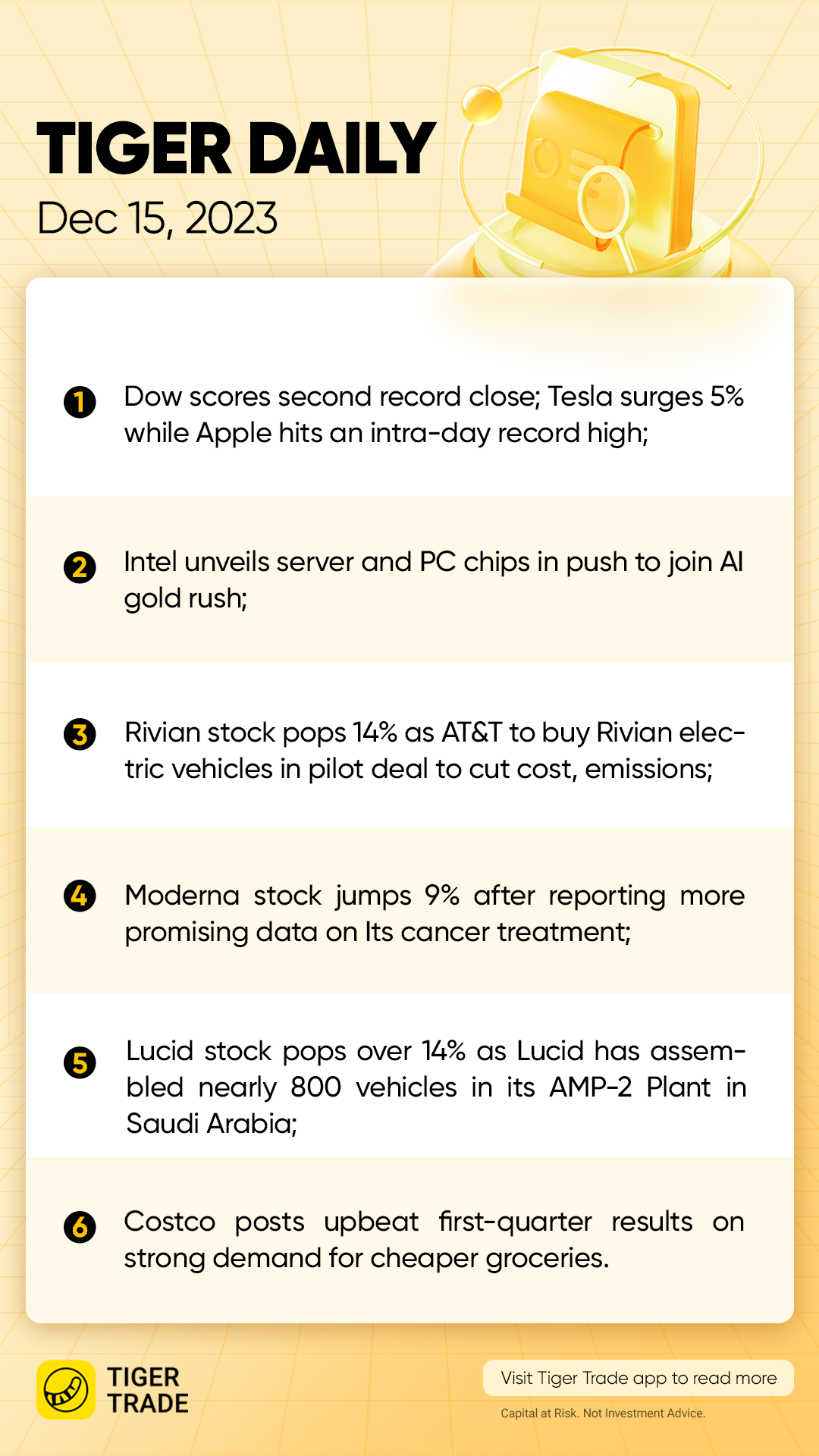

U.S. stocks ended firmer on Thursday, with the Dow Jones Industrial Average notching its second straight record high close, lifted by optimism that borrowing rates will decrease next year following a dovish pivot by the Federal Reserve.

Apple hit an intra-day record high before surrendering some of its gains to close up 0.08%.

