Starting this week, due to some degree of market correction, there has been a significant decrease in the proportion of options with expiration dates in the large market orders. Previously, major tech companies such as $NVIDIA Corp(NVDA)$ $Tesla Motors(TSLA)$ $Microsoft(MSFT)$ $Apple(AAPL)$ experienced varying degrees of pullback (with different levels of volatility for each stock).

However, on June 27th, they resumed their upward trend, indicating that the foundation of this bull market is still intact.

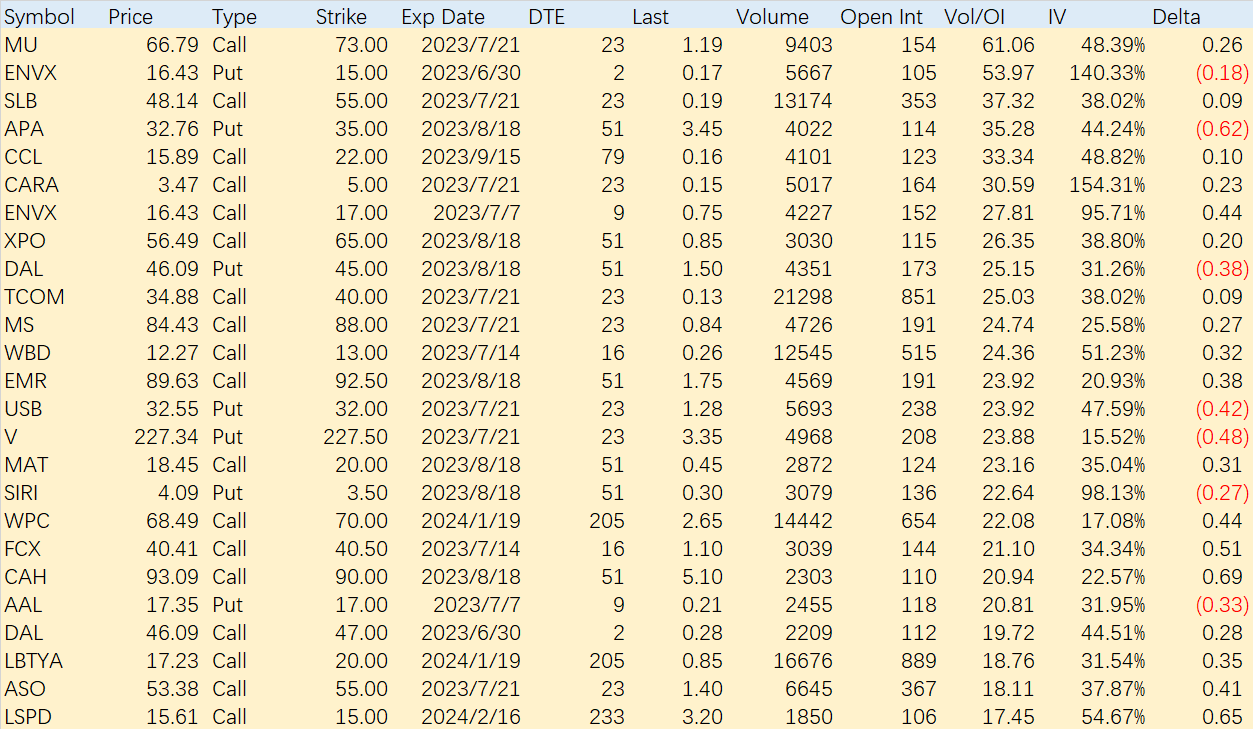

The next few days will likely determine the extent of this bull market. Expectations for a rate hike in July have already risen to over 75%, and the market will certainly take this into account. On June 27th, the majority of the unusual activity was focused on covered call options, but the range of affected categories expanded beyond the technology and meme stock sectors to include various other sectors. It appears that investors in different sectors are seeking some degree of risk mitigation.

Several notable stocks to mention include $Micron Technology(MU)$ $Schlumberger(SLB)$ $Carnival(CCL)$ $Cara Therapeutics(CARA)$ $XPO Logistics(XPO)$ $Morgan Stanley(MS)$ . In the banking sector, $U.S. Bancorp(USB)$ , and in the payment industry, $Visa(V)$ , experienced significant put option activity. This could be attributed to the anticipation of a rebound following the alleviation of pressure, as well as the potential performance improvement resulting from the interest rate hike.

In the second half of the year, the aviation industry is also expected to perform well, as indicated by the market's strong outlook. $United Continental(UAL)$ $Delta Air Lines(DAL)$ $American Airlines(AAL)$ have all witnessed large orders, which is relatively uncommon under normal circumstances.

Comments

When will inflation peak and reverse? When will the job market collapse and we'll see a wage re-set? Just after the top of the parabola.

Market volatility is just a rollercoaster ride, my friend. Hang on tight and enjoy the thrills!

The big tech giants got pulled back, but don't worry, we'll bounce back like Tigger

看起来市场调整给我们的期权讨论蒙上了一层阴影。是时候深呼吸了

Oh no, no more last day options? 😱 What are we gonna do without that adrenaline rush?!

当你有了标准普尔500的地图,谁还需要选择呢?让我们去野外探险吧