WGC Believes Gold Will Outperform in 2022, GLD Shows the Biggest Inflow Since 2004

World’s Top Gold ETF Sees Holdings Surge in Bullish Demand Sign. Why and How? Any other gold ETF you might also interested in?

1. GLD ETF Welcomes the biggest Inflow since 2004

The world's largest Gold ETF---- $(SPDR Gold Trust)$ (NYSEArca: $(GLD)$) expanded last Friday to have the most shares in the issue since August, needing an additional 27.6 tonnes of bullion backing from Thursday's closing level, worth $1.63 billion. That's the biggest 1-day capital inflow in Dollar terms since listing almost 18 years ago.

Fluctuations in ETF holdings are a good indicator of investor interest in gold.GLD was launched on the New York Stock Exchange in November 2004 by World Gold Trust Services and State Street Global Investment Management. One of the fastest exchange-traded products.

Since the beginning of 2022, $(GLD)$ has increased by 2.24% to $172.03, currently the gold future price is around $1,841.76.

2. Why is risk aversion at an all-time high recently?

Gold is typically seen as a “safe haven” asset in times of uncertainty, why is risk aversion at an all-time high recently?

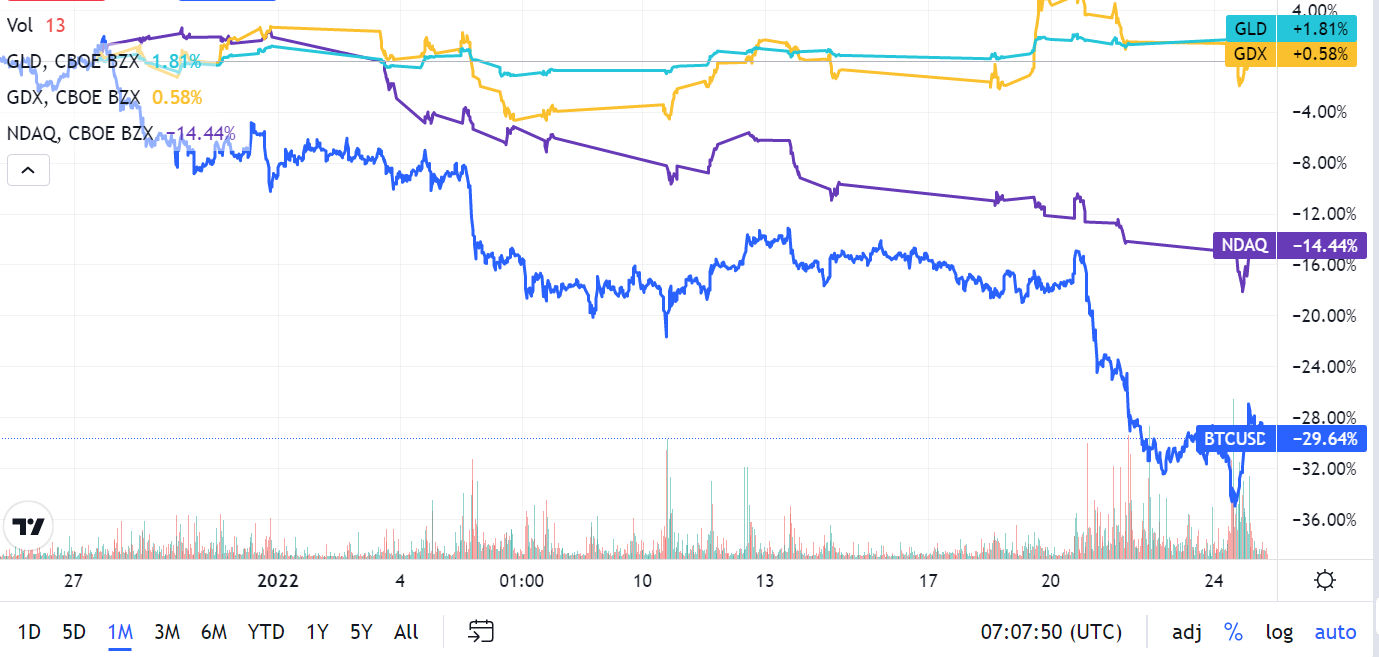

Since the end of 2021, the FED has said it is ready to tighten monetary policy, and this Wednesday, the FED will hold a crucial policy meeting that economists expect will signal a rate hike starting in March. Gold’s appeal may be dampened, but falling stocks, U.S.-Russian tensions, and a rout in Bitcoin have boosted safe-haven demand.

