Looking back at 2021 with love and regrets

Market Sentiment

What a year 2021 has been. The tiny SARS-CoV2 virus is still messing up with our daily lives. Just when things were starting to normalise, a newly discovered variant Omicron threw a curve ball causing some countries to halt or even reverse decisions to re-open borders.

As end of 2021 approaches, the market mood has dampened down quite a bit. The market breadth is not looking rosy, more stocks are below MA200 than above. The impeding QE tapping and interest rate hikes in respond to rising inflation by US Fed are weighing down market sentiment too.

In the trading landscape, a strong bull was dominating the market in the first three quarters of 2021. Major indices were breaking all time high, even cryptocurrency was making waves (pun intended, super volatile moves for Bitcoin).

COVID-19 Theme

Feb 2021 saw the start of the largest vaccination drive than mankind has ever seen. Previous vaccination programmes were generally rolled out over years or decades. But the advancement of biotechnology has allowed us to access COVID-19 vaccine in unprecedented speed.

Moderna, BioNtech, Pfizer, Johnson & Johnson, Novavax, Astra Zeneca just to name a few obvious ones, roared to all time high. Did you catch the train? I took a small profitable swing trade with Pfizer. Nothing to boast about, purely practicing my trading skills based on breakout trend.

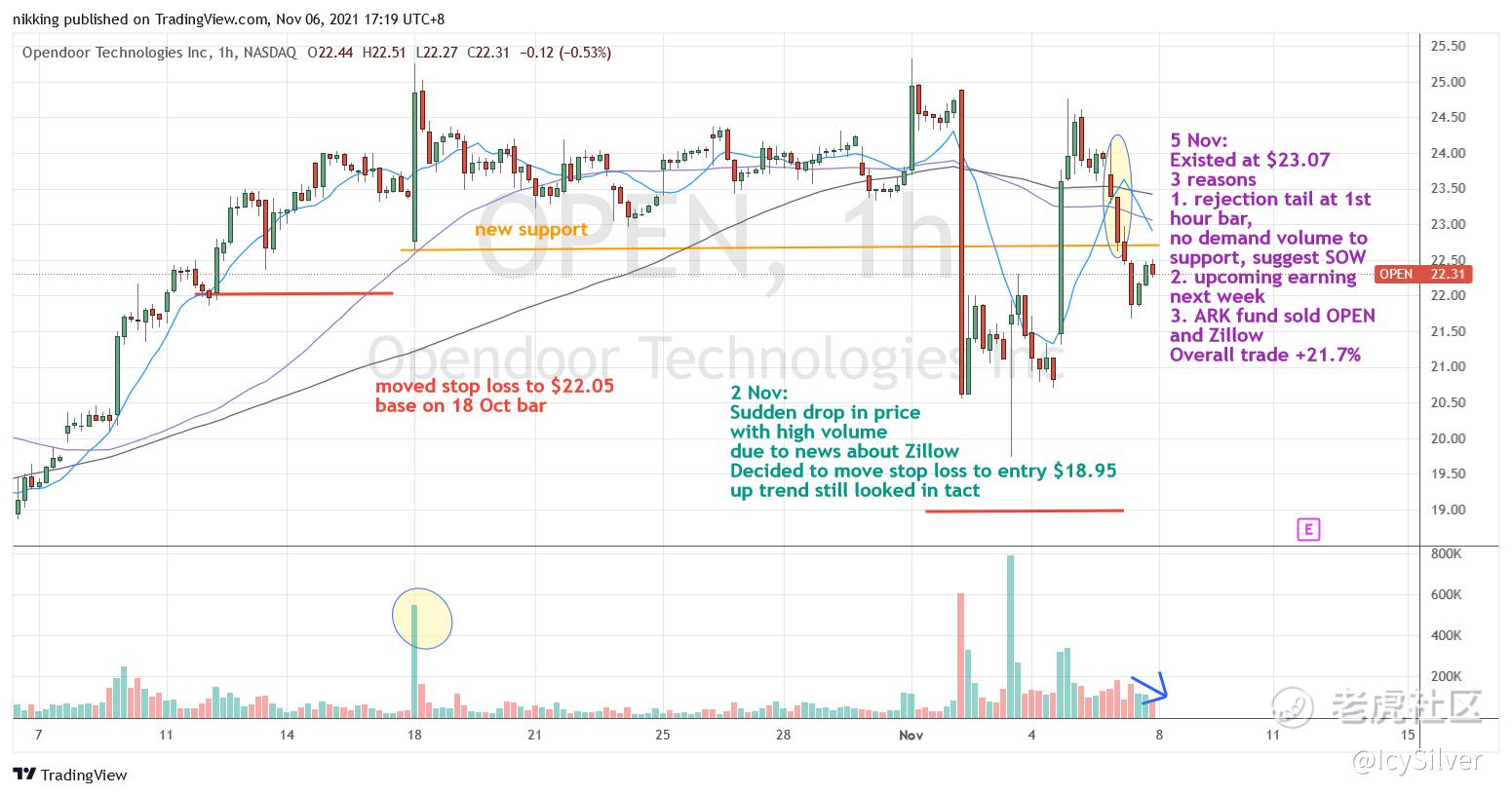

Good Trade Execution: Timing to Exit Trade Perfectly

One memorable trade in 2021 for me was with Open$Opendoor Technologies Inc(OPEN)$. Been learning to read chart with Wyckroff method so it was great to be able to time my exit of Open perfectly before the price crashed.

