I have bad news and good news about the recent pullback in the market.

The bad news is that big orders have been put in and institutions have really started shorting.

The good news is to put the spread bearish, but the downside is limited.

Institutional short strategies have generally been less aggressive this year than last, with the exception of banks. In the strategy design belongs to the relaxed state, the price drop is the best, if the price does not fall, there is no loss. So while there's very little upside right now, there's not a lot of downside, especially in the heavily weighted tech stocks.

Personally, I think we can give up small-cap stocks to some extent this year. Comparing $C3.ai, Inc.(AI)$ to $Microsoft(MSFT)$ , the trend is clear, real AI stocks are more resistant when the market is generally short of cash. The market is voting with money.

From the point of view of the plate, the non-essential consumer goods $Consumer Discretionary Select Sector SPDR Fund(XLY)$ correction range will be larger than the Internet communication service $Communication Services Select Sector SPDR Fund(XLC)$ correction range.

The put spread of these two sectors is as follows:

and

We can further think about the fluctuation range of ETF components based on the option strike price of the above strategy. The XLC component is not going to go down much, and the XLY component is going to go down a lot.

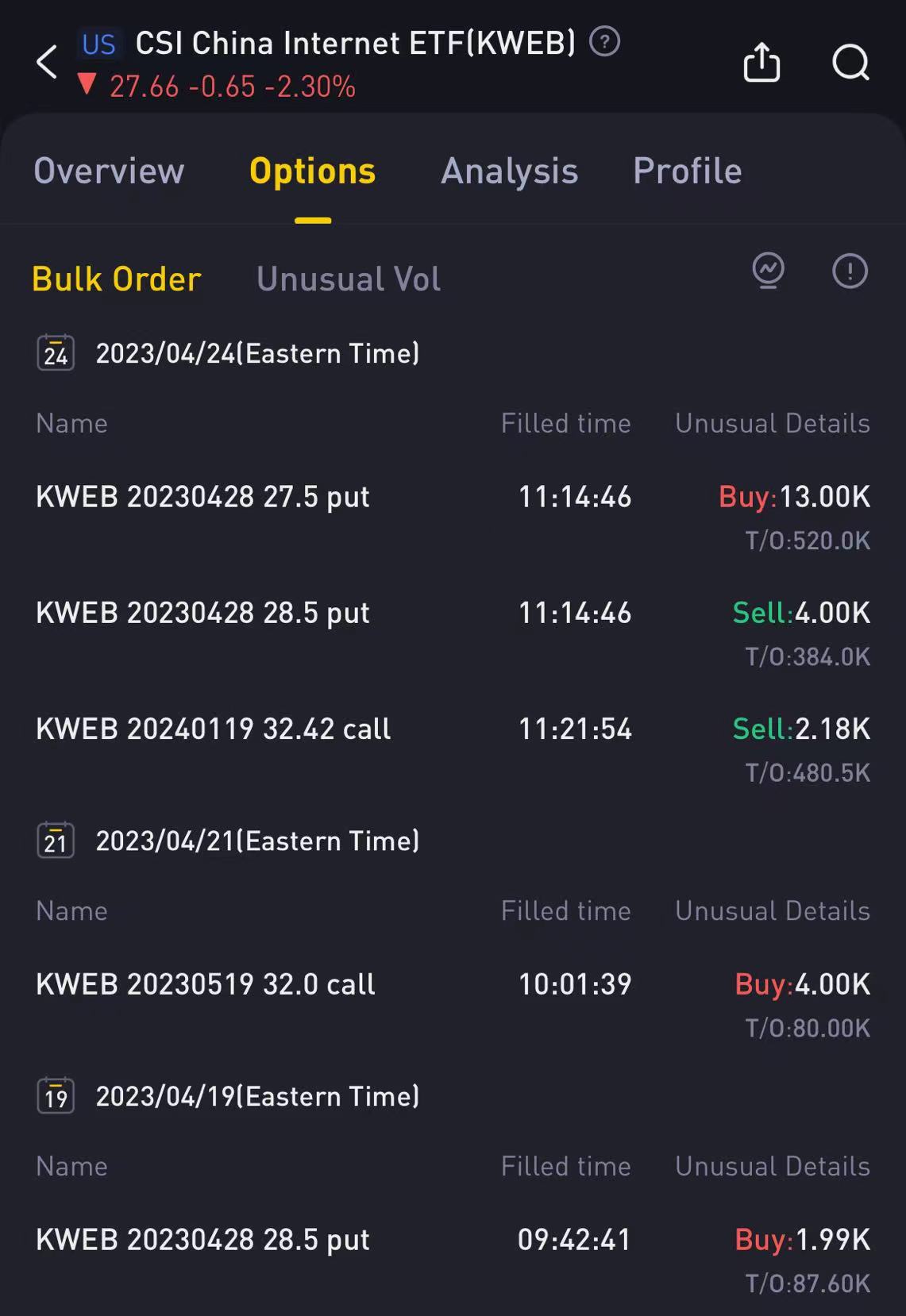

The correction has been global, and so have A-shares, though it may be nearing its end. The result is that someone quickly took a put $KWEB 20230428 28.5 PUT$ and then rolled it:

If this option is closed, it's almost a bottom.

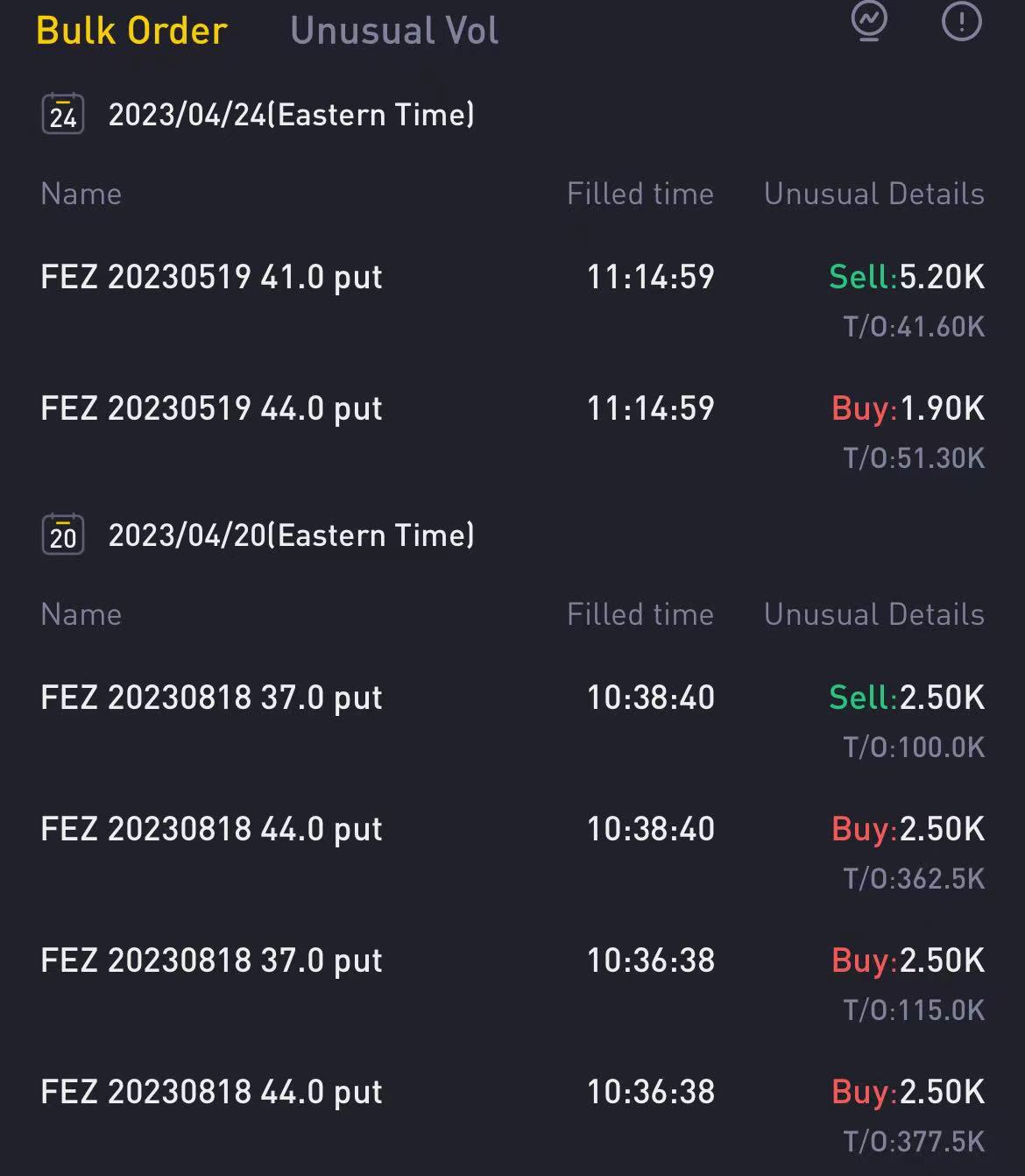

The US stock market and the A-share market have all pulled back, and the European stock market cannot be avoided either:

However, the expiration date of this strategy is conservative, and I get the feeling that traders are not very confident about the downward trend in European stocks.

