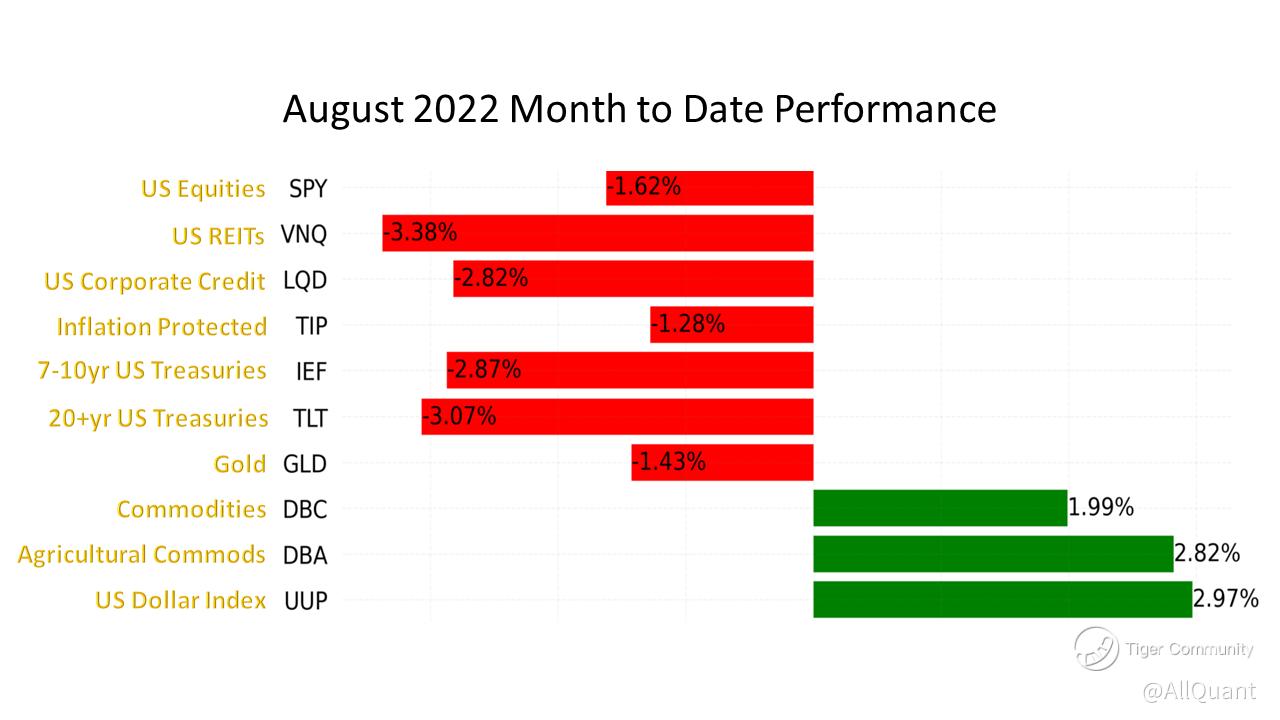

After Jerome Powell's short but clear speech at the Jackson Hole symposium, S&P 500 is in the red for the month. The risk-off sentiment is back, as seen by the negative performance of REITs and investment-grade corporate bonds.

Yields are up month to date. TIP is outperforming IEF, indicating heightened inflation expectations.

Over in the commodity space, most commodities are up despite the strong USD. The exception is gold which is down month to date. It looks like commodities are the only haven in this climate.

$SPDR S&P 500 ETF Trust(SPY)$$iShares 7-10 Year Treasury Bond ETF(IEF)$$Invesco DB Commodity Index Tracking Fund(DBC)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments