Netflix’s net subscribers are expected to creep higher in 4Q and for the whole year of 2023.

Ad-supported tier has hit more than 23 million monthly active users.

In 4Q, ARM expansion was likely anemic, with limited benefits from higher prices in the UK and US.

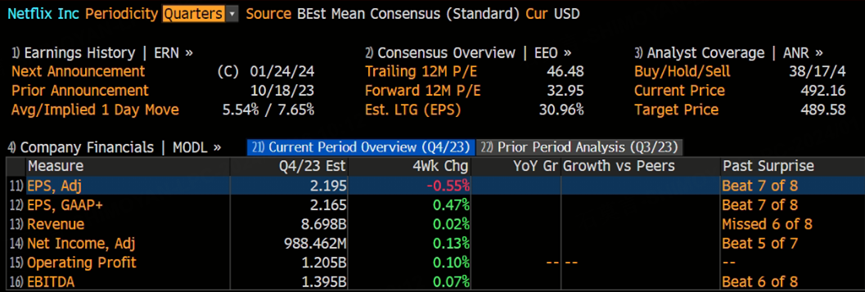

Netflix will post its fourth quarter 2023 financial results and business outlook post-market on Tuesday, January 23, 2024. Netflix's Q4 revenue is expected to be $8.698 billion, with an adjusted net profit of $988.462 million and an adjusted EPS of $2.195, according to Bloomberg's consensus expectation.

Previous quarter review & outlook

Netflix picked up nearly 9 million new customers around the globe in 3Q, surpassing the 6 million consensus forecast of Wall Street analysts.

Netflix credited the gains to its crackdown on password-sharing and a steady flow of new programming such as global hit "One Piece."

The company posted revenue of $8.542 billion, in line with analyst forecasts. Earnings-per-share came in at $3.73, ahead of Wall Street's expectation of $3.49.

Netflix projected fourth quarter revenue of $8.69 billion, in line with the $8.698 billion forecast from analysts polled by Bloomberg.

What will we focus on?

Netflix may post a strong subscriber increase in 4Q

Netflix’s net subscribers are expected to creep higher in 4Q and for the whole year of 2023.

Data from Bloomberg shows that the streaming giant may project 4Q net additions of roughly 8.9 million, keeping the pace with 8.76 million growth last quarter. This number also represents a 16% increase compared with the same quarter in 2022.

For the full year of 2023, Netflix is expected to report about 25 million subscribers’ growth. Most of the growth is from Europe, Middle East & Africa by region.

Ad-based plan hits 23 million active monthly users

Netflix’s ad-supported tier has hit more than 23 million monthly active users, Amy Reinhard, the streaming service’s president of advertising, said recently.

That’s about an 8 million increase in roughly two months; the streaming giant announced it had 15 million global monthly active users in November 2023.

“Scaling our business is absolutely our biggest priority right now, but we want to make sure we’re doing that in a meaningful way for the members,” she said.

“We remain very optimistic about our long run opportunity in this very big market,” Netflix said in the letter.

Netflix launched its ad-based plan in the United States, Canada, Australia, Brazil, France, Italy, Germany, Japan, Korea, Mexico, Spain and the UK in 2022. The standard plan with ads costs $6.99 a month in the US.

ARM expansion likely to slow in 4Q

Those gains may moderate in 2024 as the company strives for a better balance between subscriber and pricing increases, implying that average revenue per member (ARM) could be up about 5-6% through the year on potential price hikes in overseas markets, apart from progress on paid sharing and advertising. In 4Q, ARM expansion was likely anemic, with limited benefits from higher prices in the UK and US.

Ultimately, Netflix is poised not only for 2024 revenue reacceleration but a gain in operating margin to 22-23%. Momentum in free cash flow is likely to be sustained after reaching a record $6.5 billion in 2023.

Analysts’ opinions

Oppenheimer raised PT on Netflix to $600

Oppenheimer's Jason Helfstein raised their price target on Netflix by 26.3% from $475 to $600 on 2024/01/12. The analyst maintained their Buy rating on the stock.

Helfstein's update comes in the wake of Netflix's recent announcement on January 10, 2024, revealing that the ad-tier Monthly Active Users (MAUs) count had surpassed 23 million. This marks a significant increase from 15 million in November 2023 and 5 million in May 2023. According to Helfstein, this surge in MAUs suggests that Netflix's net subscriber additions for Q4 2024 will exceed the Street's estimate.

Highlighting the potential for further subscriber growth in 2024, Helfstein's assessment points to the "rapid pace of acceleration."

Netflix subscriber, revenue numbers trending higher: Wedbush

Netflix subscriber and sales numbers are creeping higher this quarter, Wedbush said.

Netflix keeps benefiting from former account-sharers, at least 15% of whom opted to pay more for the extra- member features post-crackdown, resulting in higher ARPU.

Netflix remains on Wedbush’s Best Ideas List with the bank expecting the company to generate significantly more free cash flow than its guidance suggests.

“Netflix has reached the right formula with global content creation, balancing costs and increasing profitability, while its password sharing crackdown and eventually its ad-supported tier should further boost cash generation,” analysts led by Alicia Reese wrote in a note.

Netflix's price target was raised by analysts at both KeyBanc and BofA

Wells Fargo analysts increased their estimate on Netflix net additions to 10.4 million from 9.5 million, based on internal research.

And BofA Securities analyst Jessica Reif Ehrlich raised her price target on Netflix's stock to $585 from $525 and kept her buy rating. KeyBanc Capital Markets analyst Justin Patterson increased his price target to $545 from $525 and maintained his overweight rating.

Rosy outlooks from Wall Street are being fueled by a digital ad market that "appears to be holding up relatively well as we exit 2023 and enter 2024," Piper Sandler analyst Matt Farrell wrote. "Our digital ad expert sees [fourth-quarter] digital ad market growth of 8.7%, with an acceleration through the end of the quarter.