The main events this week will be the latest inflation data and the Federal Reserve's policy committee's December meeting, with a decision on what they will do with interest rates due on Wednesday afternoon.

The market is overwhelmingly expecting no change to rates. Fed officials' latest projections for the economy and interest rates will offer clues into the future path of monetary policy.

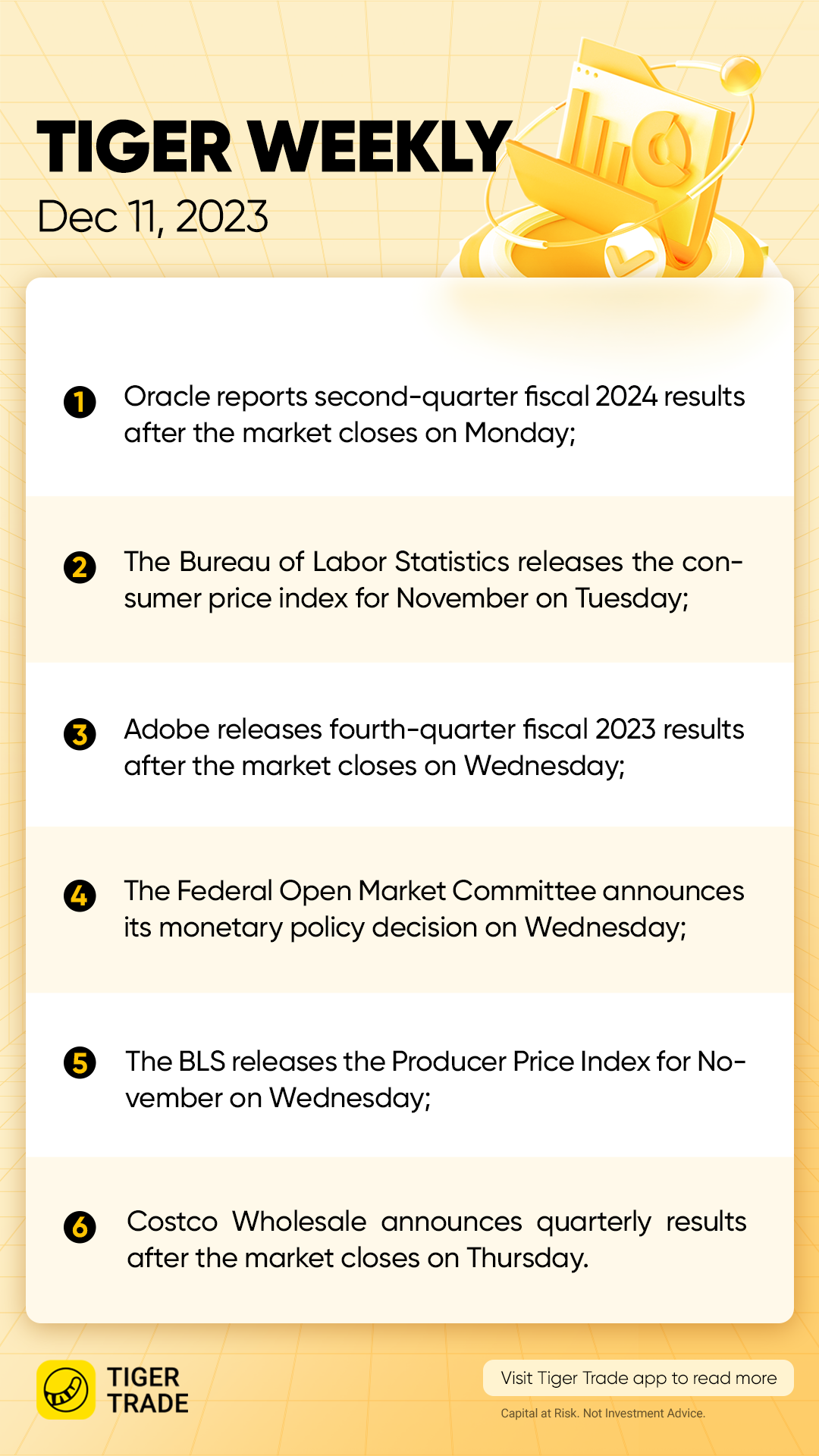

Earnings reports this week will come from Oracle on Monday, Johnson Controls International on Tuesday, Adobe on Wednesday, Costco Wholesale and Lennar on Thursday, and Darden Restaurants on Friday.

On Tuesday, the Bureau of Labor Statistics will release the consumer price index for November. Economists' average forecast calls for a 4% year-over-year rise in the core CPI, which excludes food and energy. That would be even with the October figure. The Producer Price Index for November, out on Wednesday, is expected to slow from a month earlier.

The Federal Open Market Committee is expected to keep the federal-funds rate steady at a target range of 5.25%-5.50% on Wednesday. There will be more attention on Chairman Jerome Powell's press conference that afternoon and on the FOMC's latest Summary of Economic Projections, or the so-called dot plot. The European Central Bank and Bank of England follow with their own monetary-policy decisions on Thursday.

Other economic data out this week will include the National Federation of Independent Business' Small Business Optimism Index for November on Tuesday, the Census Bureau's retail sales data for November on Thursday, and S&P Global's Manufacturing and Services Purchasing Managers' Indexes for December on Friday.

Monday 12/11

Oracle reports second-quarter fiscal 2024 results.

Tuesday 12/12

Johnson Controls International announces fourth-quarter fiscal 2023 earnings.

The Bureau of Labor Statistics releases the consumer price index for November. Consensus estimate is for a 3.1% year-over-year increase, one-tenth of a percentage point less than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4%, matching the October data. The annual percentage change in the core CPI is at its lowest level in more than two years.

The National Federation of Independent Business releases its Small Business Optimism Index for November. Economists forecast a 90.7, which would equal the October figure. The index has been below its 50-year average for 22 consecutive months.

Wednesday 12/13

Adobe releases fourth-quarter fiscal 2023 results.

The Federal Open Market Committee announces its monetary policy decision. The FOMC is widely expected to leave the federal-funds rate unchanged at 5.25%-5.50%. The debate on Wall Street has shifted to how many times the Fed will cut interest rates next year as there is near unanimous agreement that there will be no more rate hikes for this cycle. Traders are currently pricing in at least one percentage point worth of rate cuts by the end of 2024.

The BLS releases the Producer Price Index for November. Expectations are for the PPI to rise 1% year over year, while the core PPI is seen increasing 2.2%. This compares with gains of 1.3% and 2.4%, respectively, in October.

Thursday 12/14

Costco Wholesale and Lennar announce quarterly results.

The European Central Bank and Bank of England announce their monetary-policy decisions. Both central banks are expected to hold their target interest rates steady at 4% and 5.25% respectively.

The Census Bureau reports retail sales data for November. The consensus call is for retail spending to decline 0.1% month over month, matching October's drop. Excluding autos, sales are expected to be flat, after increasing 0.1% in October.

Friday 12/15

Darden Restaurants holds a conference call to discuss second-quarter fiscal 2024 earnings.

S&P Global releases both its Manufacturing and Services Purchasing Managers' Indexes for December. Economists forecast a 49.3 reading for the Manufacturing PMI and a 50.5 reading for the Services PMI. This compares with 49.4 and 50.8, respectively, in November.