Over the years, March, June, September and December are the most important meetings of the Federal Reserve to discuss interest rates, and the decision to raise interest rates is often born here. March is the beginning of another year, which leads the pace of interest rates throughout the year, so it can be described as the top priority. Therefore, we still need to pay attention to the results of the interest rate hike meeting.

So far, the market is almost certain that the Fed will raise interest rates by 25 basis points at the March meeting. As for the expectation of 50 basis points, it has been greatly reduced with the outbreak of Russia-Ukraine conflict. However, it is an indisputable fact that inflation is off the charts and prices are high. Will the Federal Reserve release eagles beyond expectations?

At present, commodities have risen a lot. Once they exceed expectations, will they have no impact on prices? I'm afraid we can't take it lightly.

I. US Stock Index

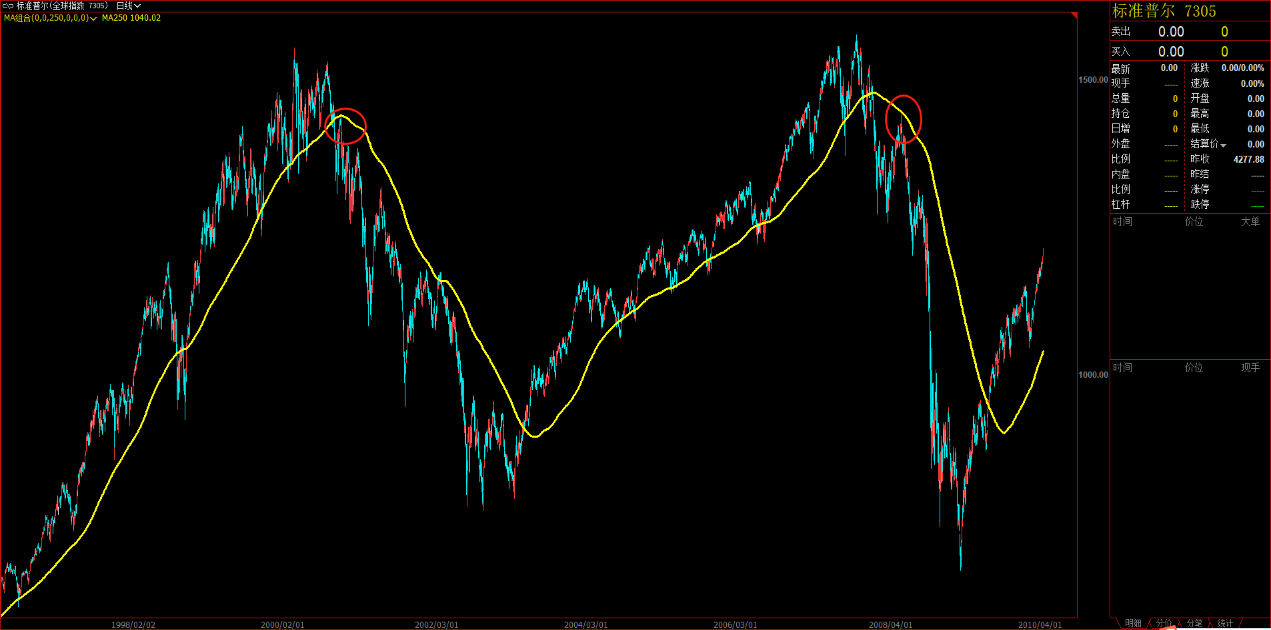

I'm afraid it's difficult to control inflation or protect the stock market. Since the news is difficult to guess, we can only rely on technical analysis to finalize the strategic basis. Looking at the US stock index, the S&P 500 stock index futures is the most eclectic index, and it is relatively reasonable to judge all the indexes of bull-bear division.

Since S&P fell below the 250-day moving average, it has become more difficult to make a long stock market. If you buy individual stocks with Buffett, the winning rate will be higher than that of a long index. In a word, if the S&P can't break the 250-day moving average (4400), it is not recommended that everyone do bargain-hunting; Friends who want to short will stop losses based on the annual line. The market news is chaotic, and it is really impossible to predict how much they will fall, but it is not a good time to do long, including A shares.

