As the curtains come down for the first half of 2023, it’s time to reflect on the stock market for the year. The Nasdaq 100 Index is poised for its best opening six months to a year ever. The S&P 500 has gained 14.5% so far this year, helping it recoup all of its plunge since the Fed kicked off its cycle of rate hikes in March 2022.

Investors may be pleased to know the half-year performance of Straits Times Index. As of the close on Friday, STI closed at 3,205.91 points, down 1.40% for the first half of 2023.

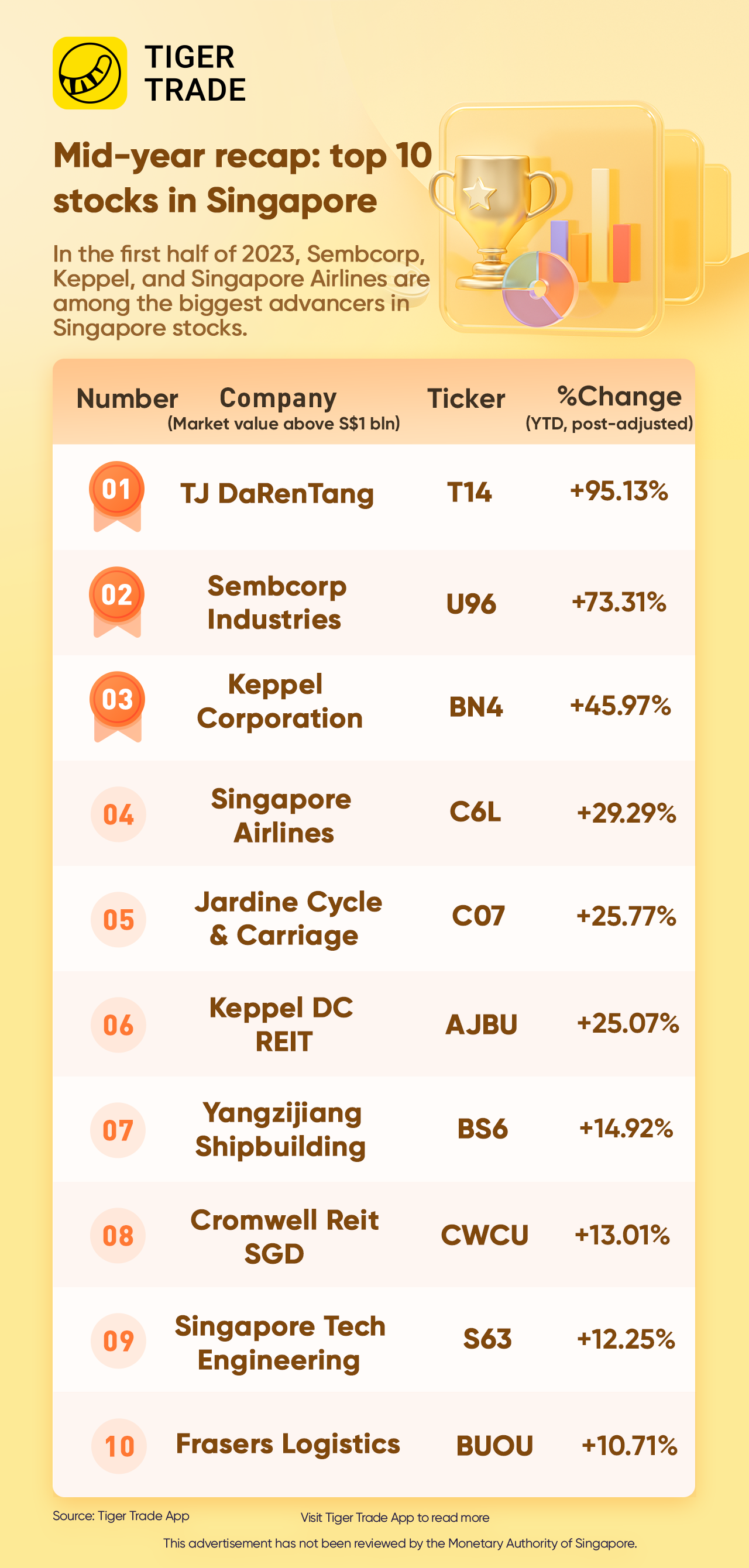

Which Singapore stocks with a market cap above S$1 billion are winners? Let’s find out.

During the first six months this year, TJ DaRenTang was up 95.17%; Sembcorp Industries added 73.31%; Keppel Corporation rose 45.97%; Singapore Airlines was up 29.29%; Keppel DC REIT increased 25.07%.

