Let's review the overall market and the trading opportunities in the stocks I've been monitoring.

The interest rate decision lands, and it's as hawkish as expected, which is also in line with common sense. Anyone claiming it's unexpected must have their own problems. The 'higher for longer' stance was set as early as last year, why didn't they believe it?

This basically confirms that there will be another interest rate hike in November this year, and it's time to start pricing it in. The current market adjustment also aligns with historical patterns seen in September. For those who are unsure or confused about the market's direction, I sincerely recommend keeping most of your funds in Tiger Vault for now.

Another currently focused event is the government shutdown. Personally, I don't think this will have a significant impact, and it's mainly a short-term disruption, or you could even call it an opportunity. Looking back to the shutdown in 2018, it caused a strong initial shock, but its impact on the overall market was short-lived.

I personally believe that these disruptions may be resolved in early October, and then the market's focus will shift to earnings season. If we anticipate a stable market in October, then the substantial premium from the current downturn is really attractive. Don't miss out, everyone.

$S&P 500(.SPX)$ has already shown a clear oversold condition with a short-term rebound. However, it may continue to dip to the levels seen in June, roughly around 4250-4220, or even possibly testing 4200.

$Apple(AAPL)$ and $Microsoft(MSFT)$ have shown relative strength. One is due to decent sales data for iPhone 15, and the other is Microsoft's event yesterday.

I’m holding $Apple(AAPL)$’s short put with strike price of $160

As I mentioned before, after the Apple event, I sold puts with a strike price of 160. My current view remains unchanged, and I'm holding the $Apple(AAPL)$ short puts with a strike price of 160. Furthermore, if the overall market heads lower, there's a good chance $Apple(AAPL)$ could reach to this level.

I just sold put of $Microsoft (MSFT)$ at $300 yesterday

And due to the late-day weakness, I'm currently in a paper loss. I sold some puts with a strike price of 300. The starting point for the gap-up in May's earnings report was at level around $290.

Personally, I believe that the buying opportunity in this pullback should be at $290 level. Given the significant gap in May, I'm not sure if it will completely fill, so my plan is to start with a small number of sell puts at 300 and then another batch at 285.

Even $Microsoft(MSFT)$ retraced to yesterday's levels, its year-to-date increase of approximately 33%. The average annual return over the past decade has been around 27%.

In the last ten years, there was only one year of negative returns, which makes it a strong performer. So, my expectation is to buy in below 300, and there may be more short-term retracements, but it's a long-term safety play.

I sold $Tesla Motors(TSLA)$ put at $225; and my desired strike price is $200

Ever since Morgan Stanley sets a target price of 400, $Tesla Motors(TSLA)$ has been very strong, and it seems like the bearish sentiment from Goldman Sachs hasn't had much impact.

Previously, I had chosen a strike price of 200 for my TSLA sell puts, but $Tesla Motors(TSLA)$ has risen to high after the bullish PT. Last night, I adjusted my strike price target of 225, purely out of the necessity to manage my positions.

TSLA finally started filling the gap from last night, which is quite substantial, spanning from 240 to 260. My plan is to enter with some positions at 225 just in case I miss the opportunity, and my target at 200 remains unchanged. TSLA is expected to release September delivery data on October 2nd, and I'm looking forward to getting on board.

