eBay Inc on Wednesday forecast current-quarter revenue above Wall Street projections after beating March-quarter earnings estimates, as it benefits from its strategy of focusing on product categories including sneakers and watches.

A selective push from the ecommerce firm also on items like collectibles and refurbished products is helping it drive sales at a time when consumer spending has moderated due to high inflation.

"There remains a dynamic and uncertain macro economic environment across the globe with inflation and rising interest rates and pressured consumer confidence ... but our focus categories remain relatively resilient," Chief Executive Jamie Iannone said in an interview.

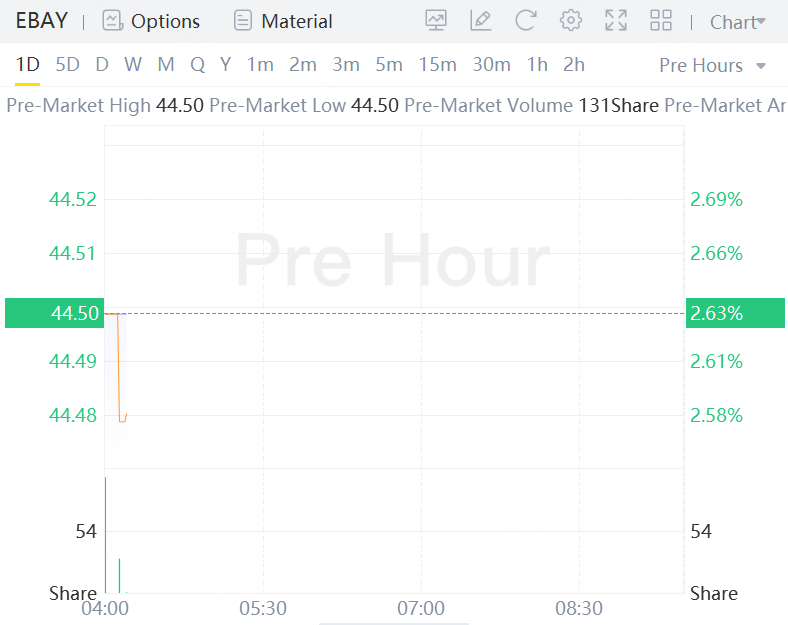

The upbeat results soothed investor sentiment, which was hit after eBay earlier this year said that demand weakness will persist in the first half of 2023. The company's shares rose 2.63% in premarket trading.

EBay is expanding listings under refurbished electronics, luxury bags and watches, and recently launched the collectibles category through its acquisition of trading cards marketplace TCGplayer last year.

EBay is also pushing to expand international sales, which contributed about 20% to its total gross merchandise volume last year, through a new program wherein eBay handles customs formalities and intermediates returns.

San Jose, California-based eBay expects now June-quarter revenue in the range $2.47 billion to $2.54 billion, higher than analysts' projection of $2.43 billion, according to Refinitiv.

Revenue in the most recent March quarter grew 1% to $2.51 billion, also beating analysts' estimate of $2.48 billion. Earnings per share of $1.11 also came in higher than estimate of $1.07.

Gross merchandise volume, a key industry gauge that denotes the total value of goods and services sold on the marketplace, however, fell 5% to $18.4 billion.