Yesterday Biden expressed confidence that he would show results in fighting inflation. I thought CPI had to fall to the 5.xx%. As a result, CPI in February was unchanged as expected at 6.0 percent and core was also unchanged at 5.5 percent. Month-on-month, it was slightly higher, at 0.5%.

There is a long way to go in the fight against inflation, and a quarter-point rise cannot be missed.

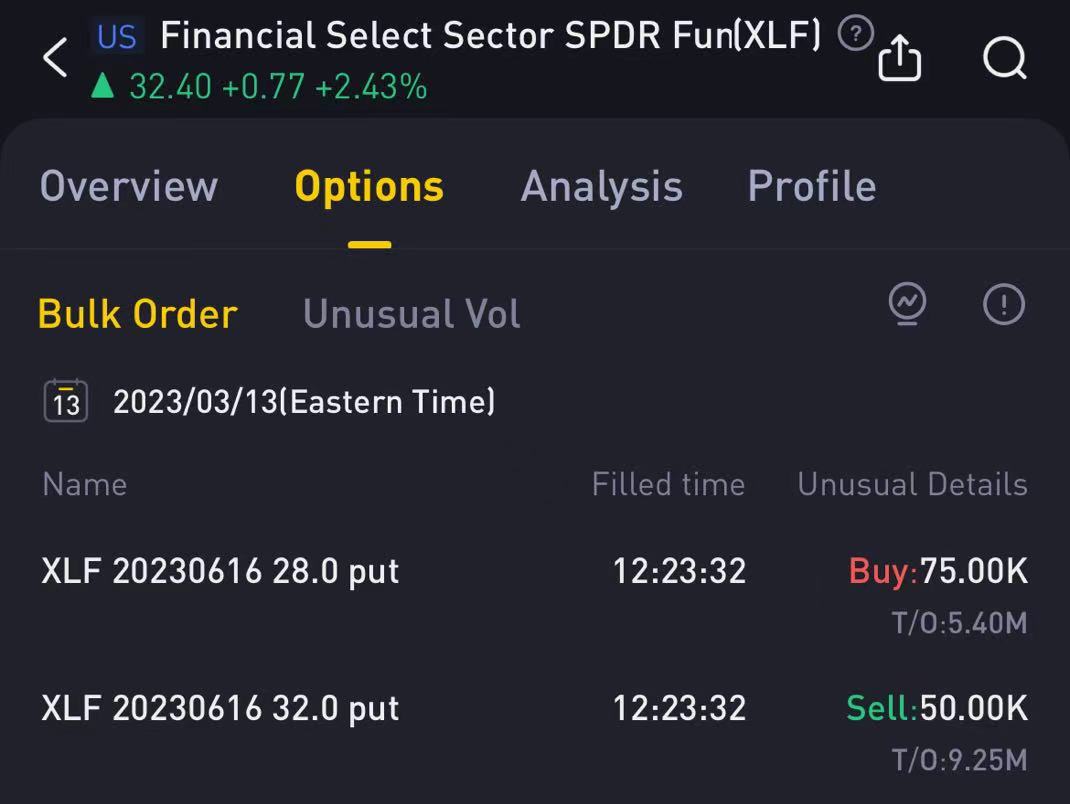

$Financial Select Sector SPDR Fund(XLF)$ Source of title

- closed $XLF 20230616 32.0 PUT$ $XLF 20230616 32.0 PUT$

- roll $XLF 20230616 28.0 PUT$ $XLF 20230616 28.0 PUT$

The 32 strike price was put in place after the February 2 FOMC meeting. The trader kept his cool for more than a month, which shows the benefit of longer expiration dates, but not so cool when the date is closer.

And then yesterday, he closed his position at 5 times profit, and he continued to buy the put option with half the profit, and the expiration is still in June, and the strike price is down to 28. That means this person thinks there's still room for a pullback, and that stocks are probably headed toward the end of October.

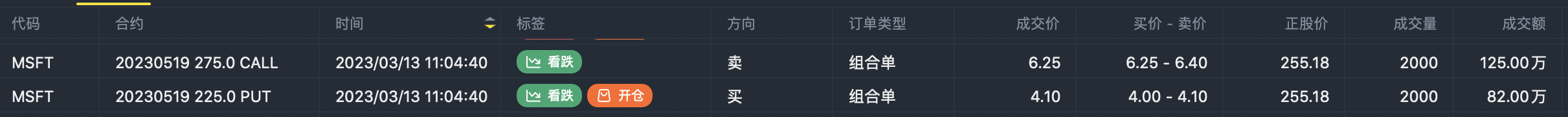

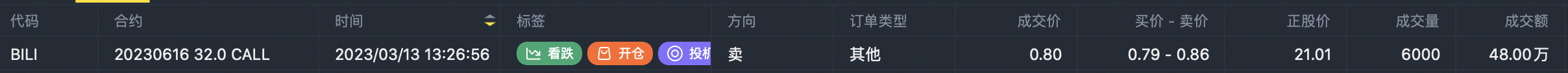

- sell$MSFT 20230519 275.0 CALL$ $MSFT 20230519 275.0 CALL$

- buy$MSFT 20230519 225.0 PUT$ $MSFT 20230519 225.0 PUT$

Comments

1million in fixes depo

2million in dividend aristo n king stocks

1 million in gold

1million in silver

1million in oil stocks

1million in mft, tesla