Big-Tech’s Performance

The U.S. stock market was divided this week, with the $DJIA(.DJI)$ Dow Jones reaching record highs in a row while the $NASDAQ(.IXIC)$ slowly retraced its steps.

Obviously, the interest rate cut market is more favorable to growth stocks, why growth companies instead of performance is weaker?In fact, the main thing that caused the Nasdaq to pull back was the highs and lows of the big tech companies that are heavyweights.

Nvidia's earnings this week attracted the attention of the whole market, but in the almost impeccable financial results after there are still 6 points of decline, nothing more than to prove that the current market on its performance statement is expected to be full of short-first investors naturally do not want to take the risk again, and long-term investors also need more information to confirm whether the "profit-taking".The whole technology stocks will be in the next few months in this controversial volatility.

And, of course, the opening of the rate-cutting cycle in September will be the biggest opportunity for a rate-cutting deal to fall into place.

Through the close of trading on August 29th, the big tech companies had mixed performances over the past week.Among the stable performers $Apple(AAPL)$ +2.34% while the rest closed lower, $Microsoft(MSFT)$ -0.58%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -1.23%, $Tesla Motors(TSLA)$ -2.08%, $Amazon.com(AMZN)$ -2.28%, $Meta Platforms, Inc.(META)$ -2.58% and $NVIDIA Corp(NVDA)$ -4.97%.

Big-Tech’s Key Strategy

Apple a standout because of Apple Event?

Apple has been the strongest performing big tech company these past two weeks, and besides its solid cash reserves and big buybacks, another big reason is the anticipation of its launch.

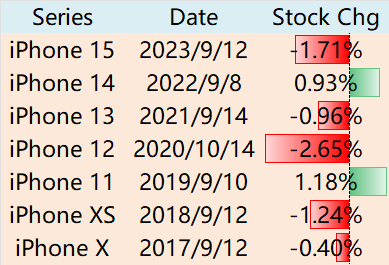

In fact, historically, the day of the launch of the new iPhone is also more down than up, which is quite understandable.Because it is difficult to meet the expectations of the Steve Jobs era "One More Thing", so it is more of a "Sell the fact" deal.

The main highlight of this year's iPhone 16 is not yet the AI chip, it is too late to upgrade, and the AI chip iPhone, according to Kuo Ming-Chi, may only be updated in 2025, the release of the iPhone 17 Pro Max this one.

The 16 series of new buttons may be the biggest highlight, sometimes even "not useful update", will give people "at least trying to change" discussion.Apple's failure to increase pre-orders for the iPhone 16 series could be a sign that the current consumer environment is still conservative and cautious.

Apple Service's business investors should be more concerned about than that. on August 5 the Department of Justice ruled that Google's payments to Apple to maintain Google Search as the default search engine for the Safari browser constituted an illegal monopoly, and while the two giants will surely continue to appeal to the Supreme Court, there is a risk that Google's annual payments to Apple(about $23 billion in 2023, or about 26% of Apple's service revenue) could be at risk. The revenue/expenses of this part of the business for both companies are highly linearly correlated.

Apple itself is a late starter in AI, and Google is a latecomer, which, given that the September 9 launch will be streamed live on YouTube, further suggests that Apple and Google are getting closer to a "strategic alliance".Whether the Justice Department wins or the tech giants win will determine the future revenue prospects of both companies.

But for now, it's probably too early to bet on anything "disruptive" at the September event.After all, Buffett has already cut half his position, and no one knows if he'll cut the other half.

Big-Tech Weekly Options Watcher

Apple's options are also actively traded at the moment, and based on the open orders that expired the week after the launch (Sept. 13), there is an extremely large amount of Covered Calls accumulating at 235, which could be a very big resistance, while the PUT's volume is relatively very small, which is a bit more bearish on a relative basis.

Big-Tech Portfolio

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtesting results are far outperforming the $S&P 500(.SPX)$ since 2015, with a total return of 1,955.0%, while the $SPDR S&P 500 ETF Trust(SPY)$ returned 221.6% over the same period, once again pulling ahead.

With the broader market pullback this week, the portfolio returned 29.91% year-to-date, outperforming the SPY's 18.22%.

The portfolio's Sharpe Ratio for the past year fell back to 1.7, below the SPY's 1.8, and the portfolio's Information Ratio is 0.9.

Comments