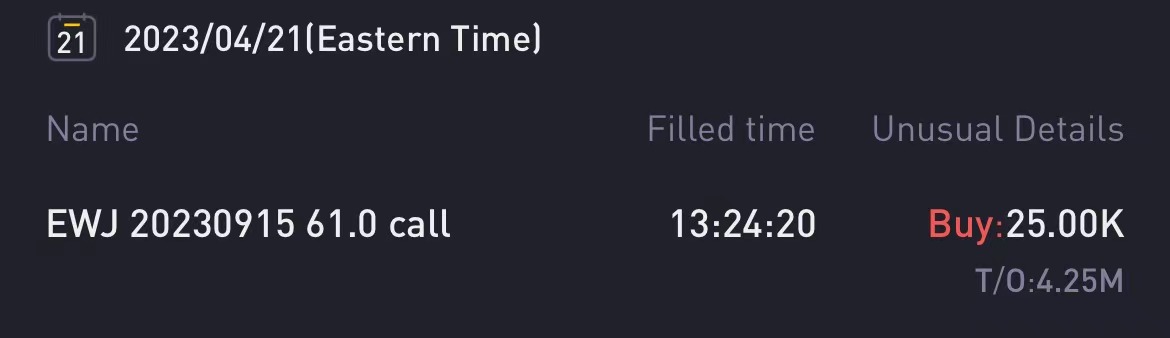

There is another market that is out of sync with the rest of the world, and that is Japan:

As you can see, institutions bought quite a lot, $4.25 million total, 25,000 lots of call options. It is estimated that institutions are optimistic about the technical surface 250 weeks average break bar.

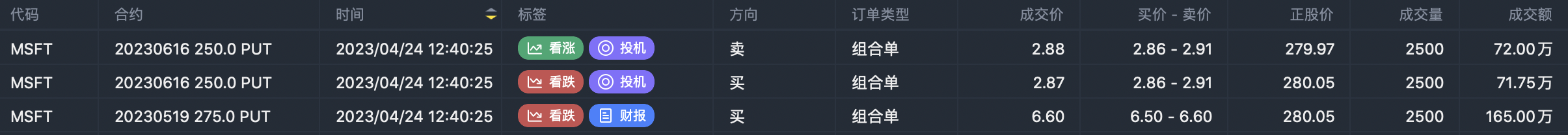

Back to the individual stocks. Recently, some institutions have been shorting Microsoft, and the bearish strategy is very cheap, to be exact, almost free:

The ratio spread is bearish, with a buy to sell ratio of 1:2. It's almost a bearish strategy with an exercise attitude. Are there any pure bears left these days?

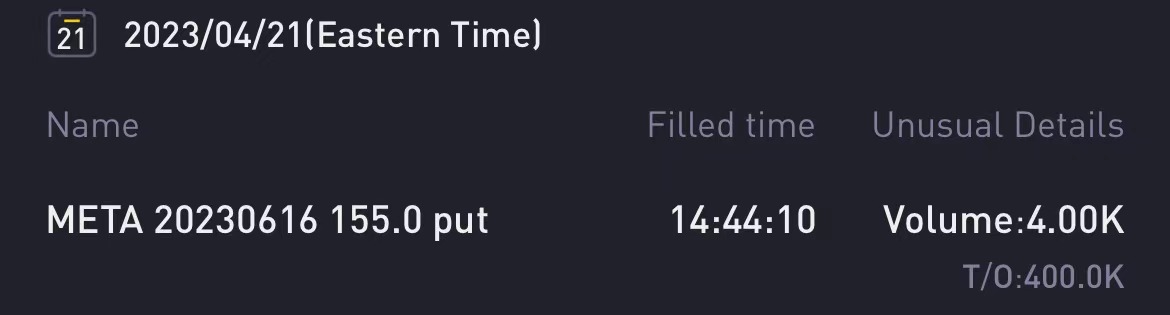

META financial reports are mostly based on straddle strategies. This order is a more typical financial strategy order, single bet side. I personally think META will pull back around 5%, no no more than 20%.