2. Crude oil

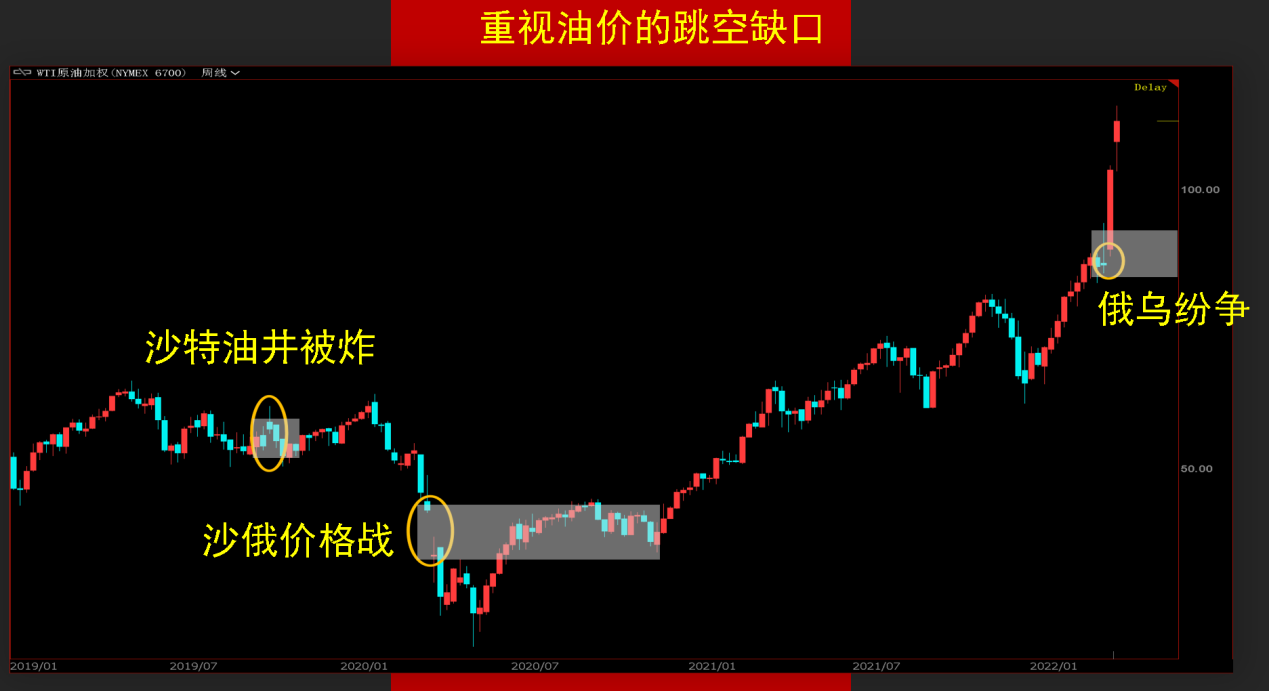

At present, it is in an extreme market, with great ups and downs. For a while, it is said that Russia-Ukraine negotiations have made progress (bad oil prices), and for a while, it is said that Iran launched rockets to attack Iraq (the Iranian nuclear deal was blocked, good oil prices). The ups and downs are all news.

Technically, the oil price gap index given in last week's post is still valid, and the oil price of about 90 US dollars will be a major support point for crude oil in the future. It is estimated that the Iranian nuclear deal will not get out, and it is difficult to fall below this price level. However, the price movement above this is very disorderly. If the war resumes, it will take 1-2 days for the price to exceed 130, and it will be treated lightly.

