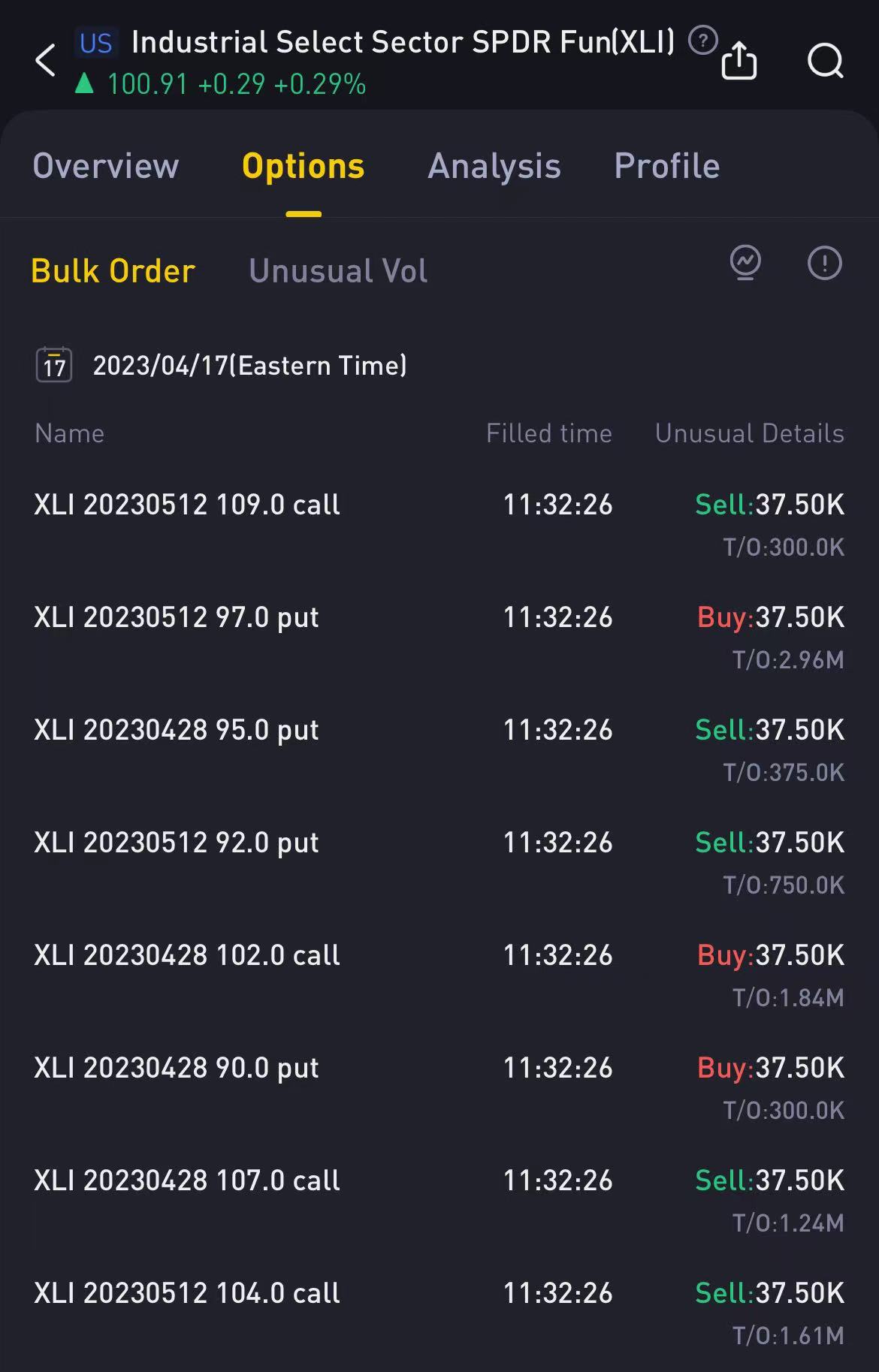

It can be seen that in some significant volatility on the institutions prefer to use ETF options trading. With that in mind, I went to the mainstream ETFs and found this bizarre order:

A breakdown shows that the April 28 portfolio is bullish, while the more forward May 12 portfolio is bearish. Overall, the viewing value is greater than the trading value.

