The Japanese market investment report mainly solves the following problems

Why does Japan keep extreme low interest rates?

Why is the “keiretsu” favored by Buffett?

How deeply is Japan influenced by Abenomics?

What are the investment opportunities in the Japanese market and how to participate?

Recently, Warren Buffett visited Japan again after 10 years, saying that he was optimistic about the Japanese stock market and considered overweight. In fact, in recent years, Buffett has been buying Japanese assets including Japan's five major trading companies, and taking advantage of Japan's low interest rates to issue yen bonds. According to its 13F, by Q4 2022, the position scale has now exceeded 13 billion US dollars, with a conservative estimate of a net profit of 4.5 billion US dollars.

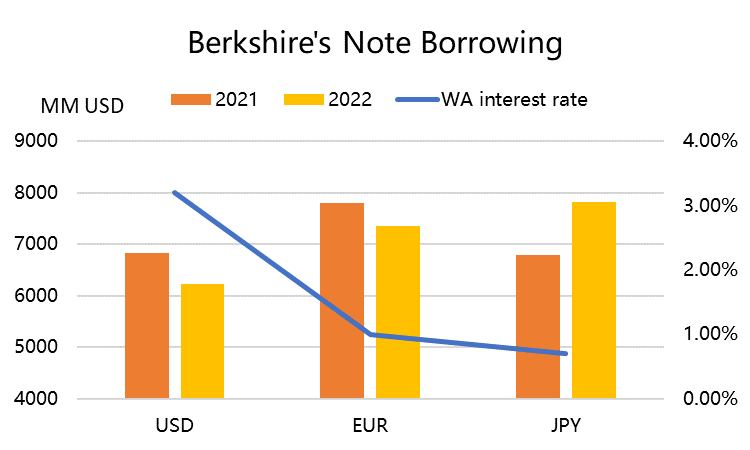

Let's make a careful calculation. In Q4 2022, Berkshire's liabilities denominated in yen exceeded 7.8 billion US dollars. In Japan's extremely low interest rate environment, the average spread between the Japanese yen and the US dollar reached 2.5% in 2022, while the Japanese yen depreciated by nearly 14% in 2022.So a $7.8 billion debt would save Berkshire $200 million in interest and $1 billion in exchange rate profits, just in terms of interest rates and exchange rates.

Japanese assets have always been a very important part of global asset allocation. Due to the different barriers to entry and understanding of Japanese assets, overseas individual investors often rarely participate, and Japanese bond market and stock market are also highly institutionalized markets. But as an investor in American stocks, it is not difficult to own Japanese assets.

Why does Japan keep interest rates that low for such a long time?

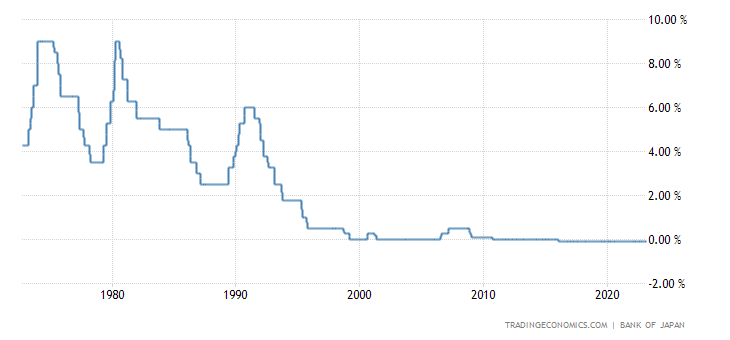

Since the financial crisis in 2008, Japan's central bank has naturally maintained "zero interest rate" and started "negative interest rate" in 2016. Now, the benchmark interest rate has been-0. 1%. From 2000 to 2008, the Bank of Japan's interest rate was only 0.6%, which is the lowest in the world. The last time the Japanese were able to earn decent interest on bank deposits was in the early 1990s, before the bubble burst.

The reason why interest rates are kept low,It is to stimulate the economy and increase domestic demand and investment.Japan's economy has experienced a "vanishing decade" since the economic bubble in the early 1990s. At the same time, with the aging of the population, the supply of labor is weakened and the social welfare expenditure is increased. The consumption concept of the elderly who have experienced the bursting of the bubble tends to be conservative, the domestic effective demand is insufficient, and the consumption market is saturated.