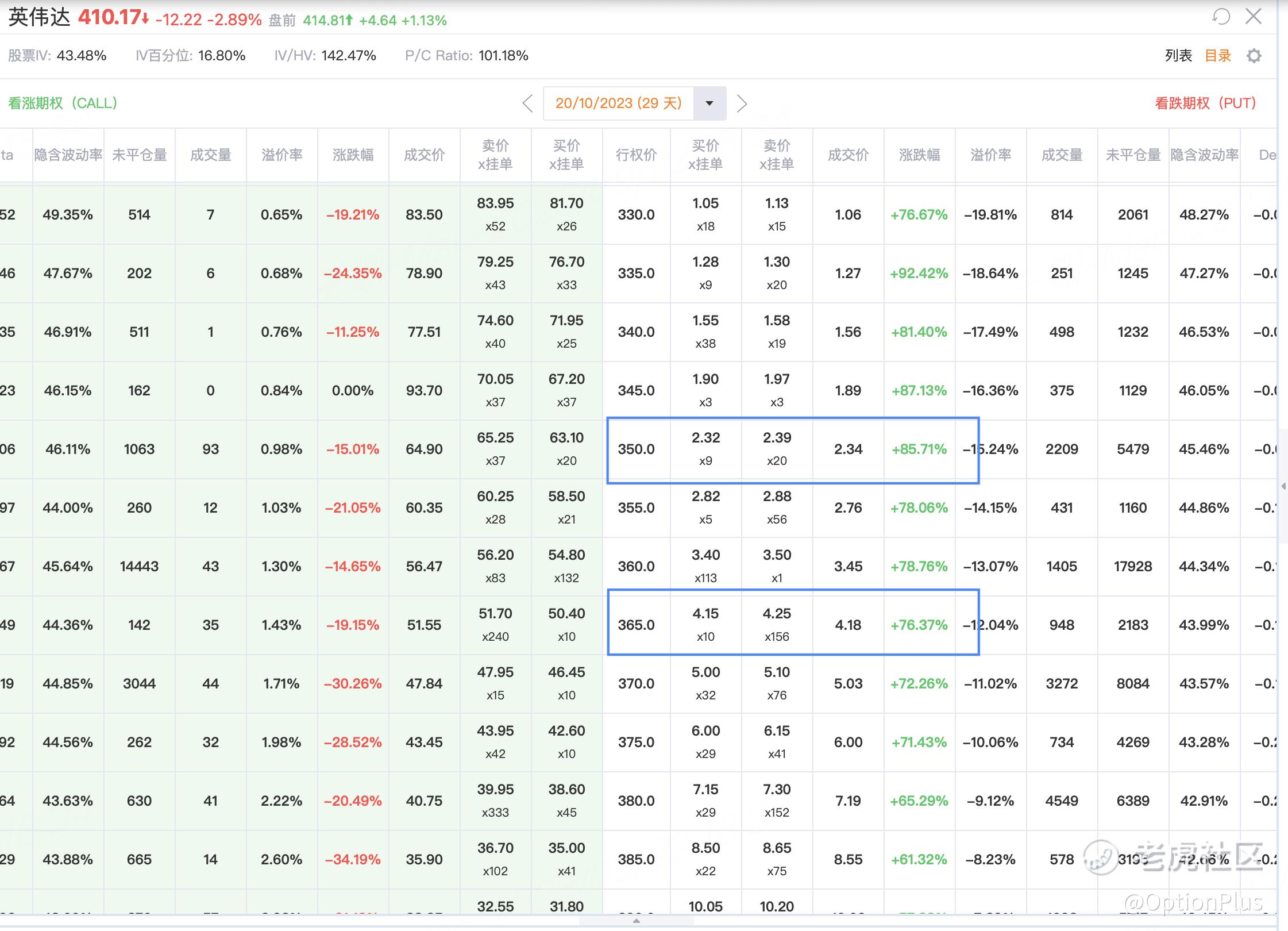

I will sell put of $NVIDIA Corp(NVDA)$ at $365 (expires on 20th Oct.) tonight

Despite the recent pullback of nearly 100 from its peak above $500, $NVIDIA Corp(NVDA)$ still has a year-to-date gain of a staggering 180%. It's just been on quite a run.

The starting point for the gap-up after NVIDIA's May earnings report was around $365, which is my first target for buying. Then there's the mid-gap level at $330, followed by the lower end at $300.

If it retraces to $300, it would mean the year-to-date gain drops to 100%, and the forward P/E ratio goes back to around 20, which, while not low, is acceptable with a certain premium.

Comments

Massive gains to be made whenever MSFT trades much higher, before the OCTOBER Earnings in my opinion.😁

Yes, the policy stance is also very clear, and the market has almost reached a consensus on this.

Overall, it appears that there are more bears than bulls in the U.S. stock market right now.

The current trend of Tesla is uncertain, but I really want to buy Tesla.