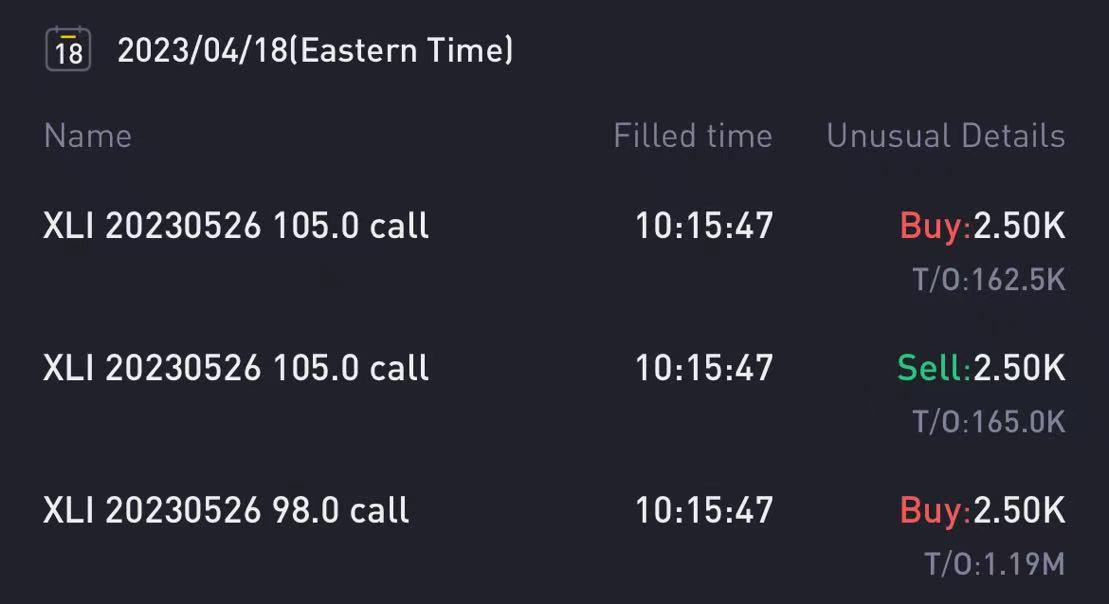

So is there a simpler trading strategy for XLI? There are:

And more specifically, which stocks can move the price of XLI?

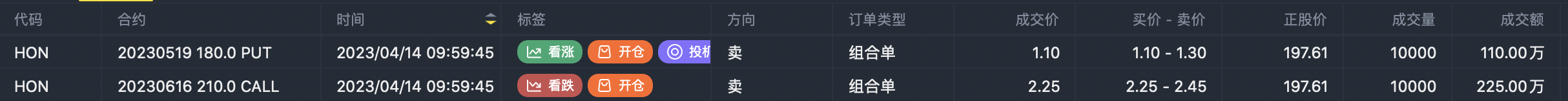

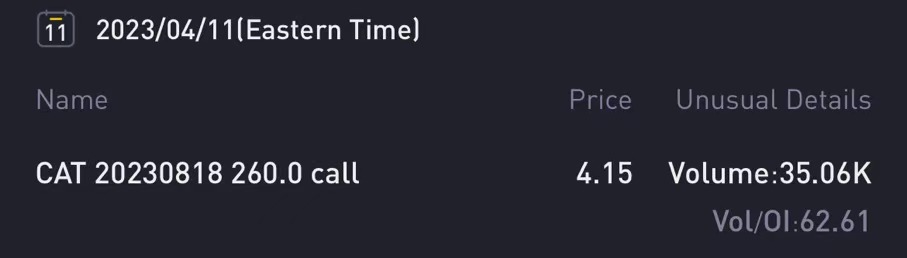

$Honeywell(HON)$ and $Caterpillar(CAT)$ have a change. But I'm not a big fan of industrial stocks. This year, the United States is to vigorously develop the local industrialization of such a logic, but from the current situation, the overall lack of capital, resulting in the plate rise and fall. Even if bullish, the gains will not be huge.

buy $CAT 20230818 260.0 CALL$ .I can't comment on this big order from Caterpillar. The traders' ordering style is obscene, not all at once, but in countless small orders.

Talk about earnings stocks

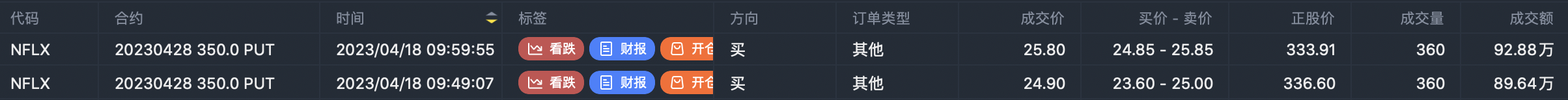

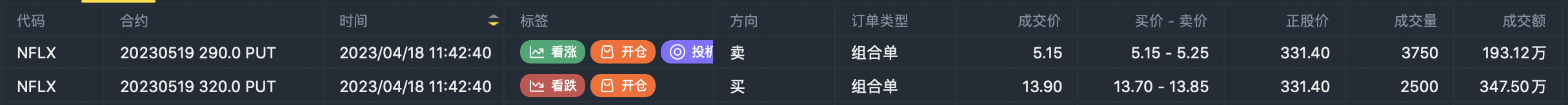

$Netflix(NFLX)$ Netflix earnings fell very little, yesterday's big option move basically did not close the position. Because the exercise price and the combination of ways to avoid time loss, similar to the short stock. The downside target is below 320 and above 290.

sell $NFLX 20230519 290.0 PUT$

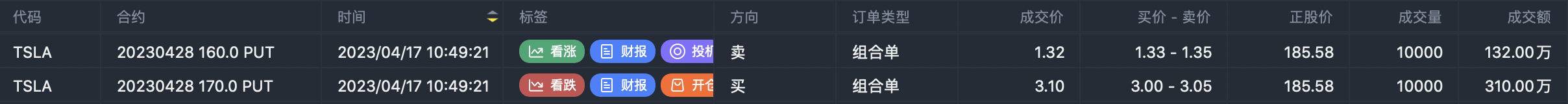

Tesla is clearly limited and bearish.

Comments

Great ariticle, would you like to share it?

$Netflix(NFLX)$

这篇文章不错,转发给大家看看

Great ariticle, would you like to share it?