This week's big news is as important as last week : including inflation expectations data on Monday, Powell's semi-annual monetary policy testimony on Tuesday, CPI data on Thursday, and PPI data on Friday.

These data were actually of average importance before, but since the market now believes that the Federal Reserve is likely to start cutting interest rates in September, if these data do not support the interest rate cut, it will hit market sentiment and produce large reverse fluctuations, so everyone should still be careful. Policy change periods are usually tossed and tossed.

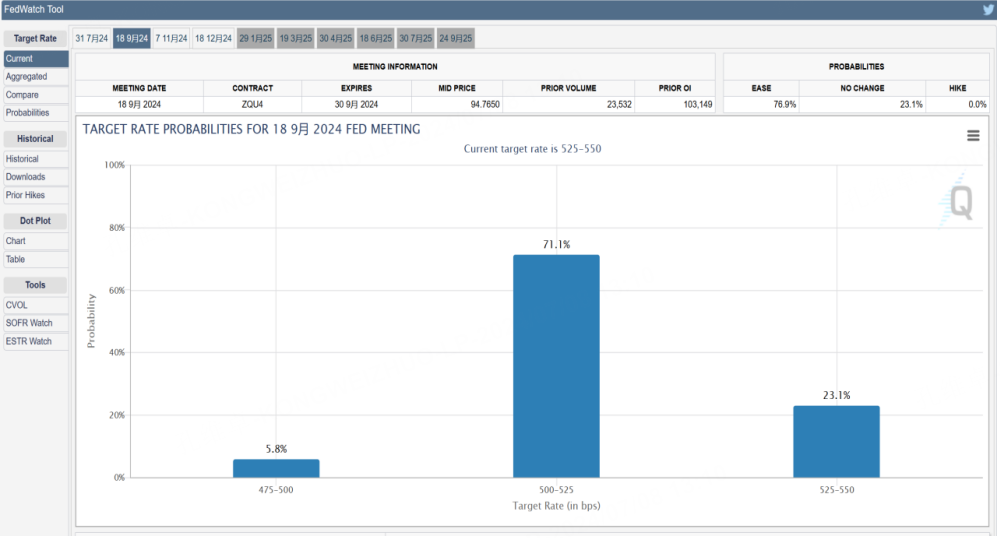

According to CME group's Fed interest rate probability observation tool, the current market believes that there is a 71% probability that the Fed will start cutting interest rates at the September interest rate meeting. According to experience, the probability of 71% is not enough to reach the level of confidence.

As long as the CPI data rises beyond expectations this week, this probability will instantly return to below 50%. This revision of interest rate expectations will lead to sharp swings in U.S. bonds and gold, so Overall, precious metals still need to be tested by this week's news.

Silver with unfinished bullish trend

Silver has strengthened sharply under the strong support of the 10-week moving average, and the bullish trend will continue.

The next goal is to hit a new high in the near future. However, the current silver price is still 30% away from the lowest price I expected ($40/oz). Therefore, finding a small low point to enter the market is still the best intervention strategy at present. As for gold, the speculative opportunities are obviously not as good as those of silver, and the independent strength of silver is the main feature of this wave of silver price increase, so it is still recommended to observe the two separately.

However, China has not increased its holdings of gold for two consecutive months, which may have an impact on the long-term trend of gold prices. Therefore, even if gold prices do not fall, it is inevitable that the market will fluctuate. Pay attention to the rhythm.

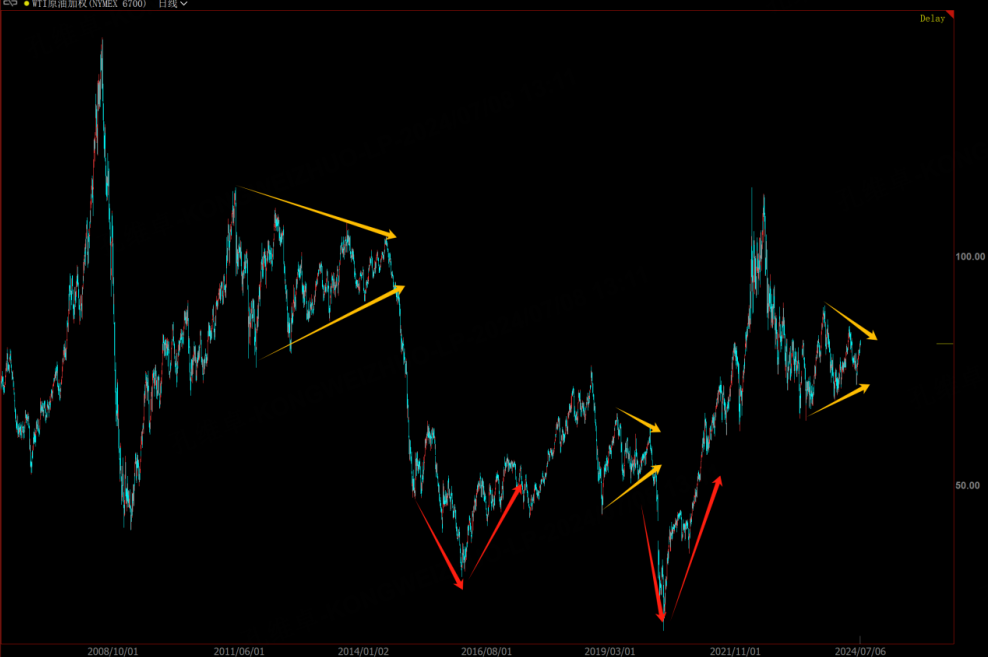

Crude oil has reached a critical point again

Crude oil is rarely mentioned in recent articles. The reason is that the oil price is in a dilemma range fluctuation, and the fundamentals have not changed much. The essence of its price fluctuation is difficult to get rid of this range (70-82), and the current oil price is running to the upper limit of the range around $82. Breaking through or selling down will make a choice in the near future, so we need to pay more attention to it.

The current fundamentals of oil prices can be simplified as the conflict between OPEC, led by Saudi Arabia, carrying oil prices and the United States suppressing oil prices in order to replenish its stocks. OPEC + production cuts led by Saudi Arabia and the U.S. Biden administration's lack of time to suppress oil prices approaching elections are the main reasons for the recent rapid rebound in oil prices. There are no bright spots in overall supply and demand. Therefore, if oil prices want to break through the range and get out of a larger trend, long-term sudden news factors are needed.

Technically, as the triangle converges, the oil price will eventually choose a main direction. Historically, this trend usually fluctuates rapidly and unilaterally after a breakthrough, so every time we reach the critical point, we need to keep a close eye on the market in order to follow up.

$NQ100 Index Main 2409 (NQmain) $$Dow Jones Index Main 2409 (YMmain) $$SP500 Index Main 2409 (ESmain) $$Gold Main 2408 (GCmain) $$WTI Crude Oil Main 2408 (CLmain) $

Comments