3. Precious Metals

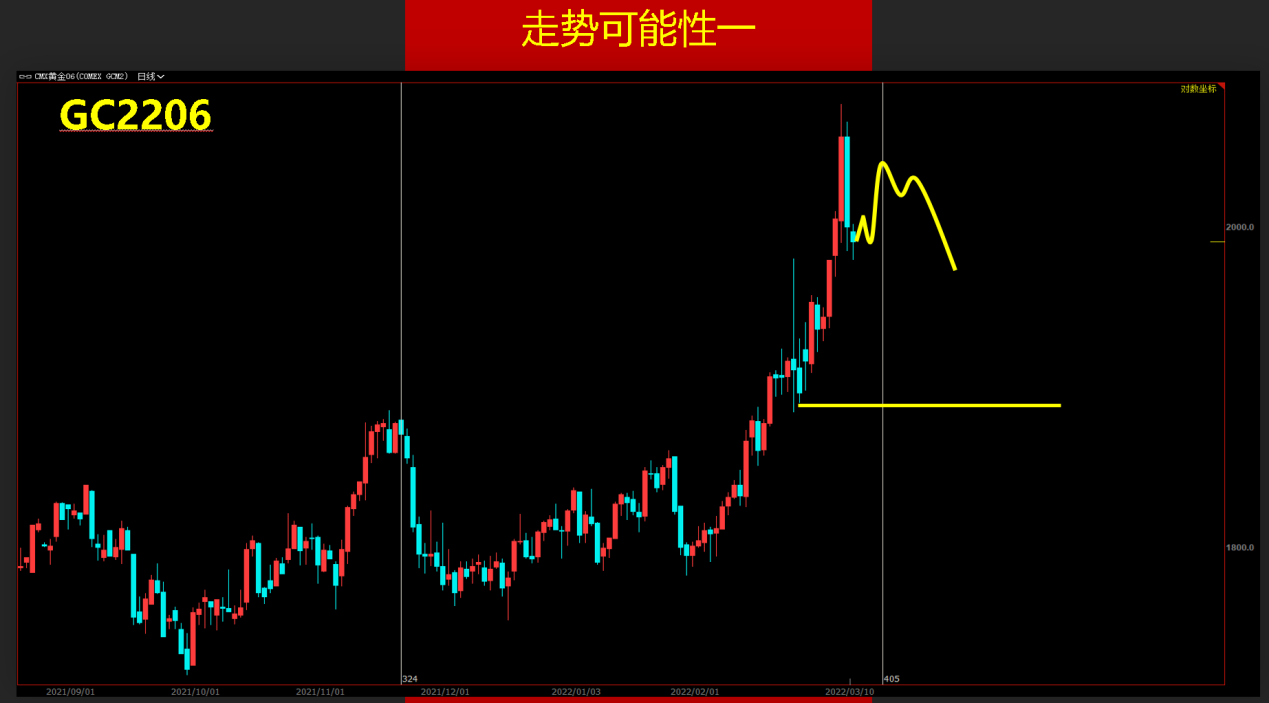

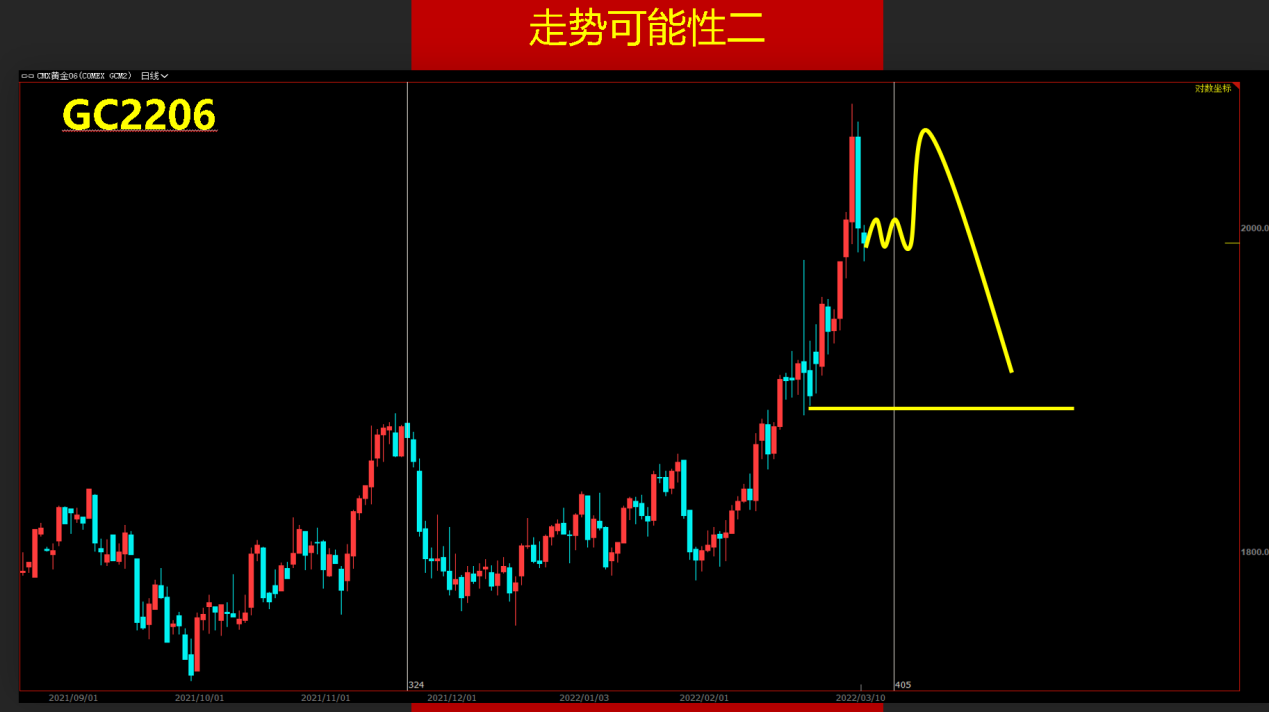

My attitute to Gold is short. The impact of Russia-Ukraine war on gold price is lower than expected, so the impact of interest rate hike may exceed expectations. The Fed's decision is an important stage node of gold price. If you are trading futures, try to short and stop your position.

Admittedly, the trend cannot be so standard, depending on whether there is a signal of raising interest rates beyond expectations. The stop loss is based on the record high to see if there is any unexpected gain.

$E-mini Nasdaq 100 - main 2203(NQmain)$ $YMmain(YMmain)$ $Gold - main 2204(GCmain)$ $Light Crude Oil - main 2204(CLmain)$ $Natural Gas - main 2204(NGmain)$

Comments