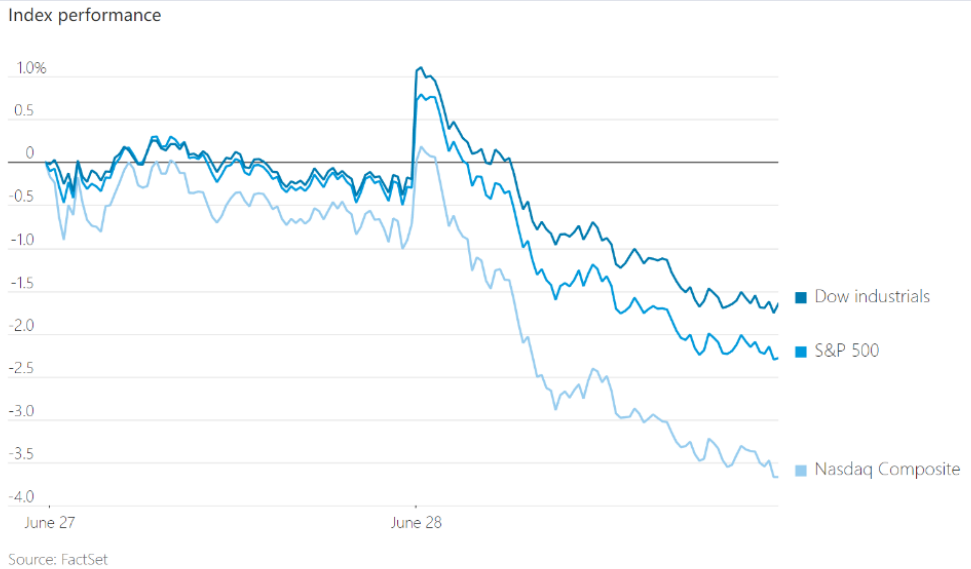

The US stock market fell across the board, and the S&P 500 index returned to the bear market. The S&P 500 index closed down 78.81 points, or 2.02%, to 3821.30 points; The Dow Jones index closed down 490.48 points, or 1.56%, to 30,947.78 points; Nasdaq closed down 344.77 points, or 2.99%, to 11,179.78 points.

At the same time,

-The US dollar rose by 0.519% and the euro fell by 0.61%

-The yield of US Treasury bonds was basically flat, and the yield of 10-year US bonds fell by 0.2 basis points to 3.192%

-Bitcoin fell back to nearly $20,000

-Gold was sold again and fell to the level of 1820

-Oil prices rose for the third consecutive day, and US crude oil futures rose by 2%

There is a simple reason for the current trend of the market, and there is also a profound reason.

On the surface, it is affected by economic data-the consumer confidence index of the United States fell to the lowest level since February 2021 in June (the gap between consumers' views on the present and their expectations for the future has widened, increasing the risk of economic recession).

Data released on Tuesday showed that the index of consumer confidence of the World Association of Large Enterprises fell to 98.7 from 103.2 revised downwards in May, which was lower than the 100 expected by economists.

The situation last night was completely different from last week, when "bad news will be interpreted as good news", because the bad news is expected to lower the Fed's expectation of raising interest rates. But last night, the bad news became the real "bad news".

After the release of this data, the Fed's expectation of raising interest rates has been further enhanced:

From the perspective of market correlation trend, the economic data is poor, the US dollar index rises, but the gold price falls, which shows that the market trend is not simply affected by economic data.

This goes back to the "profound reason" we said at the beginning-the Fed needs to change the market.

First, the excessive rise in the market induces more bargain-hunting funds to flow in, which makes financial conditions looser, which in turn forces the Federal Reserve to maintain a tight stance.

Second, the Fed needs to remain hawkish and lower inflation expectations (what the Fed is doing is anchoring inflation expectations). If inflation expectations remain high, the Fed must push up the nominal interest rate (real interest rate + inflation rate). If inflation is to fall, the policy interest rate must be higher than the predictable inflation forecast.

To end the tightening cycle real interest rates must be positive either allowing short-term bond yields to rise further or allowing inflation expectations to fall. So we will see that even in the case of a sharp decline in the stock market, the speech of Fed officials is still fighting inflation "at all costs".

From the actual situation, the Fed's efforts have not been in vain:

-The longer-term inflation expectations of the University of Michigan survey released last week fell from a 14-year high.

-The bond market shows that inflation expectations for the next five years are declining, and the five-year break-even interest rate has dropped to about 2.8% (the level before the war between Russia and Ukraine), which means that the market expects the CPI increase in the next five years to be closer to the Fed's inflation target of 2%.

Wise people on Wall Street have already started the "inflation peak" bet ahead of time, which may be more reliable this time than the last time, because the decline in inflation expectations is self-fulfilling. High prices are changing consumer behavior and preventing them from buying more goods. In other words, the factor that changes high prices is "higher prices".

Profiting from market mispricing is such a case. When most people are still preparing for higher and higher inflation, you find the clues of "inflation peaking" in advance and trade accordingly. After tonight, the market is likely to set off speculation of "inflation peaking".

Another question worth thinking about is that the voice of economic recession is getting louder and louder last week, but the market is getting higher and higher. Have you ever thought about what will happen when Wall Street investment banks cut their forecasts for US economic growth one after another? That moment has not yet arrived. In addition to speculating expectations, the market will always be tested by reality for a moment.

$NQmain(NQmain)$ $ESmain(ESmain)$ $YMmain(YMmain)$ $GCmain(GCmain)$ $CLmain(CLmain)$

Comments