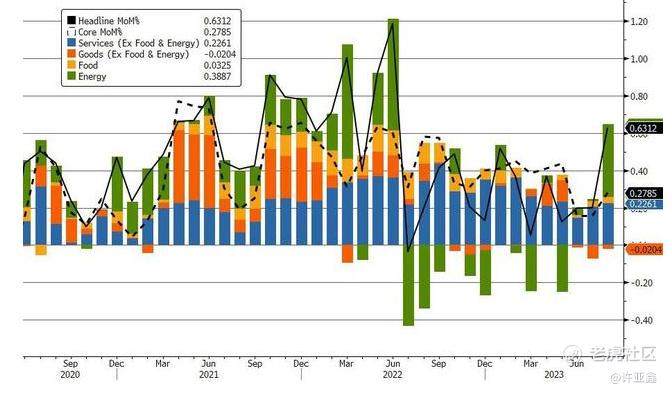

While oil prices rebounded sharply, the CPI growth rate in the United States rebounded for the second consecutive month in August, and hit the biggest month-on-month increase in 14 months. The year-on-year growth rate of core CPI continued to slow down, but the month-on-month increase accelerated for the first time in six months, and the growth rate was higher than expected, highlighting the price pressure.

According to the data released by the US Bureau of Labor Statistics, the year-on-year increase of CPI in the United States rebounded from 3.2% in July to 3.7% in August, which was the second consecutive month that the year-on-year growth rate rebounded, exceeding the expected 3.6%. In August, the month-on-month growth rate of CPI also accelerated from 0.2% in July to 0.6%, which was in line with expectations and the largest month-on-month increase in 14 months. Among them, gasoline prices rose by 10.5% month-on-month, which became an important driving force.

We believe that since Russia announced joint production cuts in July, oil prices have risen by 20%; At the same time, due to Biden's selling of strategic crude oil reserve SPR, the number of days of US crude oil supply (including SPR) dropped to 46 days, a new low in 40 years.

Therefore, it is not surprising that tonight's CPI data rose month-on-month and year-on-year, and the financial market has already partially priced in it before However, the annual rate of core inflation fell back, which alleviates the market's worries about continuing rate hike to a certain extent and helps non-US currencies rebound.

Data show that the core CPI, which is more concerned by the Federal Reserve after excluding energy and food, has dropped from 4.7% to 4.3% year-on-year, which is in line with expectations and the smallest increase in the past two years. However, the month-on-month increase of core CPI was slightly to 0.3% from 0.2% last month, exceeding the expected 0.2%.

At present, the general analysis on Wall Street also believes that the cooling of core CPI may reduce the pressure on the Fed to a certain extent, but the large fluctuation of oil prices is likely to make European and American countries need to keep high interest rates for a longer time, and there is still the possibility of rate hike in the Fed in the fourth quarter of this year. At the same time, the renewed acceleration of core CPI could force the Fed to push up interest rates further, potentially causing a downturn in the economy.

As shown in the above figure, from the perspective of sharing year-on-year data,Housing prices increased by 7.3% year-on-year, accounting for more than 70% of the total growth of core CPI.Other items with significant year-on-year growth include auto insurance (+19.1%), entertainment (+3.5%), personal care (+5.8%) and new cars (+2.9%).

After the release of inflation data in the United States in August, the probability of the Federal Reserve keeping interest rates unchanged in September dropped to 91%, and the market bet on the Federal Reserve's rate hike in November rose.

Next, the focus of the market will turn to the September interest rate resolution to be announced by the European Central Bank at 20:15 Beijing time on September 14. At present, the futures market thinks that the probability of the European Central Bank's rate hike this week is 75%.

-END-

NQ100 Index Main Connection 2206 (NQmain) $$Gold Main 2206 (GCmain) $$Dow Jones Main Link 2203 (YMmain) $$2205 (NGmain) $$WTI Crude Oil Main Line 2206 (CLmain) $

Comments