U.S. stocks edged lower on Wednesday as a robust upward GDP revision eased recession fears, while Federal Reserve officials' remarks raised questions about the duration of the central bank's restrictive policy.

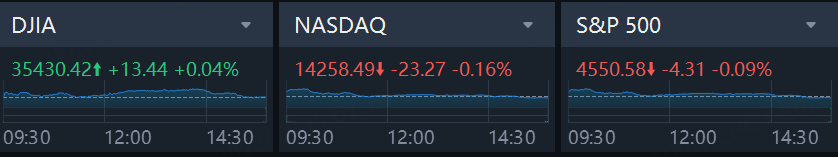

Market Snapshot

The Dow Jones Industrial Average (.DJI) rose 13.44 points, or 0.04%, to 35,430.42, the S&P 500 (.SPX) lost 4.31 points, or 0.09%, at 4,550.58 and the Nasdaq Composite (.IXIC) dropped 23.27 points, or 0.16%, to 14,258.49.

Market Movers

General Motors rose 9.4% after the auto maker reinstated its earnings guidance for 2023, said it would increase its dividend, and outlined plans for an accelerated $10 billion stock buyback program. GM said it expects net income in 2023 of $9.1 billion to $9.8 billion, compared with a previous range of $9.3 billion to $10.7 billion.

Cigna fell 8.1% after The Wall Street Journal reported the health-insurance giant was discussing a stock-and-cash merger with Humana that could be finalized by the end of the year. Humana was down 5.5%.

Rover Group soared 29% to $10.96 after the online marketplace for pet care said it would be acquired by Blackstone for $11 a share in an all-cash transaction valued at about $2.3 billion.

Petco Health & Wellness fell 29% after the pet-goods retailer swung to a loss in the third quarter and slashed its adjusted earnings outlook for the fiscal year.

Fluence Energy rose 24% after the energy-storage products company reported a surprise profit in its fiscal fourth quarter. The company earned 2 cents a share in the period, swinging from a year-earlier loss of 32 cents a share and beating analysts’ estimates that called for a loss of 8 cents.

GameStop was up 20% after shares of the videogame retailer closed 13% higher on Tuesday. Traders have been loading up on high-risk options contracts that bet on the stock making huge gains after the company reports quarterly earnings next week.

Leslie’s fell 10% after the pool and spa retailer was downgraded to Neutral from Buy at Goldman Sachs following disappointing quarterly earnings.

Foot Locker reported third-quarter adjusted earnings of 30 cents a share, beating analysts’ forecasts of 21 cents. The stock surged 16%.

NetApp, the data and storage software company, said it expected fiscal 2024 revenue down “approximately 2%,” narrower than analysts’ estimates that called for a decline of 3.5%. NetApp said it expected adjusted fiscal-year profit of $6.05 to $6.25, higher than Wall Street estimates of $5.73 and a prior company forecast of $5.65 to $5.85 a share. The stock jumped 15% and was the best performer in the S&P 500.

Workday, the human-resources technology provider, reported third-quarter adjusted earnings that beat Wall Street expectations and said subscription revenue in the period rose 18.1%. Workday also raised its fiscal-year forecast for subscription revenue, saying it expects $6.598 billion, up from previous estimates of $6.57 billion to $6.59 billion. The stock rose 11%.

Hormel Foods fell 4.6% after the owners of Planters and Spam issued an adjusted earnings range for fiscal 2024 that was below consensus.

Pure Storage fell 14% after beating on the top and bottom line for its third quarter but issued fourth quarter revenue guidance well below the Street.

Nutanix rose 8% after beating on the top and bottom line in its first quarter and issued bullish second quarter and full year revenue guidance.

Salesforce rose 8% after beating on earnings in its third quarter and provided better-than-expected fourth quarter and full-year guidance.

Snowflake rose 7% after beating on the top and bottom line in the third quarter and issued strong fourth quarter product revenue

Market News

US economy grows 5.2% in third quarter; higher interest rates eroding momentum

The U.S. economy grew faster than initially thought in the third quarter as businesses built more warehouses and accumulated machinery equipment, but momentum appears to have since waned as higher borrowing costs curb hiring and spending.

The growth pace, which was the quickest in nearly two years, however, likely exaggerated the health of the economy last quarter. When measured from the income side, economic activity increased at a moderate pace. Nevertheless, the report from the Commerce Department on Wednesday indicated the economy continued to grow despite fears of a recession that have persisted since late 2022.

Fed's Beige Book finds economy has slowed - and so has inflation

The U.S. economy slowed in November while inflation also tapered off, according to a Federal Reserve survey, suggesting the central bank could be finished raising interest rates if those trends continue.

The survey, known as the Beige Book, said the economy has softened since the previous report at the end of summer. The latest survey covers the period of Oct. 6 to Nov. 17.

A slew of top Fed officials have pointed to a recent slowdown in the economy as a sign that higher interest rates are working to reduce growth, ease shortages in the labor market and reduce the rate of inflation.