Coinbase Global reported third-quarter earnings Thursday showing the company missed estimates on revenue and earnings. However, it retained users and lowered expenses better than analysts predicted.

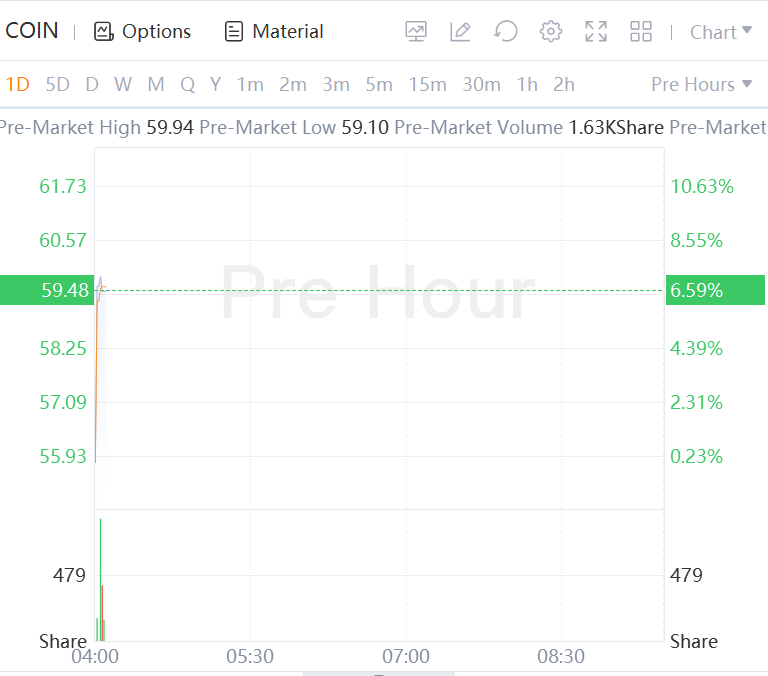

Shares rallied 6.59% in premarket trading following Thursday’s sell-off of 8.2% through the trading day. The stock is 77.5% lower than in January, closing at $55.80 on Thursday.

Here are Coinbase’s Q3 results compared to Bloomberg’s consensus estimates:

Revenue: $590.3 million versus expectations of $649.15 million

Adjusted EBITDA: -$116 million versus expectations of -$212.95 million

Adjusted earnings per share: -$2.43 versus expectations of -$2.12

Monthly Transacting Users (MTUs): 8.5 million versus expectations of 7.84 million

“Q3 was a mixed quarter for Coinbase. Transaction revenue was significantly impacted by stronger macroeconomic and crypto market headwinds, as well as trading volume moving offshore,” Coinbase said in its third-quarter letter.

Global crypto trading volumes fell by 40% globally — worse than in Q2 — according to CoinMarketCap. For the period, Coinbase reported trading volumes of $159 billion, down 27% from the previous quarter’s $217 billion.

The company reported $365.9 million in transaction revenue from fees, split between $346.1 million from retail-sized transactions and $19.8 million from institutional transactions. That compares to a 44% decline in retail transactions from the $616.2 million recorded in the second quarter and a 49% drop in institutional transactions from $39 million.

The crypto firm's second-largest revenue generator, subscriptions and services — which include payment for its staking, custody, and interest income — brought in $210.5 million, up from $147.4 million in Q2.

Within subscriptions and services, revenue from staking (from $62.8 million to $66 million) and custody (from $22.9 million to $14.6million) performed worse this quarter along with trading activity.

Interest income, on the other hand, which analysts have identified as the company's best bear market cushion, more than tripled from $32.5 million to $101.8 million as a result of rising interest rates.

Coinbase’s interest income includes a revenue sharing agreement for being the sole retail issuer of the second-largest stablecoin, USDC. As part of that agreement, it gets 30% of the yield earned from USDC reserves, which are parked in cash and short-duration U.S. Treasuries.