At 20:30 on May 10th, Beijing time, the United States released inflation data for March.

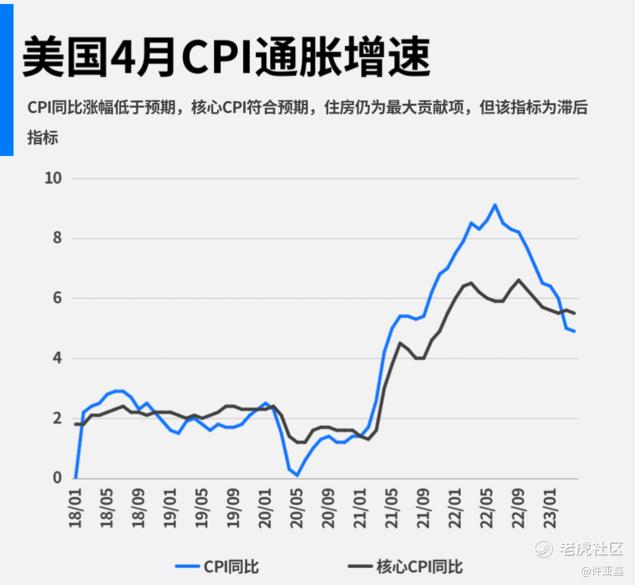

According to the U.S. Bureau of Labor Statistics,In April, the CPI of the United States increased by 4.9% year-on-year, falling for the tenth consecutive time, the smallest year-on-year increase since April 2021, expected 5%, previous value 5%; CPI rose by 0.4% month-on-month, with an expected value of 0.4% and a previous value of 0.1%.

The core CPI excluding energy and food slowed down slightly from last month, up 5.5% year-on-year, which was the same as expected and the previous value was 5.6%; It increased by 0.4% month-on-month, expected to be 0.4%, and the previous value was 0.4%.

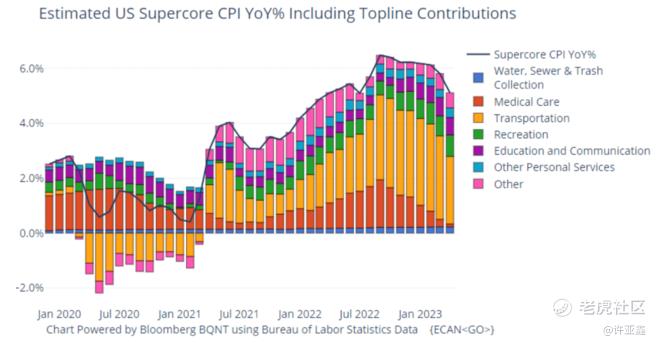

In addition, the Federal Reserve loves "super core inflation", and the CPI of core services except housing slowed down to 5% year-on-year, among which the cost of transportation and medical services declined month-on-month.

I thinks Inflation data fell for ten consecutive months,Further increasing the probability that the Federal Reserve will suspend the rate hike in June,This in itself will boost the gold price, so we saw in the short term that after the data was released, the gold price rushed to the resistance area of 2048-2050 in one breath.

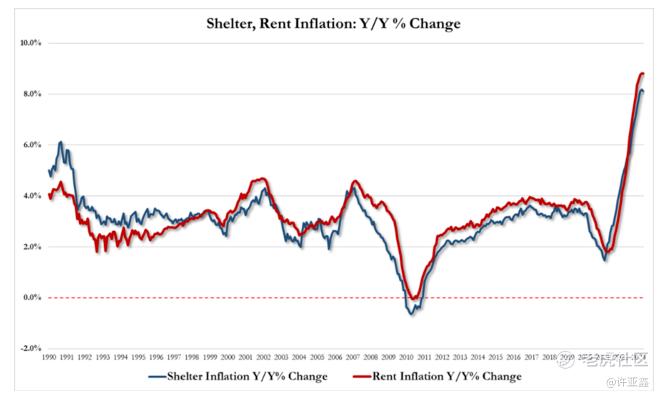

Core inflation, meanwhile, remains at 5.5%, a slight drop from previous levels but a long way from the Fed's mid-term 2%,It also implies that inflation is still very sticky,This also means that even if the Fed suspends the rate hike, it will continue to keep high interest rates for a long time. This also enables everyone to understand why gold prices once again dived from the resistance area after the opening in North America.