1、TJ DaRenTang

Tianjin Pharmaceutical Da Ren Tang Group Corp Ltd, formerly Tianjin Zhongxin Pharmaceutical Group Co Ltd, is a China-base company mainly engaged in the productionoperation and scientific research of green traditional Chinese medicine.

The Company's businesses cover the whole industry chain of traditional Chinese medicine including the cultivation of Chinese medicinal materials, trade of Chinese medicinal materials research and development, production and sales of Chinese patent medicines and so on.

TJ DaRenTang shares soared 95.13% in the first half of 2023.

2、Sembcorp Industries

Sembcorp Industries (Sembcorp) is a leading energy and urban solutions provider, driven by its purpose to do good and play its part in building a sustainable future. Sembcorp has a balanced energy portfolio of over over 15GW, with more than 5.7GW of gross renewable energy capacity comprising solar, wind and energy storage globally.

Sembcorp shares soared 73.31% in the first half of 2023.

Sembcorp Industries' recent renewables acquisitions and 10-year power purchase agreement with Singtel look favorable to Maybank. It raises its 2023-2025 earnings forecasts by 9%-11% to factor in higher margins for long-term PPAs secured recently.

But with roughly 60% of Sembcorp's generating capacity backed by one- to 18-year contracts, the utilities company "needs to strike a balance and leave some capacity exposed to the spot market," analyst Kelvin Tan says in a note. Still, he expects positive share-price momentum when Sembcorp sets a new renewable-energy capacity goal, given it has already exceeded its target of 10 GW by 2025.

Maybank reiterates its buy rating on the stock and raises its target price to S$6.00 from S$4.35. Shares are 0.7% higher at S$5.51.

3、Keppel Corporation

The blue-chip group has announced the next phase of its transformation by embarking on a major reorganisation to simplify its operating structure and go asset-light. Keppel Corporation shares has climbed over 45.97% in the first half of 2023.

As part of its reorganisation, Keppel will adopt a horizontally-integrated business model with three distinct platforms. These three platforms are the Fund Management Platform, Investment Platform, and Operating Platform.

The focus of the Fund Management Platform is to raise capital for the group and engage with and forge strong relationships with investors. Capital deployment decisions are the mainstay of the Investment Platform as this division seeks to create value for investors. Finally, the Operating Platform will house all of the group’s existing business units and will leverage Keppel’s shared support functions for better synergies.

For its fiscal 2023’s first-half earnings, Keppel will adopt a new reporting structure known as horizontal reporting. By doing so, the group hopes to demonstrate its ability to capture multiple income streams through its new operating model.

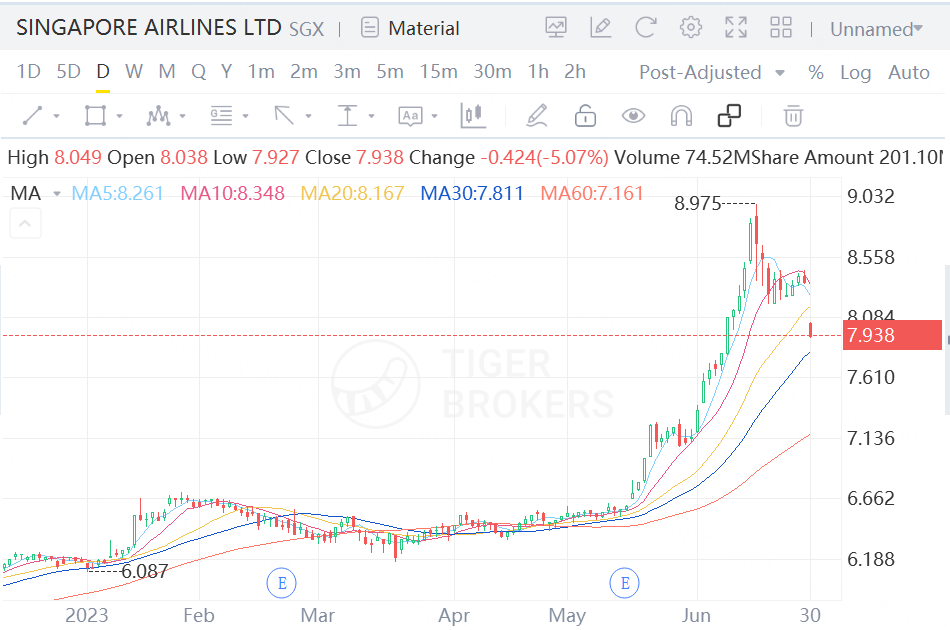

4、Singapore Airlines

Singapore Airlines’s 29.29 per cent rally in the past six months tops gains among global airline stocks after it posted record profit, driven by pent-up demand.

