Netflix is scheduled to report third-quarter earnings after the U.S. stock market closes on Tuesday, Oct. 18. Analysts anticipate revenues of Netflix to reach $7.85 billion, up 4.9% from the same period of the last year. Adjusted net income, however, is expected to slide 19.8% year-on-year to 1.05 billion.

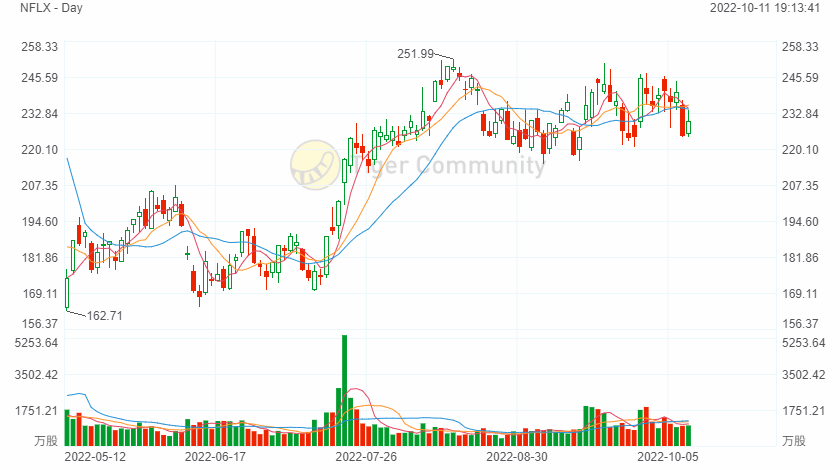

The stock gained steam in the third quarter, with shares rising more than 30% during that period. Investors may be betting that the streaming platform specialist returned to sequential subscriber growth in the third quarter.

Latest Results

Latest Results

The streaming giant's second-quarter results showed fewer-than-expected subscriber losses. Netflix reported EPS of $3.20, versus the consensus estimate of $2.96. Revenue grew 9% year-over-year to $7.97 billion, slightly below the consensus estimate of $8.03 billion.

Revenue growth was driven by a 6% increase in average paid memberships and a 2% increase in ARM (Average Revenue per Membership). Global streaming paid net additions in Q2 were -970,000, compared to the expected loss of 2 million.

Q3 Guidance

Netflix provided its Q3 outlook, expecting revenues of $7.84 billion, in line with the consensus estimate of $7.85 billion, and EPS of $2.14, compared to the consensus of $2.22. The company estimates 1 million global streaming paid net additions in Q3 (vs.4.4 million in 3Q21) after a loss of nearly 1.2 million in 1H..

The US dollar continues to strengthen meaningfully against most currencies, posting a significant headwind for all multinational US companies. Netflix has high exposure to this unprecedented appreciation in the USD because nearly 60% of the company’s revenue comes from outside the US.

Over the medium term, the company intends to adjust its business as appropriate given the relative strength of the USD to protect its operating margin and try to avoid immediate actions that could be detrimental to the business.

Most Important Things to Watch

1. Ads could be a major catalyst

For the first time in a long time, investors may not be focused on Netflix's subscriber growth, looking instead for details around the launch of a nascent ad-supported tier, which will provide a new revenue stream and may reignite user growth. Netflix will be launching a less expensive ad-supported tier for customers after losing 200,000 viewers in the March quarter. The subscriber count in the June quarter was down 970,000. The continued loss in subscribers comes during a time of economic uncertainty for many U.S. households, as inflation continues to soar and fears of a recession loom.

But J.P. Morgan analyst Doug Anmuth thinks the ad-supported tier in the U.S. and Canada is “critical to re-accelerating revenue, expanding Netflix ’s SAM (serviceable available market), and driving greater profitability.”

Anmuth estimates there will be 7.5 million ad-supported U.S. and Canada subscribers in 2023 and 22 million in 2026. He added that the ad-supported tier could generate overall revenue of about $1.2 billion in 2023 and $4.6 billion in 2026, including incremental revenue of $350 million in 2023 and $2.3 billion in 2026, “which would drive 2% upside to current 2023 estimates and 13% upside to 2026.” The analyst has a Neutral rating on the stock with a $240 price target.

2. Subscriber growth

After reporting two consecutive quarters of declining subscribers, Netflix management said in its second-quarter update that it expected to return to sequential growth in Q3. Specifically, management guided for 221.7 million subscribers, up from 220.7 million at the end of Q2.

To help membership growth, management said it has been investing in product, content, and marketing. Of course, this isn't anything new. Management noted in its second-quarter letter to shareholders that these are the same areas the streaming-TV company has invested in to drive membership growth for the last 25 years. But with two quarters of sequential declines in membership behind it, investors will be watching closely for these investments to start paying off.

Netflix cites a maturing market for connected TV adoption, account sharing, competition, and a difficult macroeconomic backdrop as some of the reasons for the company's stalled subscriber growth recently. A return to growth in the face of these challenges would be encouraging news for investors. And based on the stock's gain over the last three months, investors are likely expecting the company to achieve its third-quarter outlook for subscriber growth.

Analyst Opinions

Shares of Netflix earned multiple upgrades in September. Atlantic Equities analyst Hamilton Faber raised his rating for the video-streaming company to Overweight from Neutral, Oppenheimer’s analyst Jason Helfstein lifted his rating on the video streaming company to Outperform from Perform, and Evercore ISI analyst Mark Mahaney raised his rating on shares of Netflix to Outperform from In Line.

However, not all analysts are as optimistic. Also in Sept., Benchmark analyst Matthew Harrigan reaffirmed his Sell rating on the stock, citing overly optimistic ad pricing for its upcoming advertising-based service.