Specifically, energy and gasoline are the main driving forces for the downward trend, while housing costs are still high. The energy index fell by 5.1% year-on-year, while the food index increased by 7.7% in the past year. In April, the index of all items excluding food and energy rose by 0.4% month-on-month, the same as that in March.

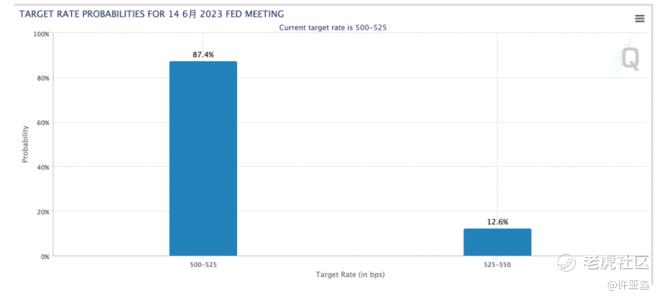

After the CPI data of the United States was released in April, CME's "Federal Reserve Watch" tool showed that,The probability of the Fed keeping interest rates unchanged in June increased from 79.9% to 87.4%, and the probability of rate hike's 25 basis points decreased from 20.1% to 12.6%.The market price reflects the probability of another rate hike in June, which has dropped to about 10%, and traders expect the Federal Funds rate to drop from 5.08% this week to about 4.38% before the end of the year.

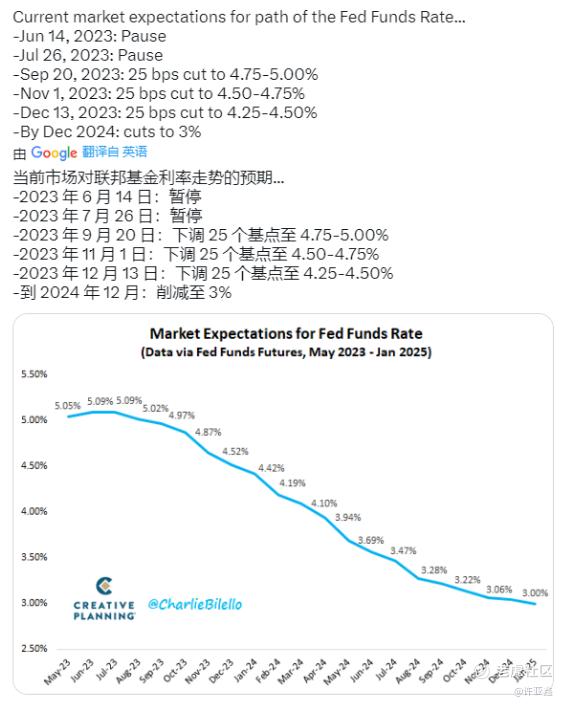

From the further market expectation, after the data is released, the market expects to suspend the rate hike in June and July, then cut interest rates by 25 basis points in September, November and December respectively, and then the benchmark interest rate will drop to 3% in December 2024.

I don't agree with the above market expectations. Before the release of non-farm payrolls data and inflation data in April, I tend to cut interest rates only once in the fourth quarter of this year. Now, after the release of the data, my conclusion is that the Federal Reserve will remain inactive this year.

In other words, the Fed's subtext is: You can't bet that I don't have bullets in my gun, I do have them, but I just won't pull the trigger again, and you can't expect me to put away my gun within the year.

As for the actual operation of inflation data tonight, Peter brought a wave of very coquettish data to do long first, and then the data rushed to the resistance area to stop profits and short backhand, which is directly the market of one fish and two eats, of course 666!

-END-

NQ100 Index Main Connection 2206 (NQmain) $$Gold Main 2206 (GCmain) $$Dow Jones Main Link 2203 (YMmain) $$2205 (NGmain) $$WTI Crude Oil Main Line 2206 (CLmain) $

Comments

The Nasdaq reached a new interim high last night, and it is closely related to it.

If CPI drops a few more times, there might be expectations of an interest rate cut.

do you think the gold price will break through the resistance zone this time?

Interest rate cuts are already a done deal

a decline is good for the US, but not so much for us