TL;DR: A mysterious institution is bullish on Tesla, expecting the stock price to explore $210 in June and return above the year's high of $250 by August.

On the afternoon of April 28th, a sudden news report revealed that Elon Musk had been invited to visit China. The main purpose is to discuss the deployment of Tesla's self-driving technology in the Chinese market. Although there is no specific timeline, judging from official Weibo statements and the Tesla app's purchase page descriptions, cooperation between the two parties seems highly likely.

On Monday, Tesla finally reversed its sluggish performance this year, with its pre-market stock price surging 12%, showing strong signs of a trend reversal. Previously, Tesla's option big orders were predominantly bearish, with the main strategy being selling call options. Just last week, a big player sold 43,000 call option contracts, hoping that he was implementing a covered call strategy by holding the underlying stock, otherwise, this wave would immediately wipe out his position.

I can understand the big player's rationale: After the earnings report, volatility declined significantly, and the fundamentals did not support a further rebound breakout in the stock price. In Q1, he had already adopted the strategy of selling the $200 call options, making a killing. This pricing strategy had been validated by the market, so it made sense for him to continue executing the same strategy.

However, this bear seemed to have overlooked Elon Musk's greatest passion in life: ruthlessly crushing shorts.

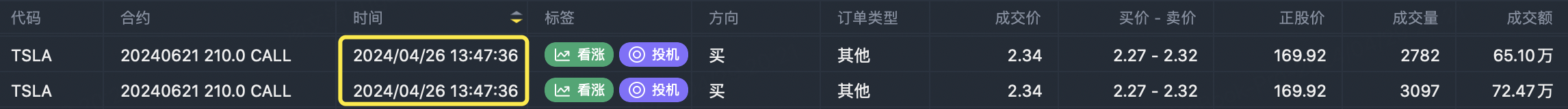

At 1:47 PM on Friday, April 26th (again, why is it always this time?), someone suddenly bought a big call option order of 10,200 contracts of the $TSLA 20240621 210.0 CALL$ , bullish on Tesla's stock price reaching $210 by June.

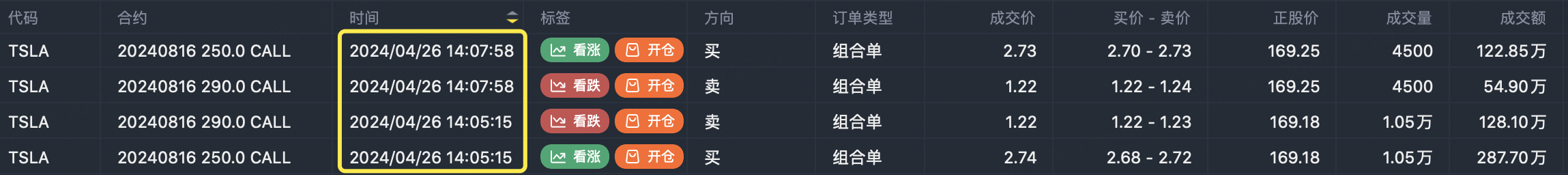

Immediately after, 20 minutes later at 2:07 PM, someone else traded a call spread big order: Buying 15,000 contracts of the $TSLA 20240816 250.0 CALL$ while selling 15,000 contracts of the $TSLA 20240816 290.0 CALL$ , bullish on Tesla's stock price returning above the year's high of $250 by August, but not expecting a surge above $290.

I estimate that most traders were caught off guard by these two orders. Long-term bullish positions probably didn't mind, as they're just staying long. However, short-term bearish positions were likely severely impacted and will have to make significant adjustments to their positions this week.

In an extreme scenario, Tesla's stock price could directly explore $200 this week. Based on the current open interest, the $190 and $200 call options have 13,000 and 12,000 contracts respectively, while the two strike prices in between only have 4,000 and 6,000 contracts. It's hard to say how many short sellers will be forced to cover and how many bulls will jump in at the open, but the $210 strike price might even come into play sooner.

Comments

Great article, would you like to share it?

Great article, would you like to share it?