Since last week's earnings reports from $JPMorgan Chase(JPM)$ $Citigroup(C)$ $Wells Fargo(WFC)$ this week saw the release of financial reports from $Morgan Stanley(MS)$ $Bank of America(BAC)$ $Goldman Sachs(GS)$ , major players in the U.S. banking industry.

Overall, the impact of the Q1 "Silicon Valley Bank crisis" seems to be gradually fading, and market expectations were set quite low. Surprisingly, most banks managed to exceed market expectations in terms of revenue and profits, though variations exist across different business sectors.

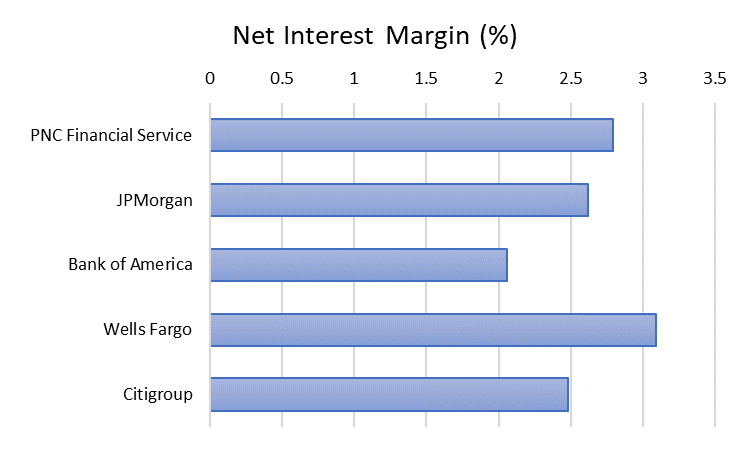

Interest income, in general, surpassed expectations. Contrary to concerns about deposit outflows after the Q1 banking crisis, the large banks actually benefited from increased interest rate differentials, particularly in business segments directly connected to consumers and communities. This explains why JPMorgan, Wells Fargo, Bank of America, and other banks with a strong consumer focus outperformed the rest.

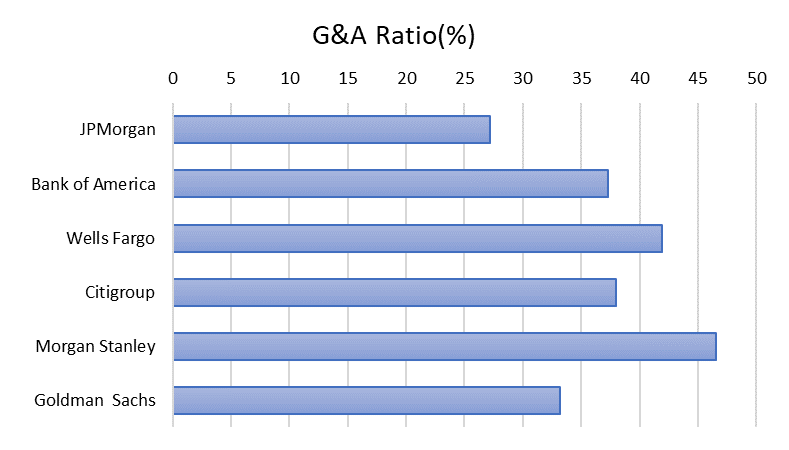

However, investment banking business experienced a widespread decline, in line with a global trend. Trading, underwriting, and advisory fee revenues all saw varying degrees of decline in Q2 compared to both the previous quarter and the same period last year. Although the overall performance slightly outperformed lowered market expectations, the outlook for investment banking throughout the year remains less optimistic, especially for companies with a higher proportion of investment banking operations like JEF, Goldman Sachs, Morgan Stanley, Barclays, and Deutsche Bank. Compared to Morgan Stanley and Citigroup, Bank of America's trading and fee revenues exceeded expectations, while Morgan Stanley's performance met expectations, and Wells Fargo's smaller division appeared to be the strongest.

Performance in wealth management and trading revenues was dependent on underlying assets, leading to different outcomes for various banks. The "debt ceiling" crisis in late May caused more volatility in fixed-income trading but equities performed well in Q2. For example, while Morgan Stanley's fixed-income and commodities business fell short of expectations, its decline in equity trading was less severe than anticipated.

As a result, banks have initiated workforce reductions, cutting down on compensation expenses starting from Q2. Among them, Goldman Sachs implemented layoffs later than others, and as a consequence, their profits declined more rapidly. It is projected that their profits will continue to decline over the coming quarters.

