It has been nearly four days since Russia hit Ukraine on Thursday. Although the news is very chaotic, at least we have seen the two sides enter the negotiation stage. We don't know the outcome of the negotiation. However, Russia needs political and military strategic security, so this part will not be too concerned for financial markets. However, Western countries have just begun to impose financial sanctions on Russia, which is the key to affect future market prices.

First, look at "new sanctions" from "old sanctions"

In 2014, when Russia annexed Crimea, Western countries had already sanctioned Russia on a large scale. After eight years of ups and downs, Russia was able to carry it over. This trip dares to "send troops" to Ukraine, which shows that Russia is confident. Apart from military crushing, what is more important is that it thinks that economic sanctions are not fearful. Is this really the case? Can another sanction really resist? We will wait and see. But at present, the key is that we need to review the measures of European and American sanctions against Russia at that time and the impact of financial market prices.

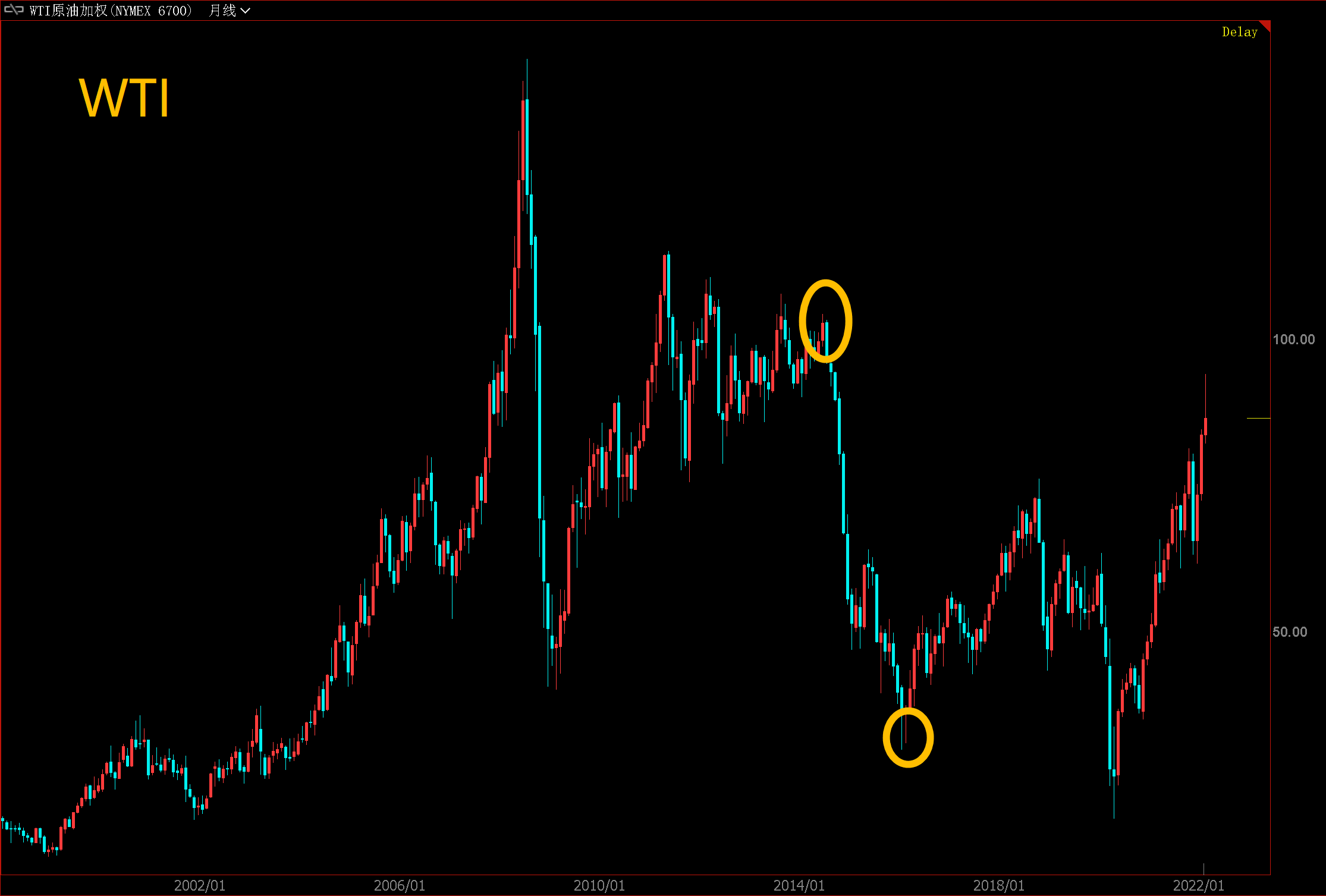

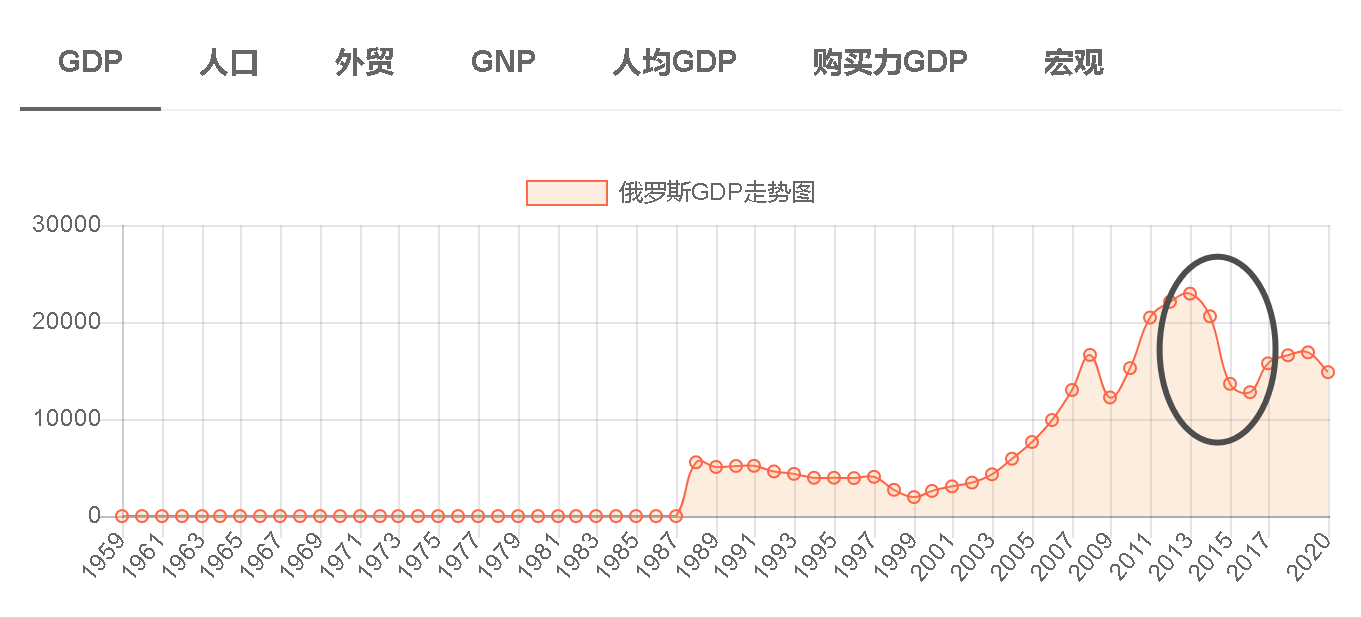

In that year, American shale oil and Saudi Arabia did not limit production, and forcefully reduced the oil price from $100 to $30. Together with other economic sanctions, Russia's GDP, which earned foreign exchange by selling energy, dropped by nearly half.

Then, if the West really suppresses Russia, suppressing oil prices is definitely the best way. After all, the United States also hopes that the drop in oil prices will drive down inflation data, but OPEC countries have just recovered from COVID-19 pandemic's oil price shock. Can they cooperate with the United States to kill one-third of oil prices again? This is difficult to estimate. But at least bullish oil prices have become difficult.

