The familiar story has returned, and it was unexpected that the short play of Wall Street was renewed again in the third quarter of 2023, rewriting the legend.

A quick rundown of the first two seasons. After the FOMC meeting on February 2, some people bought 50,000 lots of xlf puts $XLF 20230616 32.0 PUT$ , holding it for more than a month, and rolling profits after the banking crisis erupted and the government announced its intervention. He used the macro pressure generated by the FOMC to cover up an early positioning of small bank stocks.

The problem is, if I can see a problem, can't people in the government see it? So in May, after two months of preparation, the SEC announced that it would pursue any form of misconduct that might threaten investors or the markets. The XLF option movement shifted from buy put to sell put. The banking crisis is over, interest rates are rising and the stock market is rising.

Then, on August 2nd, Fitch, one of the world's three big rating agencies, announced that it had downgraded the country's sovereign credit rating from AAA to AA+, with a stable outlook instead of negative. The US stock market exploded again.

It is worth noting that the announcement of the rating time before the release of July non-farm and CPI data, July non-farm on August 4, and July CPI on August 10. From the forecast point of view, due to the low base for the same period (June 9.1%➡️ July 8.5%), the market expects a certain rebound in the CPI annual rate. The main tone of this earnings season is to lower the valuation, so the announcement of a downgrade at this time, the timing is just right, forming a serial move.

How far can the market be pushed down? We can tell a thing or two by looking at FANNG's corporate orders.

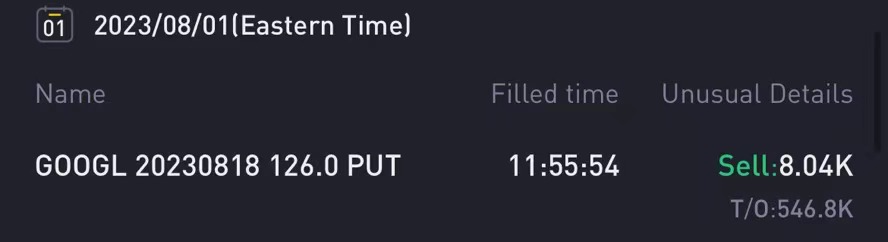

sell $GOOGL 20230818 126.0 PUT$

On August 1, some institutions sold 8,000 hands, a veritable big order. That works out to $100 million, or $30 million based on a third of the margin.

The strike price 126 is located on the 10-day moving average. Google jumped 5.7% in this financial report, but in the AI sector, Google PE is only 27, and has been in a relatively low valuation, so this may be the confidence of the institution to sell put.

sell $MSFT 20230811 350.0 PUT$

Unlike Google, Microsoft did not make a decisive single move after the earnings report. On the contrary, before the earnings report, there were 10,000 put options sold by institutions with a strike price of 350. The break-even point for this order is 350-12.4=337.6. If Microsoft doesn't get back above 337 by next week's deadline, institutions will either cut the meat or take over.

At present, this institution does not mean to stop the loss, it seems that the institution thinks that the price of 337 can be accepted.

In this financial report, Microsoft management mentioned that the impact of office 365 coplit function charges will not be gradually reflected until the second half of this fiscal year, that is, two quarters later. The second half of the year? Now is the second half of the year, I suggest that you take a good grasp of this lower point.

Another interesting fact is, don't trust the sell call and buy put when the market is falling, and don't trust the buy call and sell put when the market is rising. Specifically, on the day of the fall, an institution sold a CALL option $MSFT 20230811 330.0 CALL$ , and the result was that the stock price had to recover the next day. This is very embarrassing, I remember Nvidia seems to have a similar case, to my pit.

buy $META 20231117 270.0 CALL$

Although this is a large order to buy 110,000 lots of call options, it does not represent good news. In-price bulls generally indicate a rough market outlook, and there were many such moves in August last year. Never buy an outside call just because of an inside call order.

As well as AMD high probability quarterly 5-day line pullback, Nvidia monthly line 5-day line pullback.

In summary, through the huge orders of more than 8,000 lots of volume that I screened, it can be seen that the giants who can influence the market seem to feel that this pullback is expected. So there is no need to worry too much about what to do, but the market will always be in a state of high pressure before the CPI falls, I think it is a good time to sell put.

As a final reminder, American shows usually have an Easter egg at the end or a plot reversal scene for everyone to remember, and the Easter egg for the first two seasons of the empty plot is this:

Counterintuitive trading tip: Buy NVDA to hedge market risk

We pay more attention to the big option order, do not short the top, the price is appropriate to buy, this year should not be too bearish.

Comments

MSFT fundamentals have been stable and excellent; Great opportunity to buy at these prices and keep long term. Be patient. MSFT will appreciate significantly in the near future

MetaVerse should be spin off. Then, META stock will rise by 50% overnight.

I'm enjoying both the SP and dividends...and the future of MSFT.

MSFT's the future, stay with it long-term if you aren't a day-trader.

GOOG had better earnings than AMZN. we should move higher.