Trump's "assassination" incident has been fermented for a week, and the influence of "Trump trading" has expanded rapidly, becoming a new round of trading logic in the current market.

I also shared my views with you during the live broadcast last Thursday. Unless Trump's support suddenly drops, the deal will last until before the election. Therefore, last week, stock indexes and commodities ignored the Federal Reserve's expectation of three interest rate cuts this year, and the downward adjustment may continue to be turbulent.

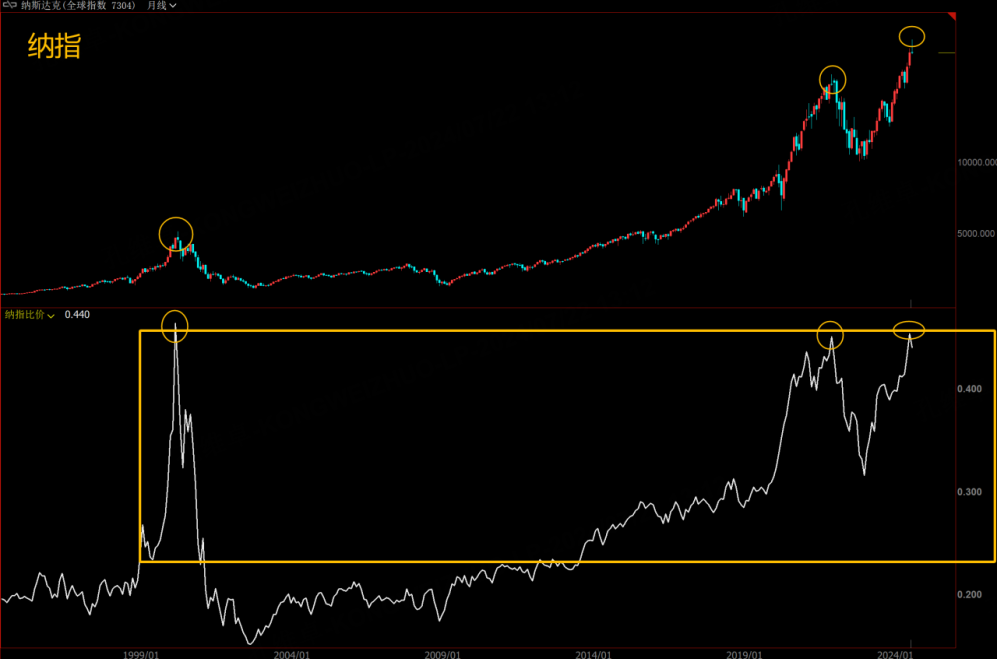

1. Does the peak price ratio of the Nasdaq and the Dow correspond to the high point of the stock market?

As early as the post on June 24, I emphasized to everyone that we should pay attention to the relationship between the price comparison of the Nasdaq and the Dow. At that time, it was already at the peak of the historical range. According to the past situation, it was extremely easy to have a high point in the stock market.

Although it was not clear at that time what kind of news would cause the decline, once the "terror indicator" was fulfilled, everyone could not take it lightly.

At present, in the case of Trump's attempted assassination, the market's expectation of Trump's return to power is unprecedentedly high, which leads the market to trade Trump's future policy impact in advance, and all "investments" not supported by Trump's policies will be abandoned.

Trump has always advocated supporting the return of traditional industries to the United States, and at the same time, he is not very friendly to monopoly technology companies (after Trump lost the election in 2021, his FB account was banned, which was regarded as the reason for his bad relationship with meta), so It caused the market to heavily accept the index and neglect the Dow investment trend. It can be seen from the technical chart that once the price ratio of the Nasdaq and the Dow reaches an inflection point, the strength between the two indexes will not end in a short time, so the Nasdaq is likely to be relatively weaker than other indexes in the future.

2. Impact of other commodities

For the impact of "Trump Deal" on commodities, you can watch my live video last week, or continue to pay attention to my live broadcast at 8: 00 this Thursday night, and I will continue to share my views on commodities with you in detail. The focus of this week's post to remind everyone is crude oil.

Technically, crude oil has reached the extreme position that needs to be broken through. No matter which side you choose to break through, there will usually be a wave of rapid fluctuations. However, last Friday night's unprovoked plunge, everyone must be extremely careful. Because fundamentally, the core of the "Trump Deal" is to maintain old energy without paying attention to new energy, which will encourage traditional energy companies to develop a large number of new oil fields and promote the increase of crude oil production in the United States, thus negative for oil prices. Moreover, Trump's relationship with Biden is more harmonious, which makes the market have to beware of this factor, and the recent "Microsoft Blue Screen" incident is also one of the factors of the short-term decline in oil prices. Generally speaking, it is not easy for oil prices to rise at present.

Technically, 82-72 is still used as the upper and lower limits of the oil price breakthrough range. We will track which side or stop loss which side is broken through, and avoid carrying it to death.

$NQ100 Index Main 2409 (NQmain) $$Dow Jones Index Main 2409 (YMmain) $$SP500 Index Main 2409 (ESmain) $

$Gold Main 2408 (GCmain) $$WTI Crude Oil Main 2409 (CLmain) $

Comments