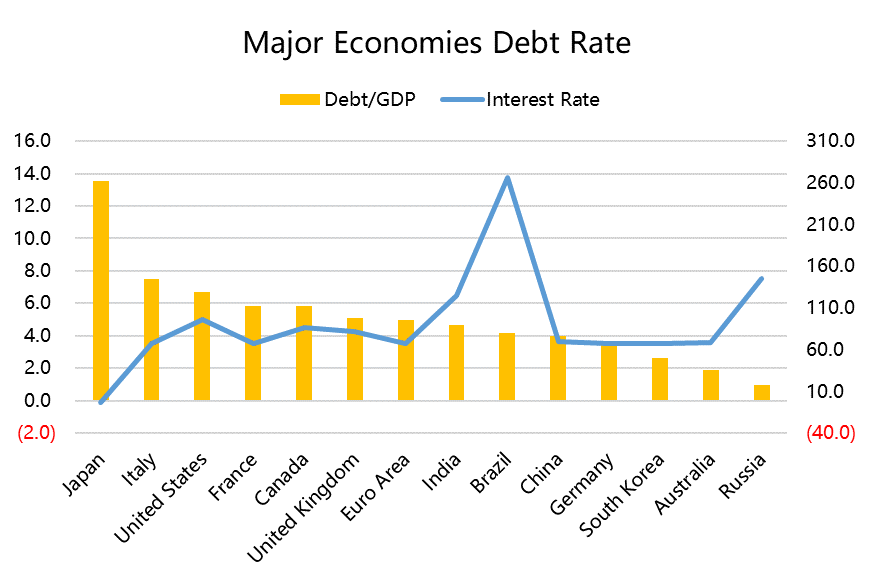

At the same time,Japan's high government debt ratio must also be matched by low interest rates. Japan's debt-to-GDP ratio of 262.5% exceeds that of all G7 economies and more than double that of the second-ranked United States. This means that once interest rates go up, government spending will suddenly increase, and the marginal growth of interest rates in Treasury Bond will be more than double that in the United States.

In addition, Japan's low interest rates can last for so long, which is a passive reason for the liquidity trap.Although the Bank of Japan has adopted a large-scale easing policy, Japanese enterprises are unwilling to increase borrowing and investment, and are not optimistic about the economic prospects. Japanese enterprises have a lifelong employment system, which makes it difficult to support radical expansion strategies. They often choose to reduce costs and increase efficiency. Therefore, Japanese enterprises are also leading the world in cost control. At the same time,Japanese individuals and families prefer to use cash, which also reduces the role of interest rates in economic life.

Japanese "Zaibatsu"(Keiretsu) that have to be mentioned

After the defeat in 1945, Japan was first entrusted by the United States, and ushered in the historical opportunity of the Korean War after the riddled war. Japan entered a rapid growth period of 20 years, and many groups appeared in China. At that time, it was also called "chaebol", which had a great tendency to monopolize people's livelihood industries, while the keiretsu economy made oligarchs monopolize, covering a whole set of businesses from manufacturing to finance.

But more importantly, they control the banks, the core of Japan's economy.

Due to the technology-oriented "high-quality growth" model, Japanese enterprises accumulated many advantages in the global inflation in 1970s and early 1980s. But The Plaza Accord in 1985 was the biggest turning point.Prior to this, Japan's huge trade surplus in successive years made it the largest exporter in the world, and it gained an advantage in competition including the United States. The United States called on the finance ministers and central bank governors of the seven countries to meet at the Plaza Hotel in New York and reach an agreement, ostensibly to limit the appreciation of the US dollar against other currencies, but actually mainly aimed at Japan, which was riding the dust at that time. The sharp appreciation of the yen has led to the decline of export competitiveness, which has a negative impact on Japan's economic growth.

