July CPI Preview: The Second Wave Of Inflation Approaching

Philip Thurston

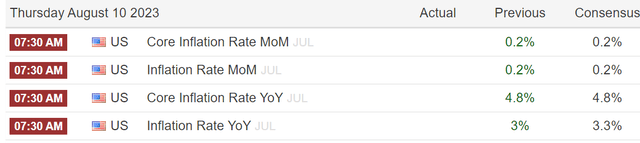

The consensus market expectations

The U.S. Bureau of Labor Statistics will release the much-anticipated CPI report for July on Thursday. The July report is especially important given that the CPI headline and the core CPI both increased only 0.2% in June.

The Fed's target is 2% inflation, which means that on a month-to-month basis, the inflation reading should be at 0.2% with some months at 0.1%. Thus, the June inflation reading gave the market confidence that inflation is on track to reach 2% over the next 12 months - if the monthly inflation continues to be at 0.2%.

In fact, the market consensus expectation for July is a 0.2% increase in the headline CPI and a 0.2% increase in the core CPI, as the table below shows. If these expectations are actually met, the market will continue to embrace the disinflationary story, and continue to expect the soft-landing, or even the no-landing scenario.

Trading Economics

The soft-landing scenario is based on the expectations that the disinflationary process will continue, which would allow the Fed to pause the interest rate hikes, and possibly cut interest rates - all before the recession hits the economy.

Many analysts are in fact lowering their recession probabilities, and even the Fed staff economists are not predicting a recession anymore. This is all based on the expectations that inflation is sustainably on track to reach the 2% target, and the July inflation consensus market expectations support this view.

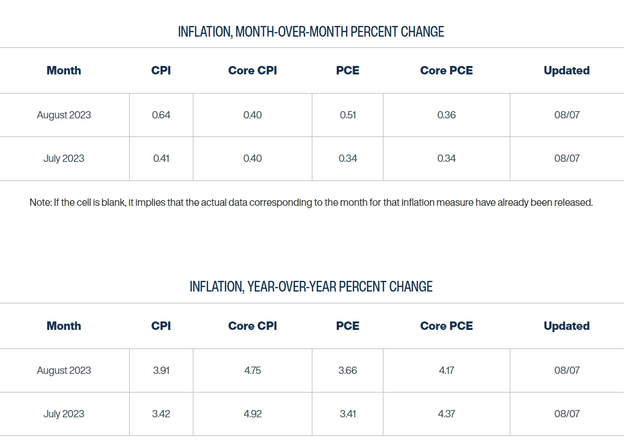

The Inflation Nowcast prediction tells a different story

However, the Cleveland Fed publishes the Inflation Nowcast, which has been reliable in predicting the actual inflationary reading over time, and it predicts that the July core CPI inflation will rise by 0.4% month-over-month (well above the market expectations), and increase to 4.9% over the last 12 months, which is an uptick from 4.8% in June. More importantly, they also predict a 0.4% increase in core CPI in August. Note, the monthly rise of 0.4% is consistent with a 4.9% annual inflation, which is more than double the Fed's 2% target.

Similarly, the Inflation Nowcast predicts a 0.4% increase in the headline CPI inflation month-over-month (also well above the market expectations), and an increase to 3.4% year-over-year. More importantly, they also predict a 0.64% increase in the headline CPI for August (accelerating monthly inflation) and a 3.9% increase year-over-year. Note, the June CPI inflation was at 3%, and the August headline CPI is predicted to be 3.9% - it seems like the second wave of inflation is approaching based on the Cleveland Fed prediction, and it is completely unexpected by the market.

The Cleveland Fed

How to reconcile the large difference between the Cleveland Fed predictions for inflation for July, and the market consensus expectations? Who will turn out right?

The model develop by the Cleveland Fed is available online, and the paper mentions:

In total, our nowcasting model uses only 8 data series—monthly CPI, core CPI, food CPI, gasoline CPI, PCE, and core PCE; weekly retail gasoline prices; and daily oil prices—though we have many data vintages to conduct the real-time analysis.