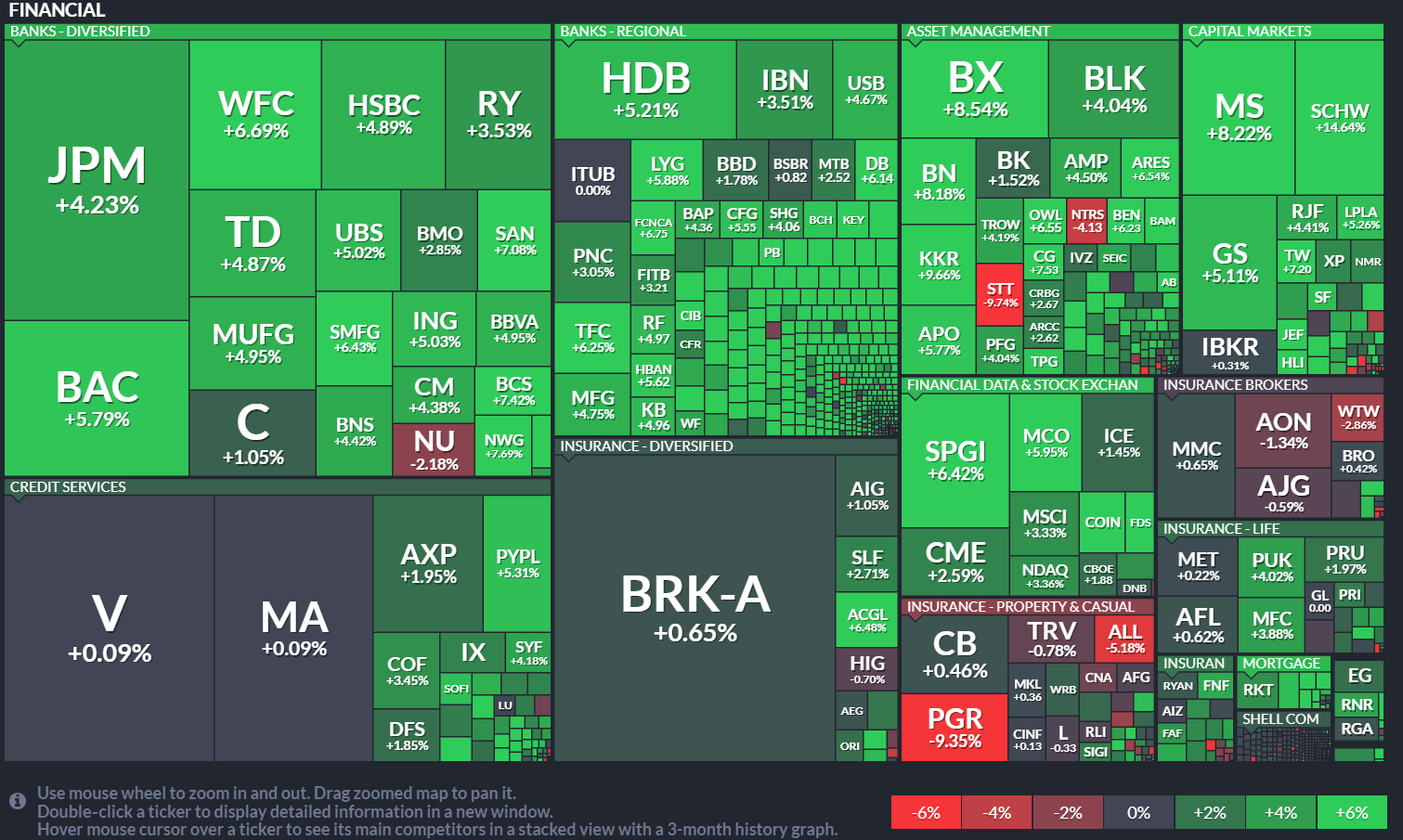

Investment and credit trading have also helped banks overcome performance challenges, demonstrating resilience. In the past week, the banking industry performed remarkably well within the entire financial sector.

In June, banks successfully passed the Federal Reserve's stress tests, further proving that their capital adequacy and liquidity were not as poor as market expectations. The Q2 financial reports also confirmed this fact through multiple ratios.

Furthermore, regional banks have recently displayed outstanding performance, outperforming comprehensive big banks during this week of banking financial reports.

This might be attributed to the alleviation of banking crises following $SVB Financial Group(SIVBQ)$ with better-than-expected recovery; regional banks have a higher proportion of interest-related businesses, showing the strongest performance in Q2;

as investor confidence gradually recovers, recession expectations diminish, and liquidity ceases to be a barrier.

Notable performers among regional banks include $HDFC Bank(HDB)$ $PNC Financial Services Group Inc(PNC)$ , and others, along with wealth management companies such as $Charles Schwab(SCHW)$ which surged by 12% following an earnings report that exceeded expectations, almost reaching pre-crisis levels from March.

We believe that as the overall banking crisis subsides and the Federal Reserve maintains higher interest rates for a longer period due to cautious principles, the pace of recovery for regional banks may accelerate.

Comments

Goldman has some of the best traders on Wall Street. They generate about $100 million profit for the firm everyday regardless of market movement. Also remember $30 billion stock buyback. Goldie will be $550 by next earnings.

In last one month C almost got to 48 three times but pulled back - let's see if this time it goes over 48, and if it does it will quickly go much higher to 60 range.

BAC is about to breakout. Get to $32.22 then breakout to $34!

Note we are still 4 points away prior to SVB and FRB. JMP, Wells, Citi All recovered.

Why is Goldman Sachs getting a higher multiple than JPMorgan?