More importantly, the Bank of Japan has not adopted a tightening policy (it can be said that its master will not let it). Easing monetary policy led to a rapid rise in asset prices, which contributed to the formation of the economic bubble in the late 1980s.The business intersection and mutual shareholding among large consortia also further accumulate risks. More importantly, the keiretsu itself is a bank. Under the low interest rate policy, bank lending has further increased leverage. In that era when asset prices were rising rapidly, any money in hand, whether borrowed or not, was basically invested in the "stock market" and "property market".

Due to the excessive expansion of credit, the bubble of Japanese economy was finally punctured in 1990. The stock market and exchange rate plummeted, the value of assets halved, many enterprises began to go bankrupt, and the economy declined. In the late 1990s, financial institutions also began to go bankrupt.

These big consortia also experienced the Internet bubble in 2000 and the subprime mortgage crisis in 2008. The Japanese government also intends to reduce the influence of consortia on the economy, and also intends to carry out some restructuring. Yes, the keiretsu is still an important pillar of the Japanese economy.

Why Abenomics makes Bank of Japan in awkward?

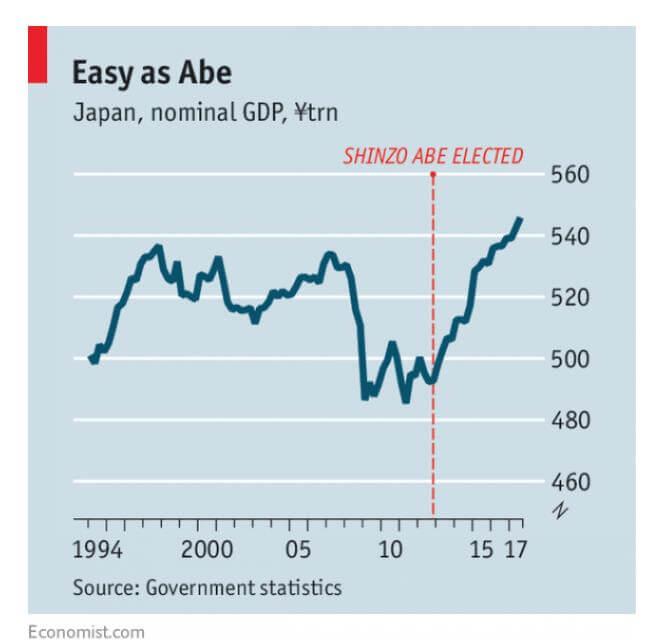

After Abe came to power again in 2012, he took charge of the government for eight years and successfully started its "Abenomics". Its original intention is to save the "lost 20 years", and its essence is stimulating the economy and carrying out structural reform of the economy through more flexible and easing fiscal and monetary policy than before.

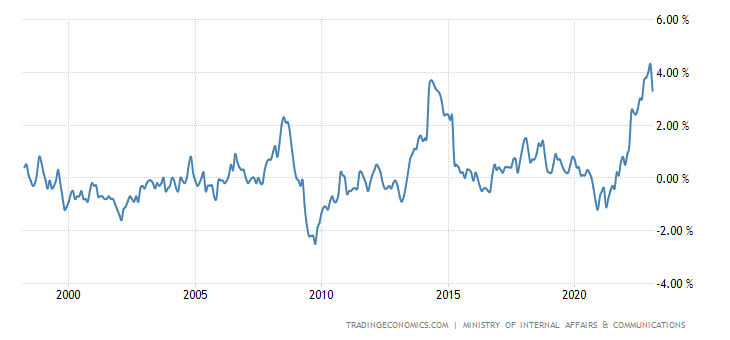

In terms of fiscal policy, such as increasing government expenditure and reducing taxes to stimulate economic growth, mainly infrastructure and support for enterprises; In terms of monetary policy, under a large number of quantitative easing policies, the Bank of Japan purchased a large number of Treasury Bond and other financial assets, which increased liquidity in the market, lowered interest rates and stimulated inflation in order to achieve economic growth. Although the inflation rate still does not reach the expected 2%, with the global economic recovery, Abenomics has achieved certain results.

As time goes by, some problems gradually emerge, the two most obvious ones are: With the increasing pressure on government debt, it is difficult for the central bank to adjust monetary policy.