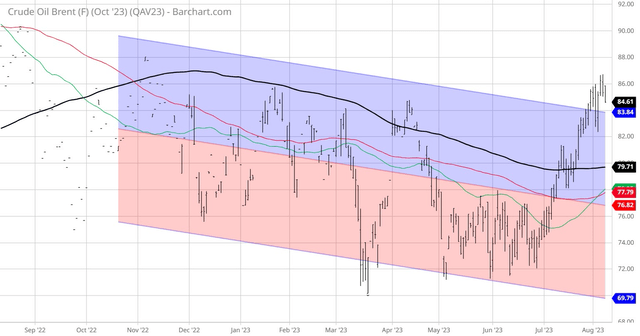

Thus, Brent crude oil price is the key daily input into the Nowcast model, and Brent was up by 16% in July. So, this is likely causing a higher Nowcast inflation prediction, that market analysts are somehow ignoring.

Barchart

Bigger picture - we are in an inflationary environment

Bigger picture - we are in an unfolding trend of deglobalization, and this is inflationary. More importantly, the process of deglobalization is transitioning into a real physical war. These has been a real war in Europe since March 2022 as Russia invaded Ukraine, which caused the initial spike in oil and food prices. Unfortunately, there is no end in sight for this war. Further, the Russia recently exited the Black Sea Grains agreements, which is causing a renewed spike in wheat prices - and putting new pressure on global food prices.

With respect to oil geopolitics, Russia needs higher oil prices to continue the war. Saudi Arabia is also reducing the supplies to keep oil above $80/barrel to balance the domestic budget, while the U.S.-Saudi Arabia oil-for-security agreement seems to be shaky at this point.

Thus, it is reasonable to expect that we will continue to experience spikes in commodity prices due to the heated geopolitical situation.

Also due to the U.S.-China decoupling, U.S. companies are forced to re-shore Chinese production, and onshore some jobs deemed as important to national security. The process of re-shoring will definitely increase prices and cause some supply chain disruptions.

The process of on-shoring is meeting an entirely different problem - the U.S. labor market shortage, partly due to demographics (retiring baby boomers) and partly due to a stricter immigration policy (deglobalization). In fact, the U.S. labor shortage is likely to keep the wage growth elevated, especially if the unions start bargaining for higher wages, as the recent United Parcel Service (UPS) strike showed. This will open the possibility of a wage-price inflationary spiral like in the 1970s - which is what the BIS warned in the recent report.

Also, as the process of deglobalization unfolds, it is reasonable to expect more trade protectionism via higher tariffs, which is also likely to cause higher inflations. In fact, the current U.S.-China trade war is centered on high-tech product, and particularly chips and the materials to produce the chips. It is likely that the trade war will widen to include the barriers on more products.

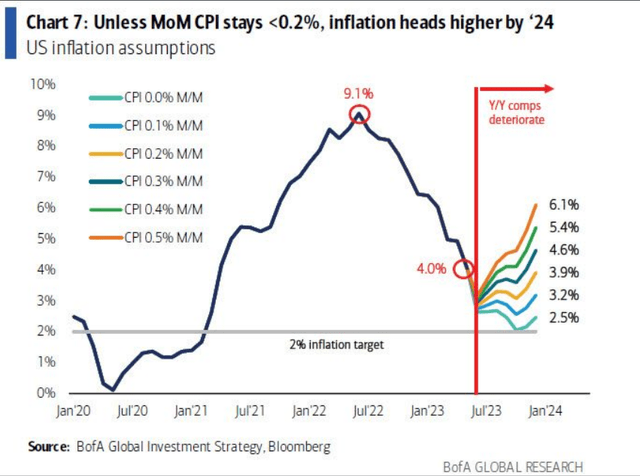

Thus, we are likely to experience the waves of inflation and disinflation over the medium term. Just recently in 2023 we were in a disinflationary period as the base effects from the inflationary spike in 2022 faded. Now it seems like we are about to enter a new inflationary period, as commodity prices continue to rise and the geopolitical situation heats up this fall.

Implications

The major implication is that the soft-landing scenario based on expected disinflation and the return to steady 2% inflation is very unlikely in the current macro environment. The July CPI report is likely to give us the first taste of the likely new wave of inflation, which is, by the way, not surprising to anybody following commodity prices or just news.

How far the second wave of inflation extends is unpredictable - it depends on the geopolitical situation, and the Fed. This is how Bank of America sees the second wave:

Bank of America

The Fed has the ability to push the global economy into a recession by continuing to increase interest rates and crush the global energy demand. The market currently expects that the Fed is done with the interest rate hikes. But, given the current macro environment, the Fed will likely be forced to continue hiking until energy prices collapse, and the U.S. labor market returns to balance.

Thus, I see a substantial risk of an imminent sharp correction in the S&P 500 (SP500, SPX) as the market reprices higher inflation expectations, and the more aggressive Fed policy.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.