U.S. stocks fell across the board on Monday, with U.S. stocks on track for their biggest monthly drop since March 2020. Only the U.S. dollar, gold, and U.S. Treasuries rose on safe-haven demand. 3. Gold's perform outlook by World Gold Council

3. Gold's perform outlook by World Gold Council

It’s been two years since the start of the pandemic and the world seems ready to move on: global stock markets have strongly rebounded from their 2020 lows.

Regarding the performance expectations for gold in 2022, the World Gold Council pointed out:

- While rate hikes can create headwinds for gold, history shows their effect may be limited.

- At the same time, elevated inflation and market pullbacks will likely sustain demand for gold as a hedge.

- Jewelry and central bank gold demand may provide additional longer-term support.

- Gold has typically outperformed following the first rate hike of a Fed tightening cycle

Sources: Bloomberg, ICE Benchmark Administration, World Gold Council;

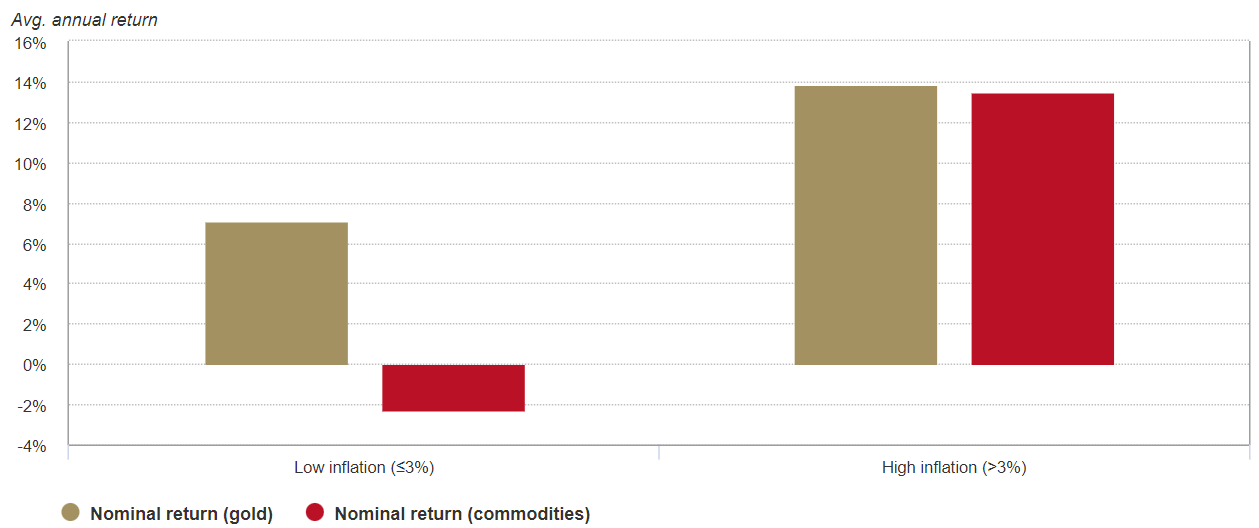

- Gold historically performs well in periods of high inflation

Gold and commodity nominal returns in US dollars as a function of annual inflation*

4. Gold’s behavior will depend on which factors tip the scale

Gold will likely face two key headwinds during 2022:

- higher nominal interest rates

- a potentially stronger dollar.

However, the negative effect from these two drivers may be offset by other supporting factors, including:

- high, persistent inflation

- market volatility linked to COVID, geopolitics, etc.

- robust demand from other sectors such as central banks and jewellery.

Final Question For You

Do you believe the Gold Price could test new highs of $2,100 per ounce in 2022? Yes Or No?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Nice article on gold.