The shares are trading at their highest level in five years, with the advance accelerating last month after the carrier reported its highest-ever annual net income as travel resumed following Covid-19.

“Passenger traffic is yet to fully reach pre-Covid levels, and seasonally higher summer travel for the Northern Hemisphere is just taking off,” said Thilan Wickramasinghe, an analyst at Maybank Securities.

“Plus, there are expectations of rising travel demand from China in the second half as the county’s reopening progresses.”

While airlines globally have seen business gradually improve since the pandemic, some investors have grown cautious on the sector overall amid high fares, threats of recession and China’s uneven recovery. Singapore Airlines’ outperformance may be in part due to perceptions of advantages over other carriers.

“SIA’s investment in premium branding – such as offering free wifi on all cabin classes – should enable them to defend market share, even as more competitor capacity takes to the air,” said Mr Wickramasinghe.

“The group was proactive in getting flight capacity online early and has better staffing strength given lower retrenchments during the pandemic.”

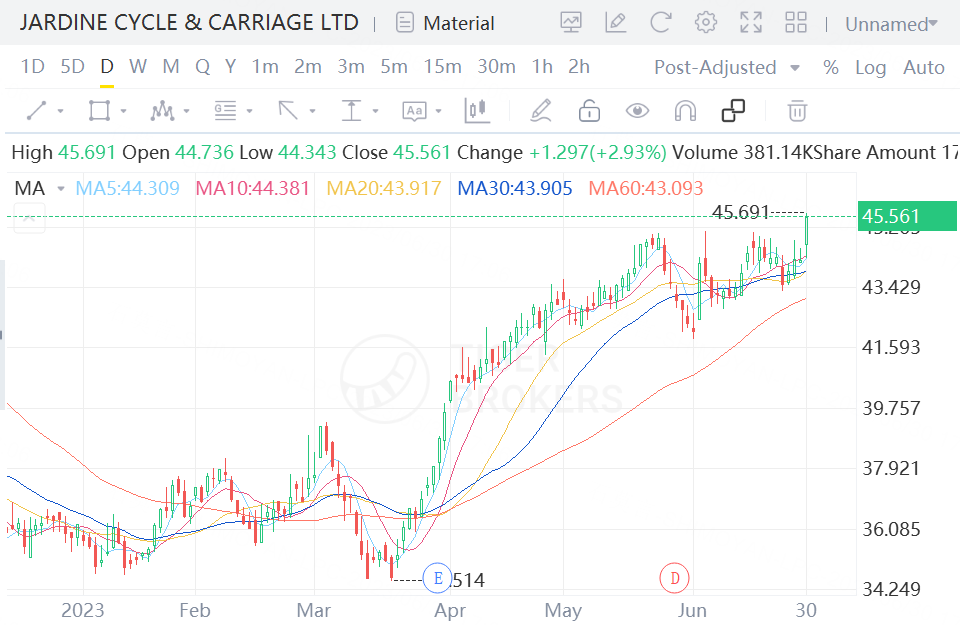

5、Jardine Cycle & Carriage

Jardine C&C is the investment holding company of the Jardine Matheson Group. It holds interests in other companies, such as Vietnamese conglomerate Truong Hai Group Corp and Indonesian conglomerate Astra, which both have automative interests.

Shares of JC&C have jumped 25.77 per cent year-to-date, outperforming a relatively flat local benchmark stock index.

Jardine Cycle & Carriage has entered a strategic partnership with used car marketplace Carro to jointly explore opportunities in the used car and aftersales businesses.

Under the tie-up, which they value at over US$60 million (S$80.2 million), Jardine C&C will take a stake in Singapore-based Carro, while Carro will acquire a stake of equal value in Jardine C&C subsidiary Republic Auto, one of the largest used car dealers in Singapore.

Jardine C&C and Carro will also form an aftersales joint venture to roll out a multi-brand aftermarket workshop business with an initial focus on Singapore and Malaysia.

The new business “will leverage Carro’s proprietary tech capabilities to seamlessly mirror and integrate the value chain from online to offline to enhance customer touchpoints,” while Jardine C&C will provide the relevant experience to support the joint venture and collaborate on ancillary aftermarket businesses.

6、Keppel DC REIT

Keppel DC REIT was the first listed data centre REIT and went public back in December 2014 at S$0.93 per share. Back then, the REIT’s portfolio comprised just eight data centres valued at S$1 billion. Over more than eight years, Keppel DC REIT has managed to almost triple its number of properties with assets under management rising more than two-fold.