Tesla shares surged 4.9%, with about $40 billion worth changing hands. Its turnover was more than double that of Nvidia, the next most traded company. The heavyweight chipmaker gained 0.5%.

Market Snapshot

The S&P 500 climbed 0.26% to end the session at 4,719.55 points. The Nasdaq gained 0.19% to 14,761.56 points, while Dow Jones Industrial Average rose 0.43% to 158.11 points.

Market Movers

Moderna jumped 9.3% after it unveiled new data from a continuing early-stage trial of the personalized cancer treatment it has been testing with Merck. Moderna said Thursday that updated results after three years show that the combination regimen of the Moderna treatment and Merck’s Keytruda continued to offer improvements in survival rates over Keytruda alone.

Rivian Automotive rose 14% after AT&T said it agreed to buy electric vehicles for its fleet through a pilot program aimed at cutting transport emissions.

SolarEdge Technologies jumped 17% and Enphase Energy rose 12% as the prospect of lower interest rates energized the solar sector. The Federal Reserve’s signal that it is preparing to cut interest rates next year was relieving fears of waning demand for solar panels.

Adobe, the maker of Photoshop and other popular media creation tools, reported fiscal fourth-quarter adjusted earnings and revenue that topped analysts’ expectations, but the stock was falling 6.4% after Adobe issued a fiscal 2024 revenue forecast that was short of estimates. The company also said it could incur significant costs or penalties related to a Federal Trade Commission investigation into its cancellation practices for software subscriptions.

Opendoor Technologies was up 11% after jumping 19% on Wednesday. Earlier this week, Opendoor was upgraded to Market Perform from Underperform at Keefe Bruyette & Woods. Analysts cited a lack of downside catalysts for the upgrade.

Occidental Petroleum rose 2.7%. Berkshire Hathaway was a big buyer of the stock in recent days, purchasing 10.5 million shares for about $590 million. Warren Buffett’s Berkshire now holds a stake of 238.5 million shares in Occidental for a 27% interest. The purchases amount to a vote of confidence by Buffett in the energy company and its CEO Vicki Hollub after Occidental announced Monday it was buying privately held energy producer CrownRock for $12 billion.

Illumina was up 3.8% after shares of the gene-sequencing company were initiated with Buy recommendations by analysts at Guggenheim and Stephens.

Foot Locker rose 10% after shares of the footwear retailer were upgraded by Piper Sandler to Overweight from Neutral and the price target was lifted to $33 from $24.

Live Nation Entertainment gained 5.7%. Shares of Live Nation, the parent of Ticketmaster, were upgraded to Overweight from Equal Weight. The firm raised its price target to $110 from $100.

Jabil reported better-than-expected fiscal first-quarter earnings and sales. Shares of the contract electronics manufacturer rose 13%. The stock will join S&P 500 on Monday.

Market News

U.S. Retail Sales Rise 0.3% in November, above Forecast

Consumers showed unexpected strength in November, giving a solid start to the holiday season as inflation showed signs of continued easing.

Retail sales rose 0.3% in November, stronger than the 0.2% decline in October and better than the Dow Jones estimate for a decrease of 0.1%, the Commerce Department reported Thursday. The total is adjusted for seasonal factors but not inflation.

Excluding autos, sales rose 0.2%, also better than the forecast for no change.

With the consumer price index up 0.1% on a monthly basis in November, the retail sales number shows consumers more than keeping up with the pace of price increases.

Intel Unveils Server and PC Chips in Push to Join AI Gold Rush

Intel Corp., the biggest maker of personal computer processors, announced new chips for PCs and data centers that the company hopes will give it a bigger slice of the booming market for artificial intelligence hardware.

The lineup includes updated Xeon server chips — the second overhaul of that processor in less than a year — that use less electricity while boosting performance and memory, the company said in a statement Thursday. Intel’s new Ultra Core chips for laptops and desktop computers, meanwhile, will let PCs process AI functions directly.

Intel’s new product with the most to prove may be the Gaudi 3, the latest installment of a line that competes with Nvidia Corp.’s industry-leading H100. These chips — known as AI accelerators — help companies develop chatbots and other rapidly proliferating services. Gaudi 3 is on schedule for release in 2024.