Some stocks become natural targets for short selling when they go public. It's not the short sellers' fault, though. These companies are often valued extremely high during their IPOs, and the entire market mindlessly chases after them or inflates their valuations when the industry is at its hottest. Therefore, it's only natural that once investor enthusiasm wanes or the industry enters a downturn cycle, the market will mercilessly kill off these valuations.

Take C3.ai Inc.(AI) for example. In essence, it doesn't have any core AI technology like Microsoft (MSFT) or Google (GOOG). It has gained attention simply because of its well-chosen code related to artificial intelligence (AI), which happens to be one of this year's hottest trends in tech.

However, attention aside, there isn't much correlation between this AI trend and C3.ai's valuation. Although C3.AI has experienced some fluctuations - surging to $34 per share in early April before dropping significantly to $17 per share in early May - it remains a meme stock.

Since May 15th, however, it has risen sharply for two days due to an "early surprise" announcement by the company regarding Q1 revenue expectations of $72.1-72.4 million USD - higher than analysts' previous estimate of $71.1 million USD but hardly surprising news.

In terms of valuation, AI has always been around 10 times sales ratio with an estimated growth rate of only 20-30% over the next few years; even if calculated based on a long-term stable net profit margin of 20%, given current expected revenue and profit margins would result in a PEG ratio that is 1.5 times too high - far from reasonable valuation levels.

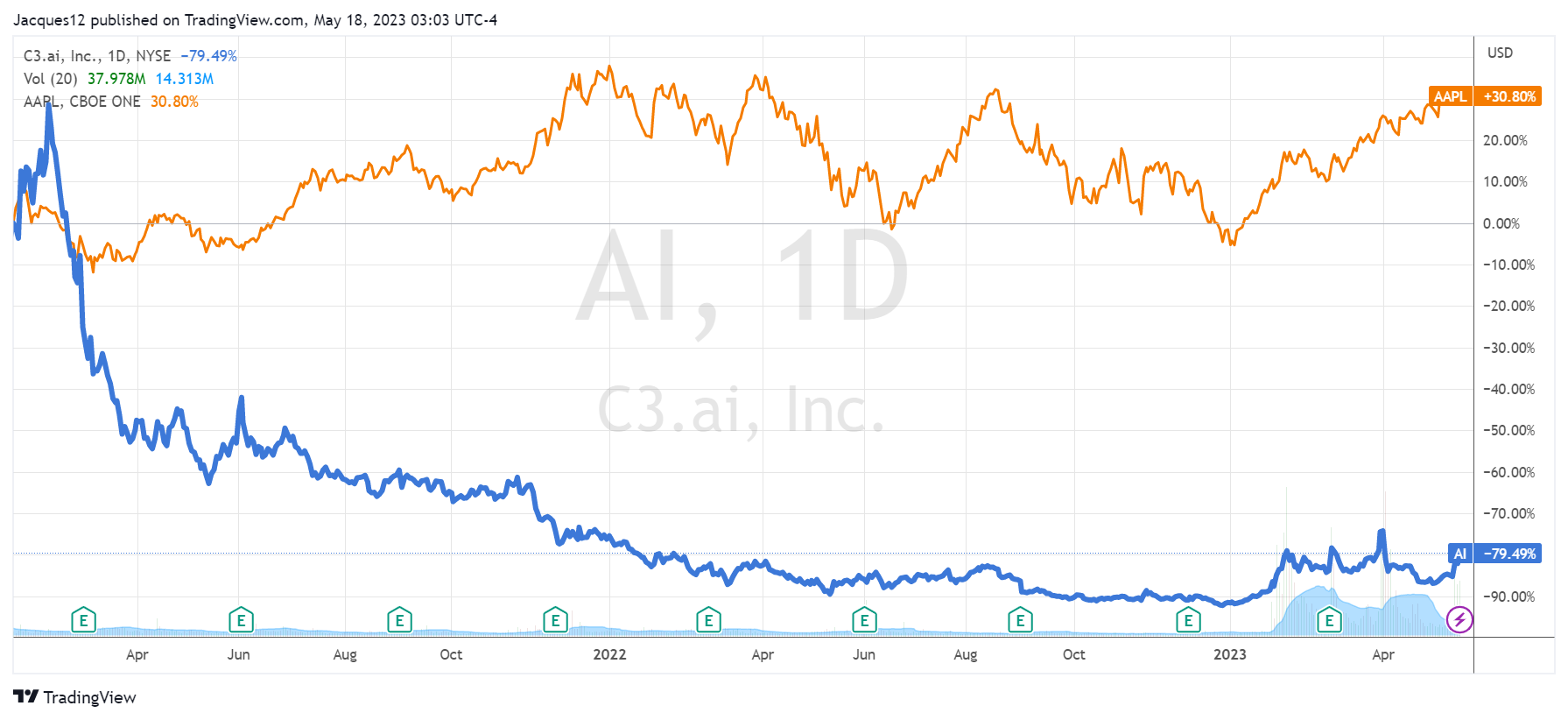

Therefore, it makes sense that this stock went from over $100 per share when first listed in 2021 down to its current price of $20 per share. Looking at its historical K-line, it's clear that this is a stock dominated by short sellers.

What are the characteristics of stocks dominated by short sellers? In fact, all you need to do is flip Apple's (AAPL) K-line upside down:

1. Long-term downtrend, opposite to the overall market trend;

2. Occasionally there will be one or two large bullish candles mainly due to short covering;

3. Then it continues its downward trend.

Although it has risen for three consecutive days now and shorts have covered some positions, the percentage of short selling remains high at over 32%, which is very concerning.

In such a situation, if you're chasing after gains unless you have the same momentum and strength as those who targeted GameStop (GME) shorts earlier this year - then it's best to follow the trend and go with the flow downwards instead.

Comments