Morgan Stanley reported a smaller-than-expected 11% drop in first-quarter profit on Thursday as a near doubling in advisory fees from M&As helped cushion the blow from a slump in capital market activity.

The investment banking powerhouse outperformed rival Goldman Sachs (GS.N) in M&A advisory even as Russia's invasion of Ukraine unsettled equity markets and forced companies to hold off on dealmaking and stock market listings.

Trading revenue, too, fared better than what some analysts had feared, falling just 6% in the quarter to $3.98 billion from the highs of last year.

Morgan Stanley earned $258 million in revenue from its equity underwriting business, down sharply from $1.50 billion a year ago, when it generated handsome fees from a spate of high-profile IPOs.

According to Refinitiv data, equity underwriting deal volumes fell 80% in the first quarter for Morgan Stanley and Goldman Sachs, the two most dominant financial advisers on initial public offerings (IPOs) globally.

The bank also reported a steep decline in fixed income underwriting revenue, hurt by lower bond issuances.

Morgan Stanley's dealmakers brought in $944 million in advisory revenues in the quarter, compared with $480 million a year ago.

But that did little for overall investment banking revenue, which slumped 38% to $1.76 billion. The unit consists of the bank's advisory, equity underwriting and fixed income underwriting businesses.

The bank's profit fell to $3.54 billion, or $2.02 per share, in the quarter ended March 31, from $3.98 billion, or $2.19 per share, a year earlier.

Analysts, on average, were expecting the bank to report a profit of $1.68 per share, according to Refinitiv data.

Net revenue fell 6% in the quarter to $14.8 billion, but beat estimates of $14.27 billion.

Return on tangible equity, a closely-watched metric for profitability that measures how well a bank is using its capital to produce profit, was 19.8% during the quarter. The figure was well above the bank's two-year target of between 14% and 16%.

Total expenses fell to $4.83 billion from $5.3 billion a year earlier.

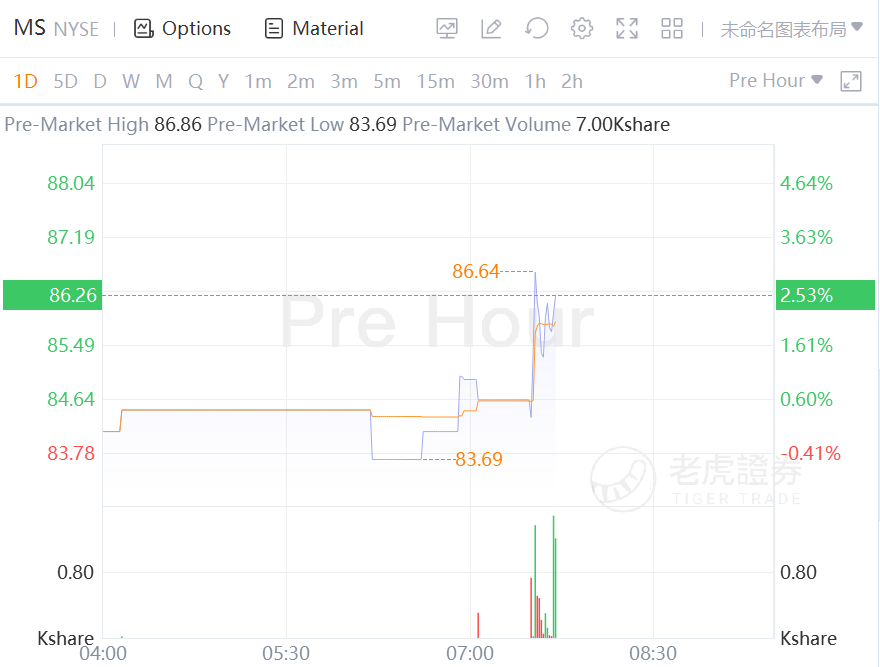

Morgan Stanley's stock jumps 2.5% premarket after Q1 results.