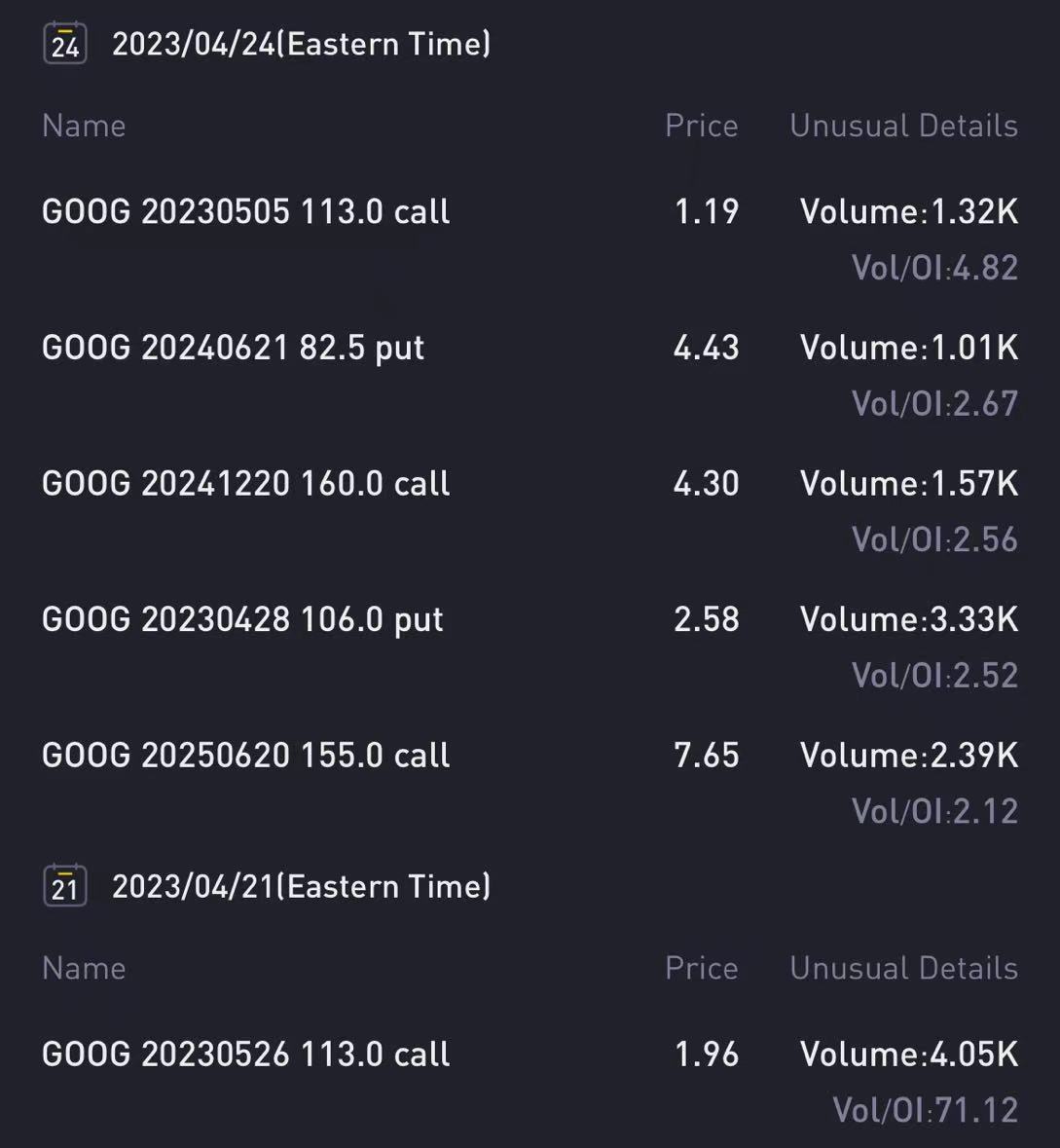

Google's interesting option move is the 113 strike call $GOOG 20230526 113.0 CALL$

Comments

weak volume today considering the run ..up to the news. the bears had the baton for a brief minute. we may get a lil more downward action but the path of least reistance is still higher

The higher it goes the more hawkish the FED will be next week ! Sell the pop !

大型科技股=增長,強勁的資產負債表

Great ariticle, would you like to share it?