This was the chart analysis and trading plan for my position on 22 Sept.

As the market unfolds, the news about Zillow shook Open badly. Based on my analysis of the price action and volume, I moved my stop loss lower to wait for a rebound in order to exit the trade with profit. This manoeuvre helped me exited with 21% profit in around 6 weeks.

The biggest take away from this trade? Applying Wyckroff analysis of price action to manage my trade successfully despite drastic bad news.

Bad Trade Execution: Importance of Stop Loss

Think any trader would be able to tell you anecdotes of how stop loss either dented or saved their capital. Sharing a lesson of moving stop loss. After Nvidia$英偉達(NVDA)$ share split, I decided to initiate a long entry on 26 July at $193. The plan was to take advantage of the break out pattern fueled by the strong demand on chips. Given Nvidia is such a darling of both short and long term investors, the initial trading plan was to hold on to long position for as long as possible.

The price moved uptrend until hitting resistance at $231. Things were looking rosy and I was feeling very pleased with myself. Then came a minor correction to the magnitude of 15% from $231 to $195. It was nerve wrecking then. Everyday I would be checking on the paper loss and debating if I should close my position to protect whatever profit I had. I decided to move stop loss to $198. Luck was not on my side and the price touched $197 and reversed.

It was such a painful lesson. On hide sight, there was no reason for me to panic. No sudden increase in volume to suggest investors are dumping Nvidia. I should have just stay calm and allow the correction to unfold. I lost in this trade because I gave in to my panic and not sticking to trading plan.

Outlook for 2022

Current market condition seems to be rather uncertain. Nasdaq, S&P and DJI all suffering corrections. There are many factors affecting the 2022 outlook. US Federal Bank meeting in mid Dec, Omicron concerns and its closely related national border policies will likely impact market condition. I would be very cautious in trading until things get more clarity. Stay away from stocks that corrected by 30% (e.g. U, BABA, Palantir), and monitor defensive counters such as PG, TSN. For 2022, I certainly hope to be a consistently profitable trader by improving my chart analysing skills and trade execution.

Last Words

To me, trading is like an art of understanding the market forces. Is the bull or bear in charge currently? Do I expect a correction or continuation of trend?

The biggest lesson in 2021 from my trades is learning to execute trading plans with confidence. Trust my analysis of the market and not getting emotional. For 2022, I certainly hope to be a consistently profitable trader by improving my chart analysing skills and trade execution.

Sharing this and hope for a better 2022 to all!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- yansuji·2021-12-18🤔🤔I will continue to buy metaverse, which is the trend of future development. FB will launch their products, we will wait and see.2Report

- Tracccy·2021-12-18Omicron is so tired. it makes the market fluctuate again🙄🙄1Report

- Heartbeat12·2021-12-18I agree with you very much. There is a lot of uncertainty next year. The potential interest rate increase has suppressed the valuation of growth stocks. It is still difficult to confirm how it will be interpreted next year,1Report

- OutsiderLEO·2021-12-18Stop loss should not be too rigid. Companies like NVIDIA should give more tolerance and set the stop loss lower1Report

- blimpy·2021-12-18NVIDIA still has a lot of space, and new energy vehicles have a great demand for computing power1Report

- JudithGrant·2021-12-18after that, the enhanced vaccine will be promoted, so the shares of pharmaceutical companies are still worth buying.LikeReport

- BonnieHoyle·2021-12-18how to better analyze stocks? through technical analysis? Or formulate quantitative strategies? many knowledge I need to study.LikeReport

- BartonBecky·2021-12-18I am waiting for the time for aapl to buy, and when they release new products next year, they are sure to soar again.LikeReport

- MariaEvelina·2021-12-18thank you very much for sharing. your investment-experience is very helpful to my investment. thank you again.LikeReport

- BlancheElsie·2021-12-18I think Pfizer still has space to rise after the year, and we will see that investors love this stock.LikeReport

- LesleyNewman·2021-12-18I choose to invest in the long term, and I will invest in those who master the core technology.😜LikeReport

- JackPowell·2021-12-18US Fed affects the stock market, so we should grasp the future trend.LikeReport

- Yongi·2021-12-19niceLikeReport

- White Cat·2021-12-19fgbff1Report

- EAtan·2021-12-18like2Report