After a long-awaited call, the Federal Reserve finally began to enter the interest rate cut cycle after two years, and the rate of interest rate cut was 50 basis points slightly exceeding market expectations, which made the market full of expectations for the speed of future interest rate cuts.

Regardless of the speed of interest rate cuts in the future, the interest rate cut cycle has already started, and the market will re-enter the game of inflation and recession in the future. Since there is still a lot of room for interest rate cuts, the market will still be relatively optimistic in the short term. Despite the fears of recession, under the expectation that the Fed will cut interest rates more the recession, the risk of the U.S. stock index is still controllable, so there is no need to worry too much.

Compared with 2007, what should we pay attention to this 50 basis point interest rate cut compared with the past?

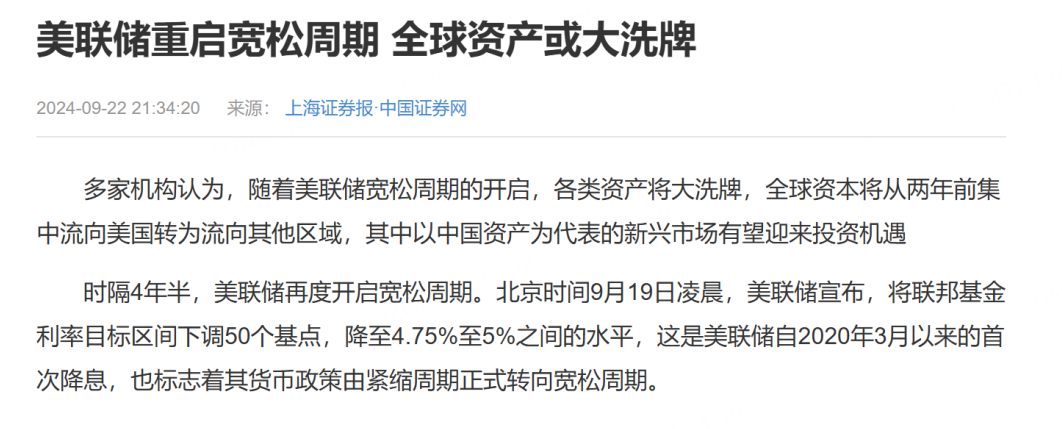

The range of the first interest rate cut in this round is consistent with the range of the first interest rate cut in the 2007 interest rate cut cycle.

Therefore, it is necessary to make an analogy with the market conditions at that time to find out what needs attention. The interest rate cut in 2007 was a passive bail-out interest rate cut.

At that time, because the severity of the subprime mortgage problem in the United States had been initially reflected, the Federal Reserve had to start to appease the market sentiment. The U.S. stock index still hit a new high since then, but we all know that the chain effect of the subprime mortgage crisis is getting bigger and bigger, eventually crushing the overall financial market.

However, this process delayed for nearly 12 months from the beginning of the interest rate cut to the outbreak of the crisis, indicating that the market still has about one year to brew until the problem finally broke out. Therefore, this time can be used for us to learn from. In the next year or so, we can still closely observe the changes in the news and calmly handle related positions such as the US stock index. However, when the problem breaks out, everyone must make a decisive decision at that time to avoid suffering greater losses.

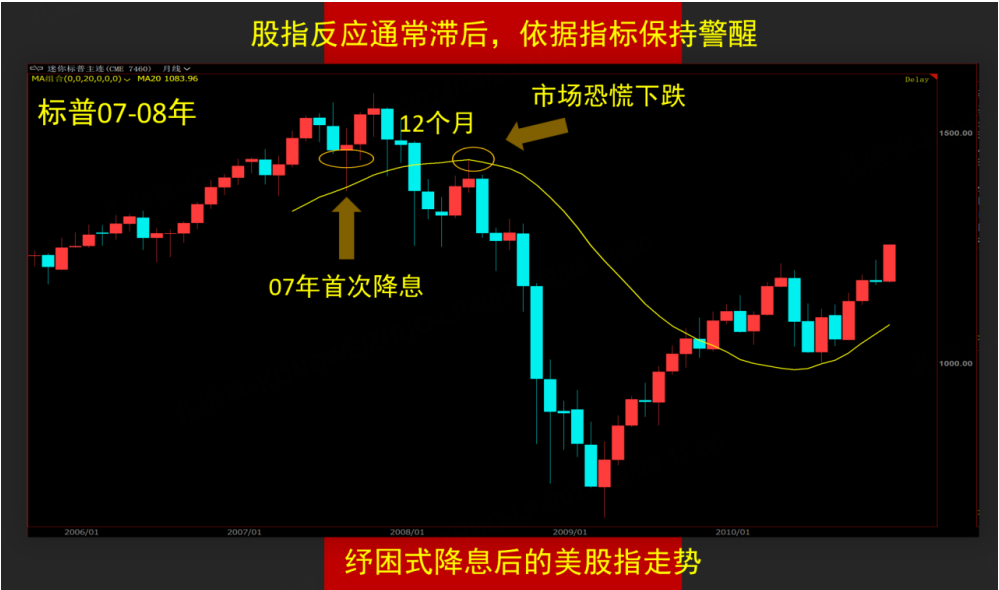

The current market is slightly better than that in 2007. This interest rate cut is a preventive interest rate cut by the Federal Reserve, and the U.S. economic data has not deteriorated, so it is believed that the trend of the stock index will not be consistent with that in 2007.

However, with the development of time, the economic recession will always respond, so that the stock index will still fluctuate sharply at a relatively high level, and even the gap between high and low points will reach 20-30%. Therefore, the interest rate cut actually shows that the Federal Reserve's concerns about economic recession expectations will eventually be reflected in the index, so everyone should pay attention to it.

Cut interest rates, good for inflation

Interest rate cuts lead to a decline in capital costs and make currencies tend to depreciate. In order to preserve its value, capital can only avoid risks by hoarding physical goods at low prices, which will lead to a comeback of inflation, and now is also the beginning. For commodities, there is no shortage of bullish effects in the future, and the layout pays more attention to rhythm. For example, agricultural products that have fallen sharply in the early stage, base metals such as copper and crude oil after falling in the future are all good tracking varieties. However, due to the existence of recession expectations, inflation expectations will be more reflected in raw materials, and downstream and deep-processed varieties may not perform well (supply decreases and prices rise but downstream consumption cannot keep up, so it cannot be transmitted to downstream products), so bulk The goal of commodity investment should pay more attention to core commodities, and I hope everyone will pay attention to it.

$NQ100 Index Main 2412 (NQmain) $$Dow Jones Index Main 2412 (YMmain) $$SP500 Index Main 2412 (ESmain) $$Gold Main 2412 (GCmain) $$WTI Crude Oil Main 2411 (CLmain) $

Comments