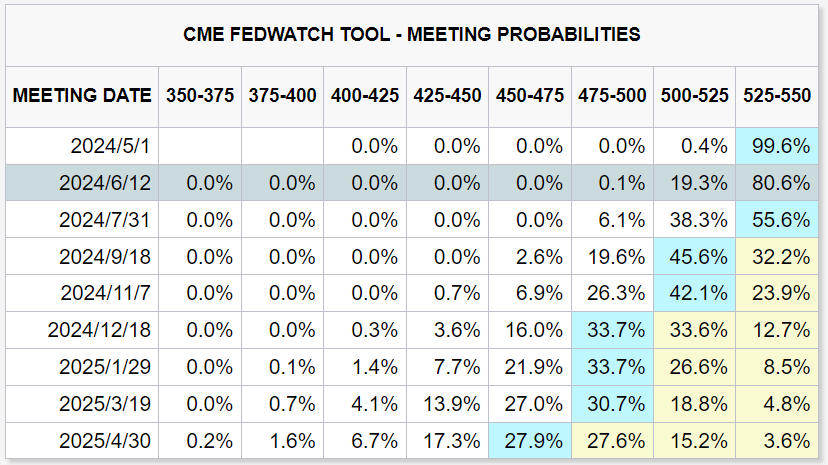

After the release of the March CPI, the CME's FedWatch Tool shows that it may be very difficult to cut interest rates twice this year. The current pricing is for a rate cut in September (with a probability of 46%), and a second rate cut in December (with a probability of 33.7% vs. 33.6%).

Why does this CPI exceed expectations and have a significant impact on the market?

It may once again expose the shortcoming of the Fed's "delayed" judgment

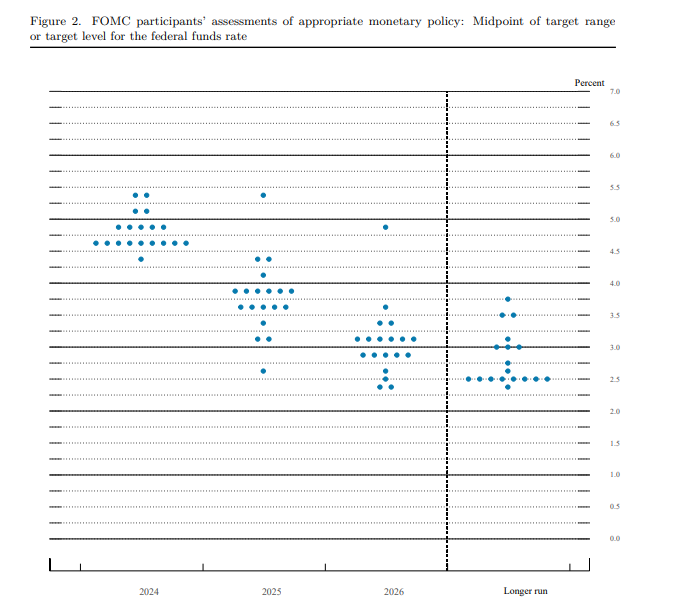

Coincidentally, on April 10th, the day the CPI data was announced, the minutes of the March meeting were also released, indicating that the expectation of three rate cuts this year remains unchanged.

Although the Fed has slowed down its balance sheet reduction this year, it does not intend to reduce the pace of reduction.

The purchasing power support brought by the wealth effect

The super bull market since the end of October last year (including almost all assets such as US stocks, US bonds, gold, Bitcoin, etc.), and the Fed released rate cut expectations at the end of last year, the market has priced in the results after the rate cut very early. Asset prices have risen rapidly, the net assets of the household sector have significantly improved, and there is a strong wealth effect.

The wealth effect is the basis for inflation, but optimistic sentiment will decline with the rise of inflation.

Not all industries are "inflating"

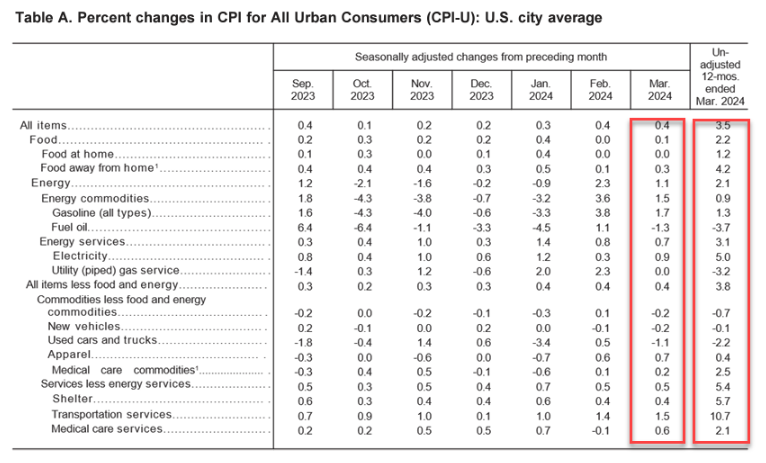

With the overall increase in wages and wealth, consumers' sensitivity to the prices of different categories of products has also changed. The fastest growth is in rents, transportation services, and medical services. Among them, rent and medical care are more oriented towards "necessary expenses", while transportation services still rose 10.7% year-on-year under the situation of falling ticket prices, mainly due to the frequent occurrence of extreme weather and natural disasters bringing more traffic accidents. Therefore, the costs of car repairs, insurance, etc., have increased, and in fact, it is not the consumer's "voluntary inflation".

The increase in these necessities will also reduce the expenditure on optional consumption. Therefore, commodities, new cars, used cars, etc. are all declining month-on-month and year-on-year, and the increase in clothing and other categories does not exceed 1%.

This also means that companies in industries with slower inflation increases may face insufficient price increases, and therefore their performance is also affected.

Changes in the CPI calculation method, and potential "manipulations"

An economist from the BLS has had frequent communications with financial institutions including $JPMorgan Chase(JPM)$ and $BlackRock(BLK)$ , discussing important inflation data related to the CPI, and calling them “super users”, indicating that they have gained priority to obtain CPI calculation details.

"🚨JPMorgan, BlackRock Among BLS Economist's CPI 'Super Users An economist from the Bureau of Labor Statistics corresponded on data related to a key US inflation gauge with major Wall

But the fact is that this economist was found to have shared some details of the CPI calculation that were not yet public at the time.

And the current algorithm is also different from before, including:

1. The update of the CPI market basket and weight has been changed from once every two years to once a year.

2. Only one calendar year of consumer spending data is used, instead of two years of average data

3. The introduction of the "month-on-month consumer price index" calculation method to measure the change in prices after consumers switch expensive products to cheaper alternatives

All of these will change the announced CPI results.

Comments