Market Overview

Wall Street tanked in a broad sell-off on Thursday(Sep 21), as investor risk appetite was dashed by worries that the Federal Reserve's restrictive monetary policy will remain in place for longer than anticipated.

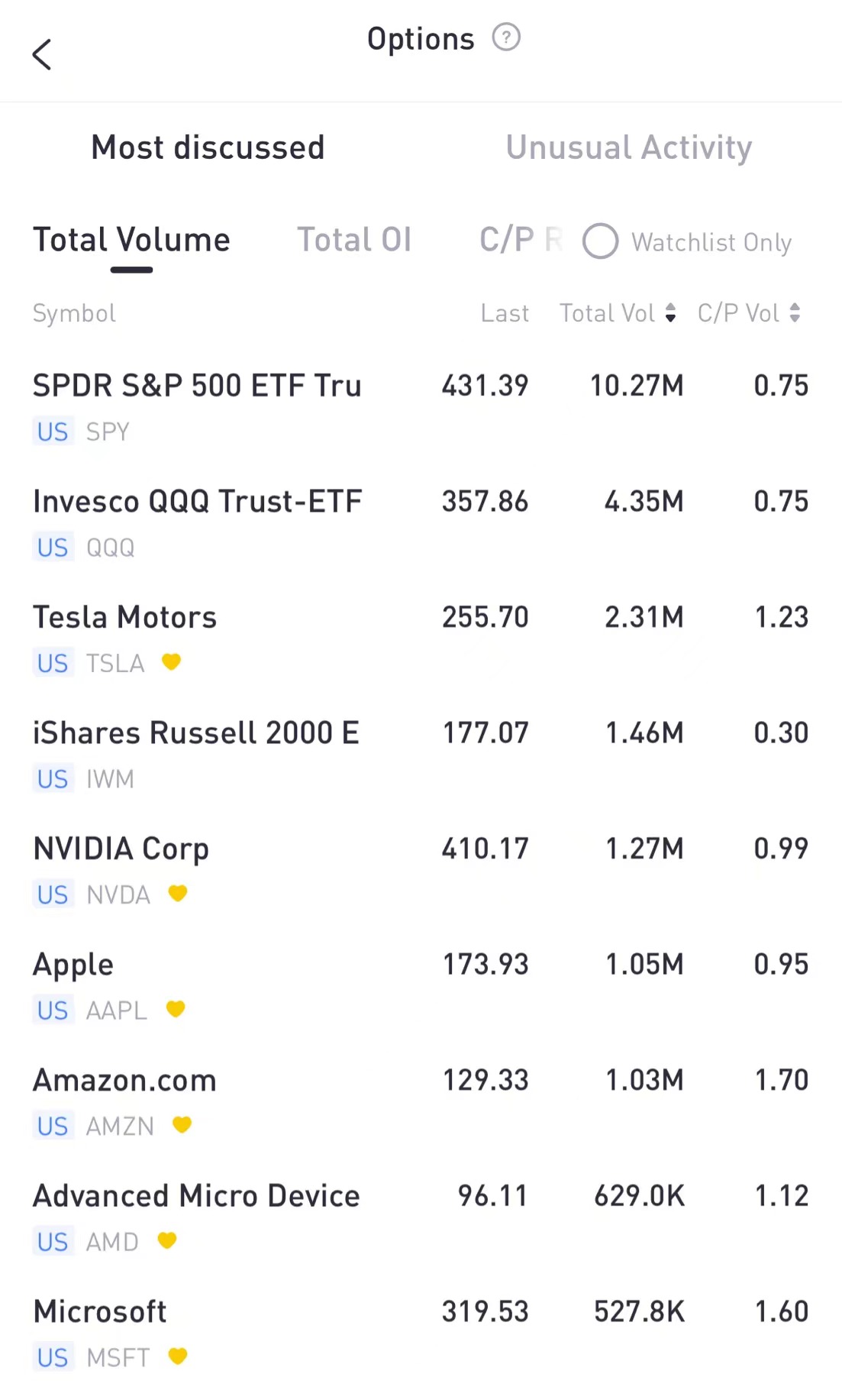

Regarding the options market, a total volume of 42,048,388 contracts was traded, up 30% from the previous trading day.

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust, Tesla Motors, iShares Russell 2000 ETF, NVIDIA Corp, Apple, Amazon.com, Advanced Micro Devices, Microsoft

Interest rate-sensitive megacaps, led by Amazon.com, Nvidia Corp, Apple Inc and Alphabet Inc dragged the S&P 500 and the Nasdaq to their lowest closing levels since June.

There were 1.27M Nvidia option contracts traded on Thursday, surging 60% from the previous trading day. Call options account for 50% of overall option trades. Particularly high volume was seen for the $410 strike Put option expiring Sep 22, with 83,726 contracts trading.$NVDA 20230922 410.0 PUT$

Unusual Options Activity

Benchmark 10-year U.S. Treasury yields touched a 16-year peak the day after Fed Chairman Jerome Powell warned inflation still has a long way to go before approaching the central bank's 2% target.

There were 426,068 TLT option contracts traded on Thursday. Call options account for 53% of overall option trades. Particularly high volume was seen for the $95 strike Call option expiring Sep 29, with 13,004 contracts trading.$TLT 20230929 95.0 CALL$

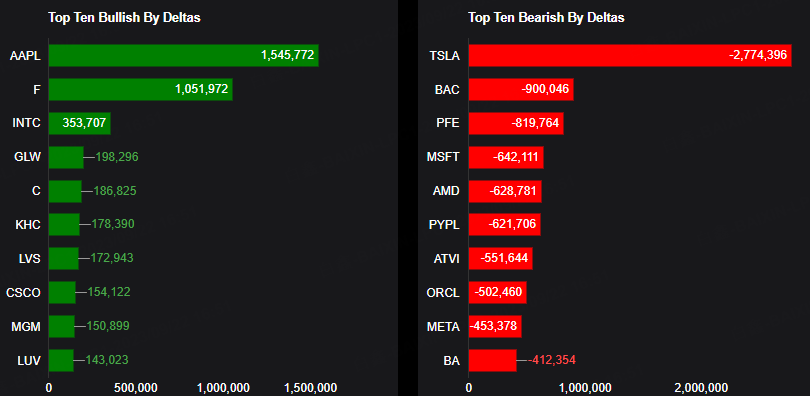

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: AAPL, F, INTC, GLW, C, KHC, LVS, CSCO, MGM, LUV

Top 10 bearish stocks: TSLA, BAC, PFE, MSFT, AMD, PYPL, ATVI, ORCL, META, BA

Based on option delta volume, traders sold a net equivalent of -2,774,396 shares of Tesla stock. The largest bearish delta came from selling calls. The largest delta volume came from the 22-Sep-23 260 Call, with traders getting short 4,036,276 deltas on the single option contract.$TSLA 20230922 260.0 CALL$

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club