It will be the busiest week of the third-quarter earnings season, with nearly a third of S&P 500 companies scheduled to report. Economists and investors will also be watching third-quarter gross domestic product and the latest inflation data.

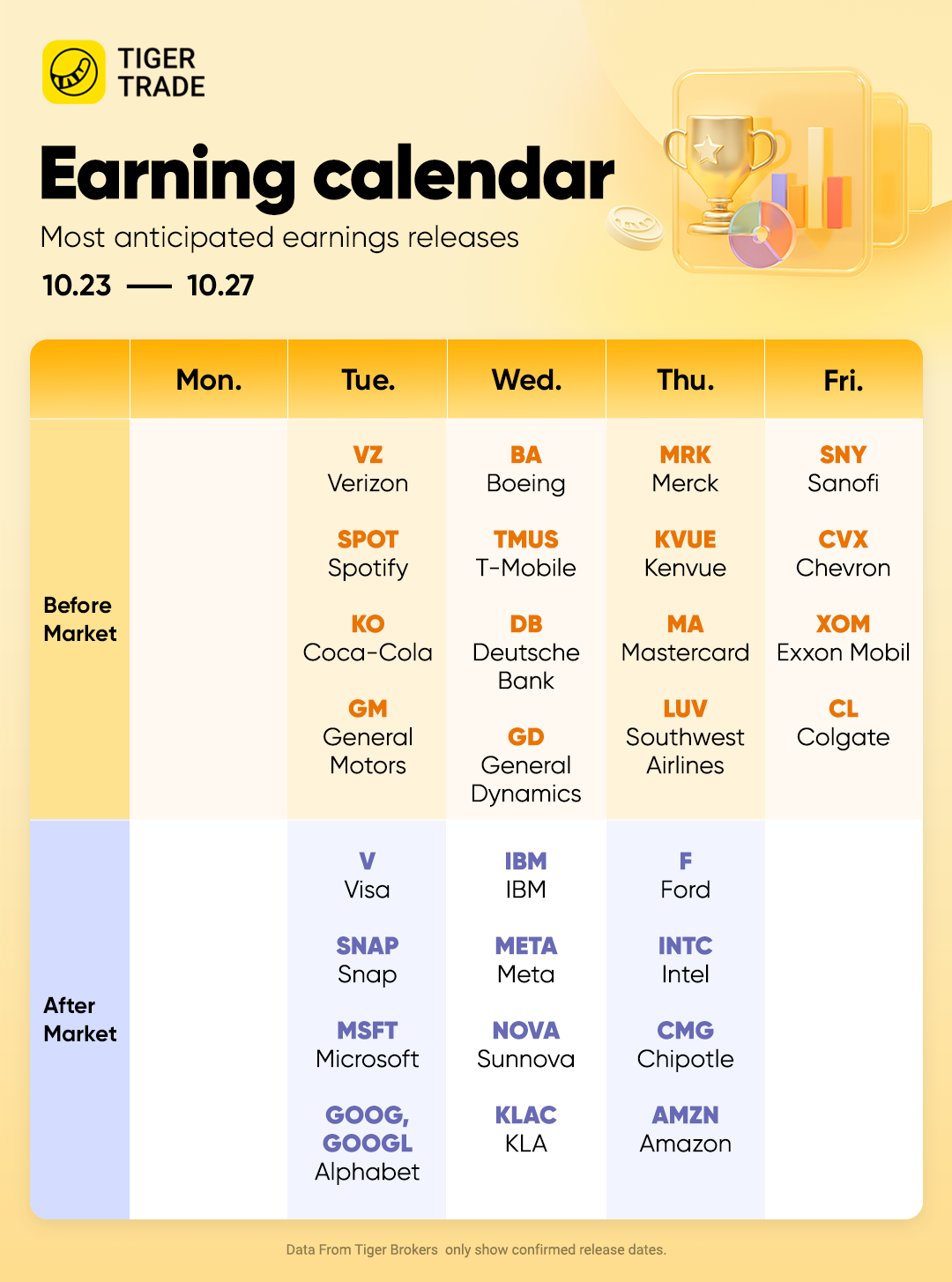

Earnings reports this week will come from several of the largest companies on the market: Microsoft and Google-parent Alphabet report on Tuesday followed by Facebook-parent Meta Platforms on Wednesday and Amazon. com on Thursday.

Coca-Cola, General Electric, General Motors, NextEra Energy, Spotify Technology, Verizon Communications, Visa all announce results on Tuesday, then Boeing, General Dynamics, IBM, and T-Mobile US go on Wednesday.

On Thursday, Chipotle Mexican Grill, Comcast, Ford Motor, Intel, Merck, Newmont, Southwest Airlines, and United Parcel Service will report. Charter Communications, Chevron, and Exxon-Mobil close the week on Friday.

The economic-data highlights of the week will include the Bureau of Economic Analysis’ advance estimate of third-quarter gross domestic product on Thursday. On average, economists see a 3.6% real growth rate in the period, versus 2.1% in the second quarter.

On Friday, the Bureau of Labor Statistics will release the personal-consumption expenditures price index for September. The Federal Reserve’s preferred inflation measure—core PCE, which excludes food and energy prices—is forecast to be up 3.7% from a year earlier, slower than August’s 3.9%.

Monday, 10/23

Cleveland-Cliffs and Logitech announce earnings.

Tuesday, 10/24

Big Tech earnings kick off with results from Alphabet and Microsoft expected after the market closes.

3M, Coca-Cola, Corning, Danaher, General Electric, Kimberly-Clark, NextEra Energy, PulteGroup, Sherwin-Williams, Spotify Technology, Verizon Communications, Texas Instruments, and Visa all announce results.

General Motors, one of the Detroit Three auto makers the United Auto Workers are striking, announces earnings before the opening bell. Management might provide an update on negotiations with the union during the conference call. The strike, which also targets Ford Motor and Chrysler-parent Stellantis, began in September.

Wednesday, 10/25

Big Tech firm Meta releases results after the market close.

Boeing, General Dynamics, T-Mobile US, IBM, and ServiceNow are also expected to announce earnings.

Thursday, 10/26

Amazon wraps a week of Big Tech earnings with results expected after the market close.

Ford’s results and conference call, scheduled after the closing bell, will offer another look at the impact of the UAW strikes.

Shell, Mastercard, Merck, Comcast, Intel, United Parcel Service, Honeywell, Bristol-Myers Squibb, Altria, American Tower, Northrop Grumman, Boston Scientific, Pioneer Natural Resources, Chipotle Mexican Grill, Keurig Dr Pepper, Hershey, Kenvue, Newmont, Royal Caribbean, and Southwest Airlines are among the companies expected to report earnings.

The Bureau of Economic Analysis releases its advance estimate of third-quarter gross domestic product. Economists see real GDP rising at a 3.6% seasonally adjusted annual rate, according to FactSet.

The Commerce Department releases new-home sales data for September. Existing-home sales for September fell to their lowest level since 2010 as average mortgage rates near 8%.

Friday, Oct. 27

Oil majors Chevron and Exxon-Mobil report financial results Friday before the market opens.

AbbVie, Sanofi, Colgate-Palmolive, and Charter Communications are also expected to announce results.

The Bureau of Labor Statistics releases the personal-consumption expenditures price index for September. Core PCE, which strips out food and energy prices and is the inflation gauge favored by the Federal Reserve, is expected to have risen 3.7% from a year ago, per FactSet.