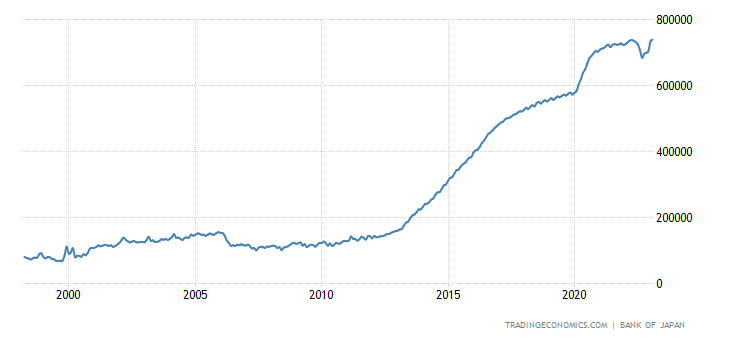

Before 2016, the Bank of Japan increased the base currency with a quantitative bond purchase program, from 50 trillion yen per year at the beginning to 80 trillion yen later. However, in 2016, the Bank of Japan further quantitative easing, adopting YCC (Yield Curve Control) as the core of its monetary policy, and purchasing bonds in unlimited quantities.

The short-term interest rate stipulated by YCC is around-0.1%, and the 10-year interest rate is around 0%, with a fluctuation range of 0.25%. That is to say, once the interest rate of Japan's 10-year Treasury Bond is higher than the upper limit of 0.25%, the Bank of Japan will buy 10-year Treasury Bond at an unlimited price of 0.25%.This also makes the Bank of Japan the largest holder of Japanese Treasury Bond, and has absolute control over the yield.

Once there is a buyer in the market with unlimited capitals, participants are less involved. At the end of 2022, there was a phenomenon that there was no transaction for many days in the Japanese 10-year Treasury Bond, resulting in liquidity problems.

At the same time, unlimited purchase of Treasury Bond will also lower the exchange rate of the Japanese yen. Therefore, in the second half of 2022, when the major economies in the world entered the rate hike cycle due to inflation, the Japanese industry went the other way and once depreciated the Japanese yen by more than 30%. Worried about the weakening of the yen's defense capability, the Bank of Japan decided to expand the fluctuation range of long-term interest rates from about 0.25% to 0.5% at the monetary policy meeting in December 2022.

However, this does not reduce the current situation that Japanese Treasury Bond are held by the central bank, nor does it reduce the balance sheet of the central bank.

The policy maker who insists on easing policy is Haruhiko Kuroda, former governor of the Bank of Japan, who has been in charge for 10 years. In April this year, Kazuo Ueda successfully took over,The focus of the market is how to gradually withdraw from unlimited easing and realize the "normalization" of monetary policy.

Once properly handled and successfully withdrawn from YCC, the yen will become the currency with the most investment value, the Japanese Treasury Bond will also get normal liquidity, and the Bank of Japan will have more monetary policy space.

Why does Japan's stock market become a safe haven for investors?

Due to the lack of volatility in the bond market and the increase in volatility of foreign exchange, Japanese stock market assets have naturally become investors' preference, and stocks have become more trading opportunities and value-added assets.

Buffett's philosophy is naturally to choose the stocks of companies with strong moat, competitive advantage, stable management, good profit, low valuation and long-term stable cash flow, and it is best to get some preferred shares. Putting this standard into the Japanese market is not a "keiretsu" that once dominated one side and still has a residual temperature?

