After more than a month of sideways, bulls and bears are impatient, Powell is also impatient, even said to speed up the pace of rate hikes, so the March rate hike probability of 50 basis points into 70%.

- Ultra-hawkish rate hike: 50 basis point rate hike probability in March

- Dovish: The Fed can live with 3% if inflation doesn't fall quickly to 2%.

Before yesterday, the market favored 2 more than 1.

At the start of the year, the consensus was for a longer rate rise, not a higher one. There is a consensus that inflation cannot fall quickly, but there is a sense that rate rises need to be gradual and Mr Powell is unlikely to reverse his plan for gradual quarter-point increases. If inflation cannot come down quickly, the Fed's acceptance of 3% can be expected.

The cold fact is that there is no theoretical basis for a 2 per cent inflation target. Presumably a data without any theoretical basis should be easy to replace.

But the market clearly underestimated Powell's determination to bring inflation down, after two consecutive months of better than expected data.

There is an obvious line of reasoning that Powell is not just drawing conclusions from the data that has been released over the past two months, but is considering an aggressive rate hike based on what he knows about the February non-farm and CPI numbers.

Then the next two weeks will not be too much of a surprise. Non-farm will definitely beat expectations on Friday and CPI will definitely beat expectations on Tuesday.

It's a surprise but there should be a lot of happy people. The bears must be happy to see the catalyst after a month of trading sideways; The bulls are also happy because this is not a good price to go long.

After two months of selling calls, do you feel like you can finally let go?

Sorry, the result is still a sell call. Compared to the last two months is the aggressive version: sell in-the-money call options:

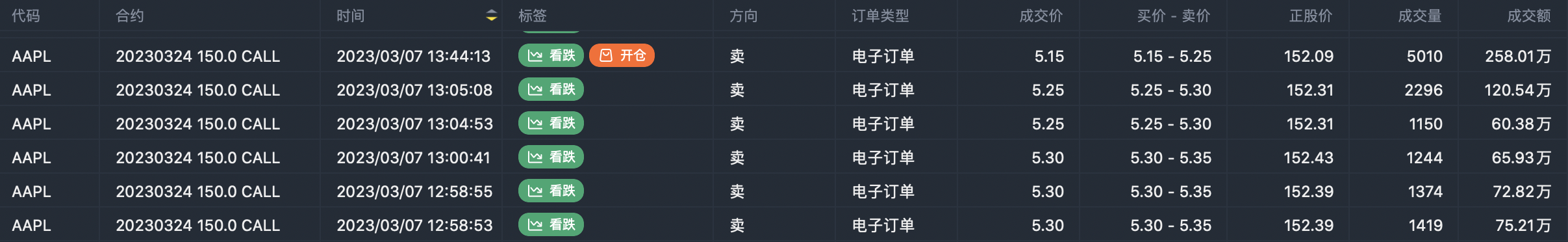

$Apple(AAPL)$ Option traded at 152, strike at 150. The direction of trade is to sell In-the-money call option

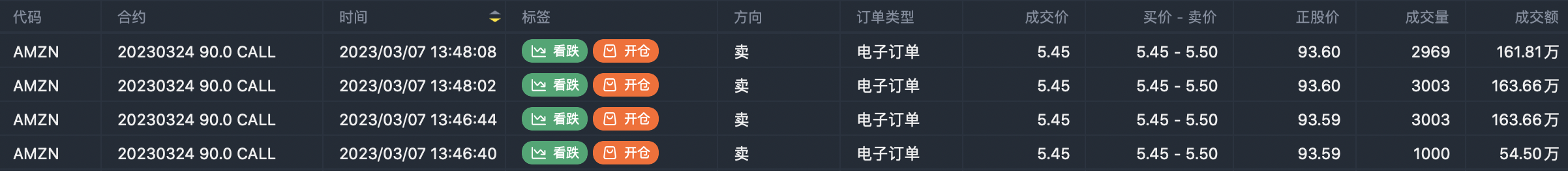

$Amazon.com(AMZN)$ Option traded at 93, the strike at 90.The direction of trade is to sell In-the-money call option

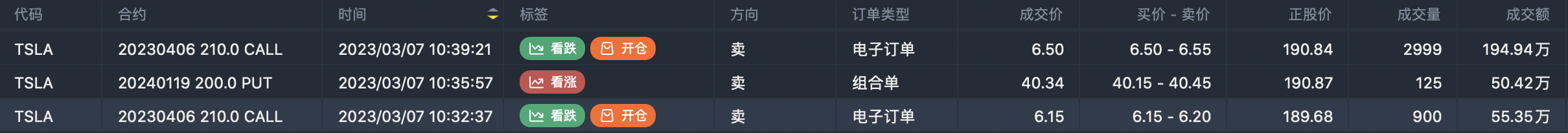

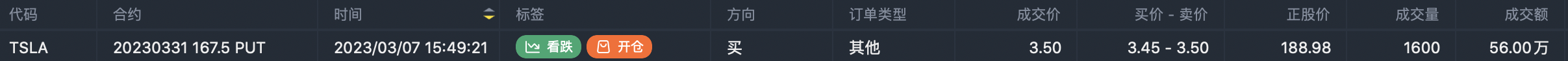

$Tesla Motors(TSLA)$ So did Tesla, though the sellers were careful not to pick in-the-money options:

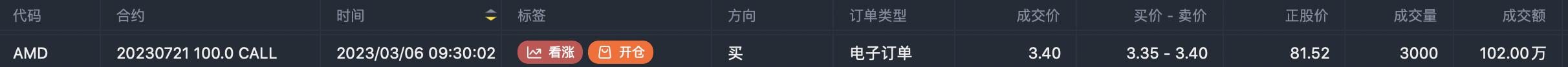

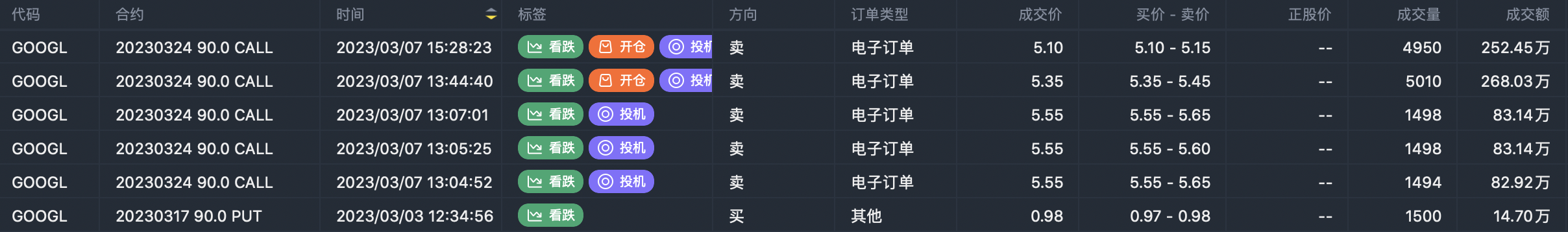

But it's worth noting that there were no big bearish orders on NVDA and AMD yesterday.

Comments

Great ariticle, would you like to share it?