Another point is that since 2014, Russia has greatly adjusted its foreign exchange reserve structure and become very diversified. From 40% of US bonds in the past to 22% of gold reserves and 45% of national debt portfolios of China, France, Japan and Germany, it can be said that Russia's largest foreign exchange reserves are actually gold. Therefore, if European and American countries want to crack down on Russia's foreign exchange reserves, they need to "cut the knife" on gold. This is fatal to the bulls of precious metals.

Second, the strategic point of view

Last week, the market fluctuated drastically, from rising to falling sharply, and agricultural products went from daily limit to daily limit. Subsequent market will become difficult, because it will be a process of gradually shifting from the overall long market to the overall short market.

Crude oil. Strategically speaking, crude oil still looks at the 20-day moving average, and if it falls below it, it will be bearish. Even under the super favorable conditions of war, the oil price has risen to around 100, so it is obviously difficult to do more. If Iran lifts the ban, the oil price will fall. Technically, it is simple and effective to look at the 20-day moving average.

Gold. Short-term pulse market has passed, followed by volatile market. Although the general direction is clear, there are always aftermath. $2,000 is an important pressure position for gold. The risk aversion has passed and the interest rate hike cycle is approaching. I really can't think of any reason for gold to grow cattle. Be careful.

Agricultural products. Except corn, other varieties have reached the position near the historical peak, and the planting area report was released at the end of March. Recently, the market of agricultural products is mostly volatile, and they still hold long positions to clear their stocks while rebounding. Short sellers should not be too optimistic. Short sellers of agricultural products are 10 times more difficult than short sellers, so they can only think in the short term. Remember.

However, if American corn wants to continue to do more, it needs to look at the degree of price decline. When its price is adjusted back to around 520 cents, it can reconsider opening positions, and it is still recommended to wait.

$NQ100指数主连 2203(NQmain)$ $道琼斯指数主连(YMmain)$ $黄金主连 2204(GCmain)$ $白银主连 2205(SImain)$ $WTI原油主连 2204(CLmain)$ $天然气主连 2204(NGmain)$

Comments