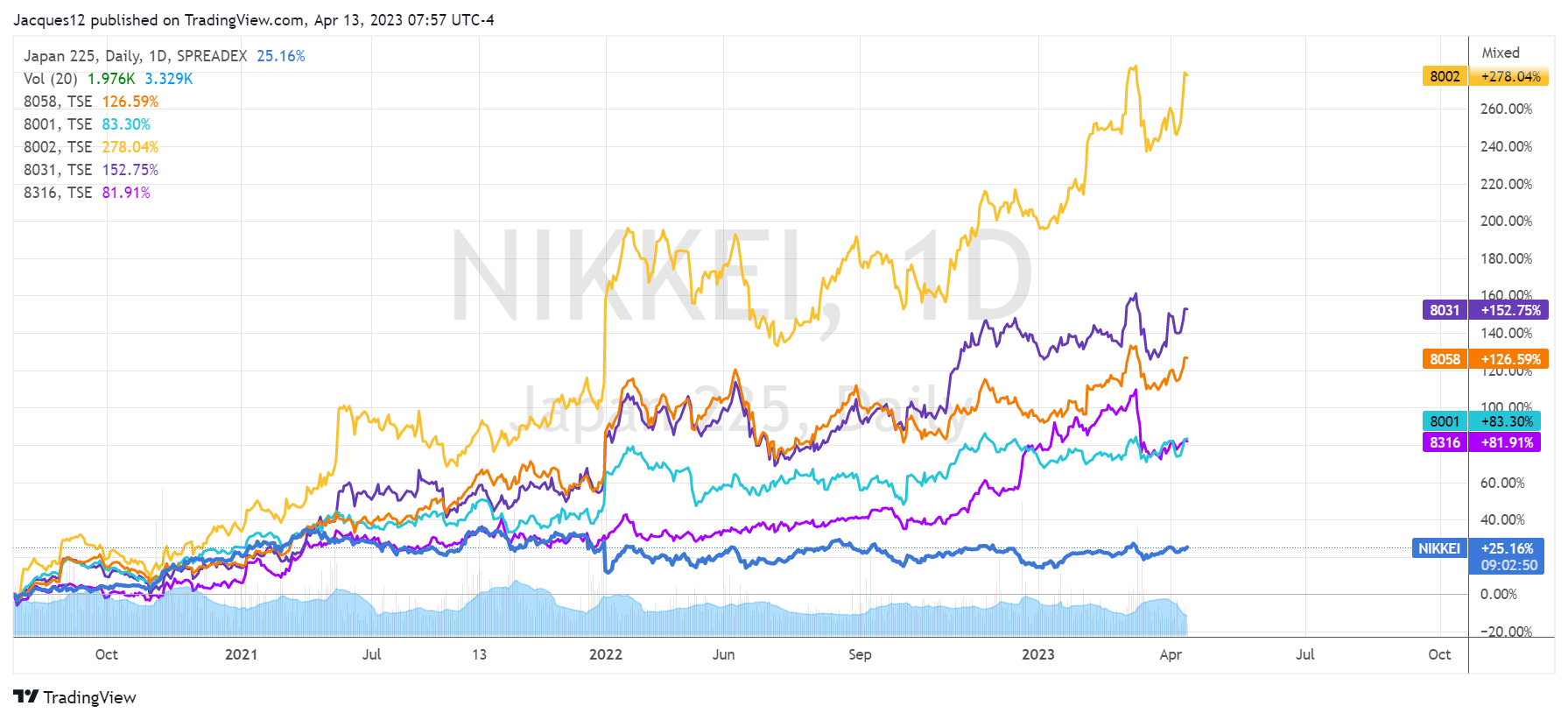

In August 2020, Buffett revealed that he held five consortia (holding more than 5% of shares), Marubeni Commercial,$Mitsui & Co. (MITSY) $Mitsubishi Corporation$Mitsubishi UFJ Finance (MUFG) $Itochu and Sumitomo$Sumitomo Mitsui Financial (SMFG) $. From the perspective of returns since then, Marubeni Commercial (ranked around 50) with a slightly lower market value has exceeded 270%, and the rest are between 80% and 150%, all of which far exceed the performance of Nikkei market.