Keppel DC REIT shares soared 25.07% in the first half of 2023.

Analysts from DBS Group Research and OCBC Investment Research have kept their calls on Keppel DC REIT AJBU, following its 1QFY2023 business update showing continued improvement.

For the three months ended March 2023, the data centre REIT owner saw its distribution per unit increase by 3% y-o-y thanks to better tax efficiency.

Keppel DC REIT's operational performance improved too, with revenue up 6.5% y-o-y and net property income up 6.3%. "It was a steady start for KDCREIT," says DBS.

Factors contributing to this include increased contribution from the REIT’s Guangdong Data Center 2 and the building shell of Guangdong Data Centre 3, various other asset enhancement initiatives, as well as organic growth from renewals and income escalations.

In addition, tenant credit remains "solid" with minimal arrears, says DBS, which has kept its “buy” call and $2.35 target price. Keppel DC REIT is looking to renew leases equivalent to 14.3% of its income this year and DBS believes the REIT's portfolio remains resilient with strong retention rates.

7、Yangzijiang Shipbuilding

Year-to-date, the group has secured new orders worth US$5.6b, almost double its 2023 target. It has also now achieved its highest ever total outstanding orderbook value of US$14.6b for 180 vessels, Yangzijiang said in an SGX filing.

Yangzijiang Shipbuilding shares soared 14.92% in the first half of 2023.

For the latest round of new orders, a total of 16 of the vessels are containerships, 11 are oil tankers, and 10 are bulk carriers.

Yangzijiang Shipbuilding looks well-placed to win more orders for delivery between 2026 and 2027, UOB Kay Hian analyst Adrian Loh says in a research report as the brokerage raises the stock's target price to S$1.65 from S$1.58 with an unchanged buy rating.

With year-to-date orders of US$5.6 billion, this exceeds Yangzijiang Shipbuilding's 2023 order-win target of US$3 billion, prompting the brokerage to raise its 2023 order-win target for the company to US$7 billion.

8、Cromwell Reit SGD

Cromwell Reit SGD has soared 13.01% so far this year.

With interest rates remaining in the spotlight, investors have continued to focus on real estate investment trusts’ (Reits’) borrowings and balance sheet resilience. Higher interest rates have typically been associated with higher borrowing costs and therefore lower distributions available for unitholders.

9、Singapore Tech Engineering

ST Engineering is DBS’s preferred choice. “Its valuation has yet to reflect the multiple growth levers that we foresee fuelling its 16% core earnings CAGR over the next two years. In a June 26 note, the DBS analysts gave “buy” calls with target prices of S$4.20. DBS analysts believe SIA's earnings may peak in FY2024 as supernormal passenger yields revert to more normalised levels.

Shares of ST Engineering have jumped 12.25 per cent year-to-date.

Singapore Technologies Engineering is poised for a significantly higher bottom line this year on a business recovery across various divisions, Nomura analysts Ahmad Maghfur Usman and Bineet Banka say in a research note. They cite the company's expectations for growing maintenance, repair and overhaul business as China fully reopens and rising interest in defense as countries seek to diversify defense programs amid Russia-Ukraine tensions. They add that TransCore is "tracking quite well" postacquisition. They keep a buy rating with a S$4.20 target price, forecasting a 25% rise in 2023 profit.

10、Frasers Logistics

Frasers Logistics & Commercial Trust is a Singapore-based real estate investment trust. The Trust is focused on investing in a portfolio of industrial and commercial properties. The Trusts investment strategy is to invest in a diversified portfolio of properties used predominantly for logistics or industrial purposes located globally, or commercial purposes or business park purposes located in the Asia-Pacific region or in Europe.

Shares of Frasers Logistics have jumped 10.71 per cent year-to-date.

Analysts at DBS Group Research (DBS) and CGS-CIMB Research remain positive on Frasers Logistics and Commercial Trust (FLCT) amid strong positive rental reversions, income contribution from completed development projects and stable occupancy rates in 1HFY2023 ended March 31.

Both DBS analysts Dale Lai and Derek Tan and CGS-CIMB analysts Lock Mun Yee and Natalie Ong have maintained their “buy” and “add” calls. DBS’s Lai and Tan have kept their target price of $1.55 while CGS-CIMB’s Lock and Ong have upped their target price to $1.52 from $1.38 previously.

The analysts all note a positive rental reversion across FLCT’s lease expiries in 2QFY2023.

Lai and Derek from DBS note that this comes mainly from the Logistics & Industrial (L&I) portfolio in Australia (+23.6%) and Germany (+24.3%), with a total of 14 leases renewed.