The Palestinian-Israeli conflict is still on the difficult road of peace talks. The focus of the market is whether if the peace talks are unsuccessful, it will trigger a melee in other countries in the Middle East (Iran is still observing whether to retaliate and counter-attack).

Therefore, when the Palestinian-Israeli peace talks were difficult on Friday night, it is normal for gold prices to continue to hit record highs. Observing the resumption of the Palestinian-Israeli negotiations next week, if the peace talks are settled, the risk aversion sentiment of gold prices will be suppressed. If the negotiations continue to fail to reach an agreement, there will really be no negative factors for precious metals.

Precious metal long market restarts?

In fact, the answer doesn't need to be discussed too much, because there are really not many negative factors to be found at present. Here we will focus on discussing the following silver situation with you.

With the sharp rebound of silver in the past two days, it can be confirmed that its adjustment at this stage has been completed and will re-enter the observation range of bullish trend. Technically, after the rebound, the monthly chart of silver has been repaired back above the 5 months moving average, which means that the long-term bullish trend has not been destroyed.

Although short-term fluctuations may still be repeated, under the premise that the price of gold has repeatedly hit new highs, silver is only the follow-up. When to make up for the increase, you can follow up a small amount and then slowly increase your position.

After all, there is still a long way to go from the target price of silver, and the target price does not need to be changed for the time being.

Crude oil is still negative

Although the situation in the Middle East is relatively chaotic, if the chaotic war situation did not occur in oil field production areas, the impact on oil prices would not be too great.

We should know that the current situation in the Middle East is just a struggle between the strong and the weak (Israel fights Hamas), retaliation and counter-retaliation, but it is not a propulsion battle between powerful countries. The consumption of crude oil is limited (the crude oil consumed by ground propulsion will increase significantly). If it is only the struggle between air missiles and drones, it will not have much impact on crude oil demand.

Therefore, the key to crude oil at present is still the supply problem. In September, the voluntary production cuts of Saudi Arabia and Russia began to gradually shrink, which is a disguised increase in production for the crude oil market, which is negative. Therefore, unless crude oil rises above the $80 mark, it is not advisable to be bullish on crude oil for the time being, although there will be a day or two The rebound is very strong, but it is also an opportunity for short sellers to build positions. Pay attention to the rhythm.

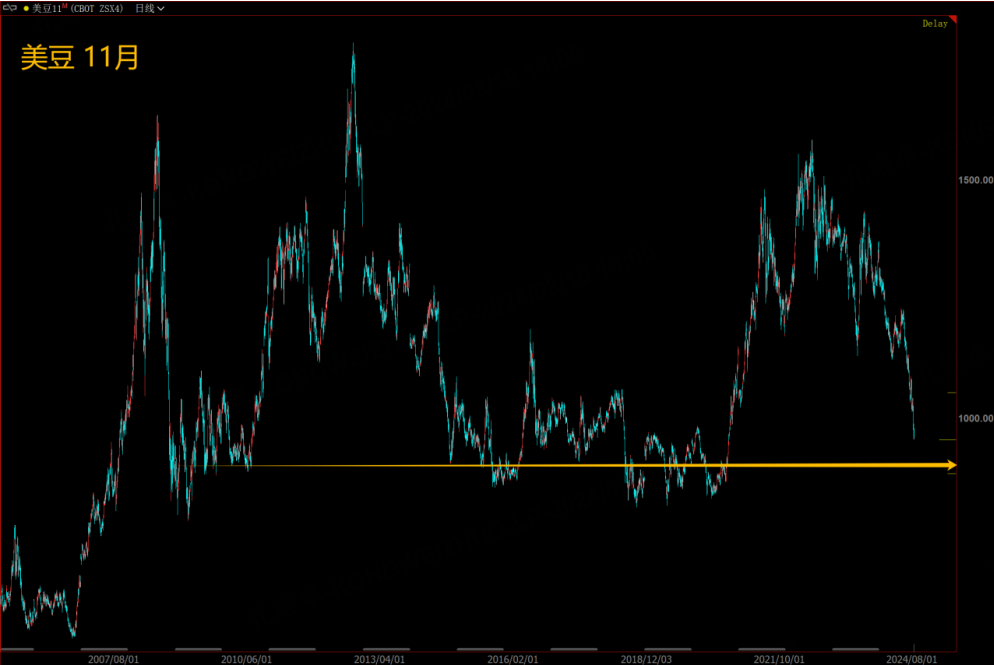

US soybean bottom observation

U.S. soybeans have fallen below 1,000 cents. Since the bottom of U.S. soybeans in the past 20 years is around 800 cents, when U.S. soybean futures fall below 900 cents in November, it is an important time for our agricultural products to observe the bottom.

Therefore, when you reach this price, you should make trial and error, and a small amount of positions are enough. Since the shock amplitude after the bottom rebounds is uncertain, you can either trade bottom-hunting agricultural products as short-term positions, that is, if you rise by 200 cents, you will run to find the bottom and then buy it back, or A small amount of positions will be regarded as long-term investments, waiting for a wave of harvest when there is a problem with the weather in South America next year. You can trade according to your own investment characteristics and account tolerance, but such key opportunities do not appear often and must be paid attention to.

$NQ100 Index Main 2409 (NQmain) $$SP500 Index Main 2409 (ESmain) $$Dow Jones Index Main 2409 (YMmain) $$Gold Main 2412 (GCmain) $$WTI Crude Oil Main 2410 (CLmain) $

Comments