Compared with the US stock market, investing in the Japanese stock market has the following characteristics:

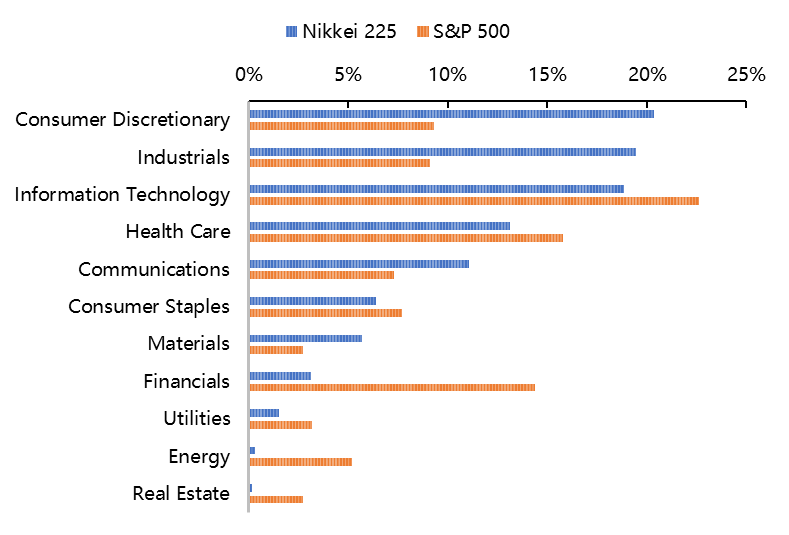

1. Different weights.The performance of the Japanese market, although it has also come from the epidemic, is also related to US stocksS&P 500 (. SPX) $The market was roughly flat. As the main weight of S&P is technology and consumer enterprises, it will perform better in 2020-2021, while the weight of Nikkei $225 is a traditional large company with a wide range of business, including manufacturing, medicine, finance, telecommunications and other industries, which will be favored by the market and perform better in the tight environment in 2022.

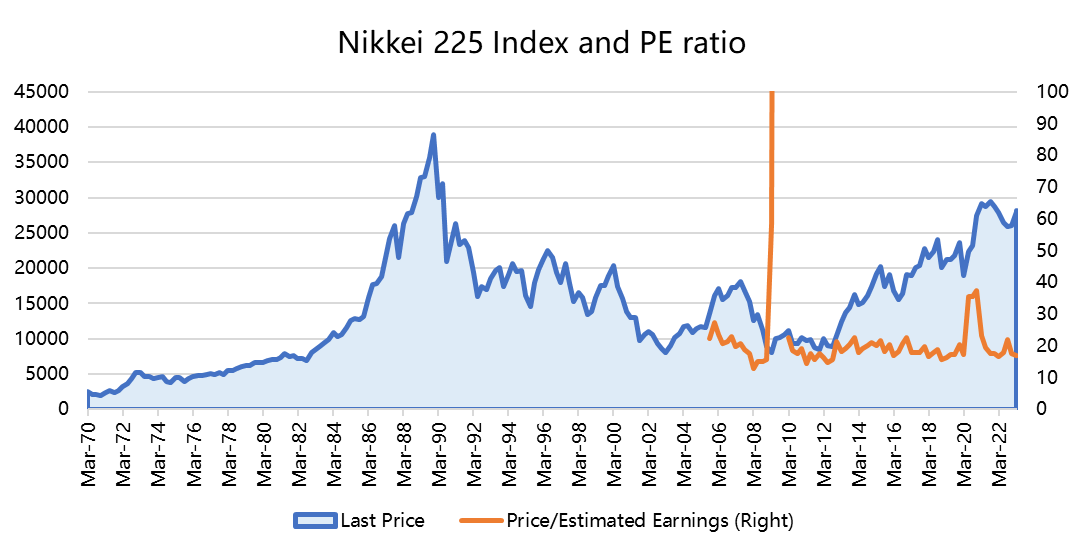

2. Lower valuation.The Nikkei index has doubled since Abenomics started, but the valuation center is still below 20 times P/E (expected P/E), and now it is less than 17 times, which is lower than the level of S&P 500.

