On June 21st, the trading volume of $NASDAQ(.IXIC)$ was second only to the quadruple witching day a week ago.

The recent surge in technology stocks has attracted more capital, but many investors have also started to take profits. The pullback of major tech companies is currently the focus of investors.

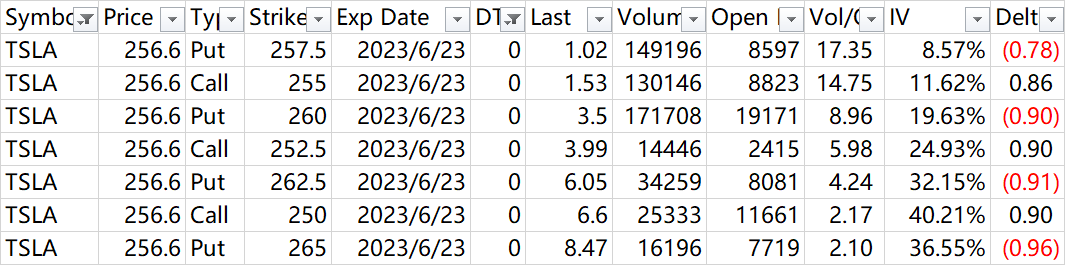

In addition to companies in the AI sector like $Microsoft(MSFT)$ $NVIDIA Corp(NVDA)$ $Meta Platforms, Inc.(META)$ , what is even more eye-catching is $Tesla Motors(TSLA)$ . Due to the continuous stream of positive news and the consecutive double-digit percentage increases in its stock price over the past ten days, it has created conditions for short squeeze and gamma squeeze. Many investors have chosen to sell out-of-the-money put options to achieve higher risk-adjusted returns (annualized yield).

Since the closing price on the 21st was $256.6, all the put contracts with strike prices above $255 have become in-the-money.

Looking at the intraday trends, the final 10 minutes of trading were intense.

Among the large trades on June 21st, there were 43.6K open contracts in-the-money.

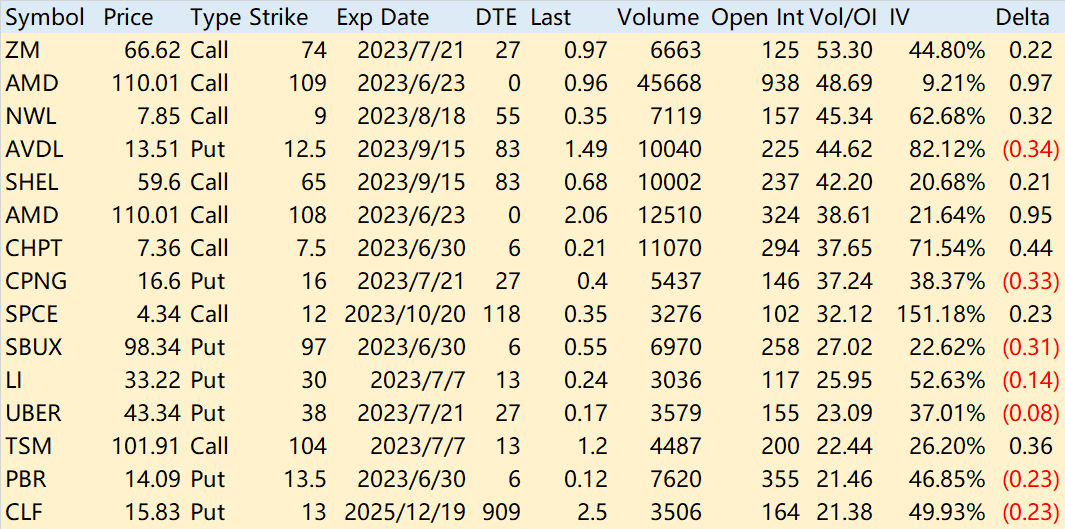

If these positions are not for adding or establishing new positions, there will be significant selling pressure next week. As for other unusual stock movements, covered calls are still dominant.

Zoom (ZM) and Chinese concept stock Li Auto (LI) also saw large put orders at a strike price of $30, indicating a positive outlook on the current trend.

Comments

I'm watching the tech sector closely for any potential pullback and may consider taking profits soon.

Tesla's recent surge and potential for short squeeze makes me cautious about selling put options.

I'll keep an eye on the large in-the-money positions for potential selling pressure next week.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?