What kind of return strategy do you prefer in the stock market? $Tiger Brokers(TIGR)$

Do you agree with the statement:

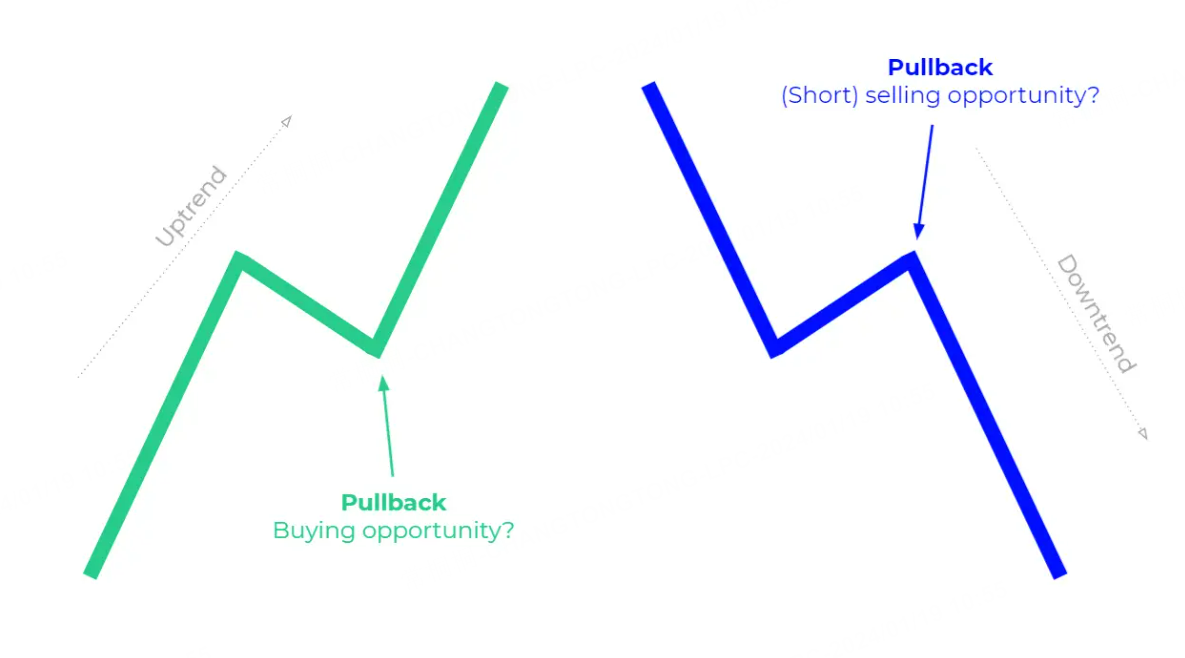

The higher the tolerance for pullback, the more likely to achieve higher returns?

Which one do you pick?

Enduring a single 50% pullback yields a 100% return; enduring ten 10% pullbacks results in a final gain of 159%.

How Much Pullback Are You Willing to Tolerate?

Do you agree with the statement:

The higher the tolerance for pullback, the more likely to achieve higher returns?

Which one do you pick?

Enduring a single 50% pullback yields a 100% return; enduring ten 10% pullbacks results in a final gain of 159%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments

comment and win coins