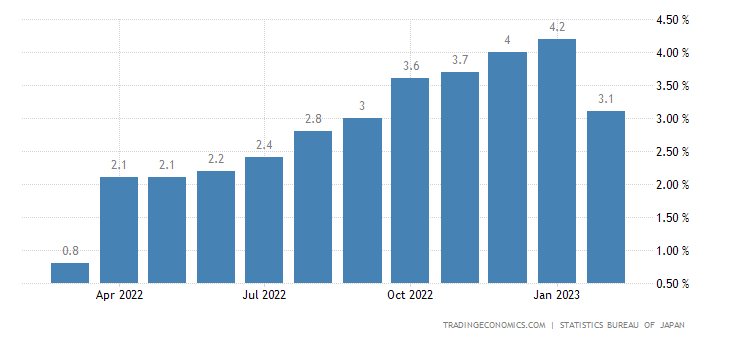

3. Yen appreciation Estimate.Japan is also affected by imported inflation. The average CPI in the past year also increased by more than 3% year-on-year, reaching 4.3% in January 2023, the highest since the economic bubble burst. After that, if Japan's long-term inflation level can reach the policy target of 2% for a long time, the central bank will inevitably withdraw from the unlimited easing policy, and the yen is expected to appreciate. In addition, the yen itself is one of the safe-haven currencies. If the global economic recession begins to take shape, it will aggravate investors' risk aversion and turn to the yen.

Therefore,For investors who want to spread the risk of the single market, the Japanese stock market is the perfect complement of the American stock market.

How do overseas investors invest in the Japanese market?

Although the rate hike for global central banks is coming to an end, it is very likely that they will face a post-inflation stagflation or recession, and investing in Japan may be the best hedge.

If ordinary investors have not studied the Japanese market and Japanese companies for a long time, the two simplest ways to invest:

1, select large integrated company. Like Buffett, a keiretsu with wide industry and strong competitiveness is naturally preferred, but it should also be noted that Buffett's position has a certain "Buffett aura". Other leading Japanese companies are often the best in corresponding fields.

For example, in the automotive industry$Toyota Motor (TM) $,Honda Motor (HMC) $; Keens of manufacturing industry$Keyence Corp. (KYCCF) $Kearns; TEPCO Semiconductor$Tokyo Electron Ltd. (TOELF) $; Sony in the entertainment industry$SONY (SONY) $Nintendo$Nintendo (NTDOY) $; The first and third party in the pharmaceutical industry$Daiichi Sankyo Co., Ltd. (DSKYF) $Takeda$Takeda Pharmaceutical Co Ltd (TAK) $; Xinyue Chemical in Chemical Industry$Shin-Etsu Chemical Co., Ltd. (SHECY) $; Japan Telecom in Telecom Industry$Nippon Telegraph & amp; Telephone Corp. (NPPXF) $SoftBank$SoftBank Group (SFTBY) $; And fast retailing, the parent company of Uniqlo, in consumer goods$Fast Retailing Co. Ltd. (FRCOF) $.

2. Choose ETFs and futures in the secondary market directly.In addition to the Nikkei ETF, Japan's major national ETFs, such as$Japan ETF-iShares MSCI (EWJ) $$Franklin FTSE Japan ETF (FLJP) $$JPMorgan BetaBuilders Japan ETF (BBJP) $In addition, there are ETFs that carry out certain hedging, such asJapan Dividend Index ETF-WisdomTree (DXJ) $$iShares Currency Hedged MSCI Japan ETF (HEWJ) $$Xtrackers MSCI Japan Hedged Equity ETF (DBJP) $In addition, there are ETFs with different styles such as value stocks and small-cap stocks, such as$iShares MSCI Japan Value ETF (EWJV) $$Ishares Msci Japan Small Cap Ind (SCJ) $Wait. And Nikkei futures,$SGX Nikkei Main Link 2306 (NKmain) $$OSE Nikkei Main Link 2306 (JNImain) $ Nikkei 2306 (JMI2306) $It is also the main trading variety.

Investors with direct trading authority in the Japanese market can directly trade Japanese stocks in the secondary market.Most brokers with unified purchasing power can directly use yen liabilities to buy Japanese stocks,Save interest rates; Of course, we should also pay attention to the expectation that the Bank of Japan will withdraw from unlimited easing and the potential appreciation of the yen.

Through indirect investment in the US stock market, you can choose ADR of Japanese companies listed in the US. Of course, in this case, the trading currency is US dollars, and the gains and losses of exchange rate are directly reflected in the stock price. Of course, ADR transactions may not be active, and large orders need to pay attention to liquidity.

Comments