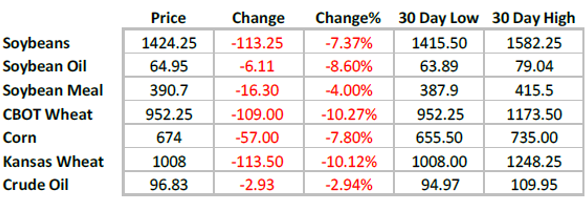

Price changes this week

Better weather and fears of economic recession have led to an overall liquidation of commodities, pushing market prices lower this week. However, since most crop yields have yet to be determined, improving weather alone will not reduce the risk premium of current prices. There is still the risk that falling yields will push up prices.

With the acceleration of winter harvest, wheat prices have fallen the most. Although the crop situation of winter wheat still shows low yield, the market must be under certain harvest pressure. In our view, the main reason for most of the price decline last week was the macro liquidation of commodities.

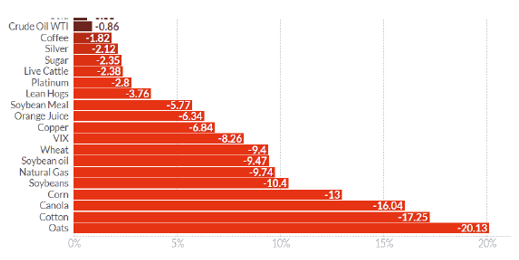

The prices of almost all important commodities have fallen for weeks (see the chart below). Moreover, if the theme of recession continues in the market next week, we may see prices fall further.

For commodities mainly used for capital expenditure (such as copper and iron ore), it can be thought that the global economic recession will lead to a sharp drop in demand. However,For food, demand is usually inelastic after taking into account a certain number of sub-stations, and we don't think the global economic recession will significantly change the demand forecast. This is because much of the balance-sheet contraction is mainly due to supply-side problems (Black Sea War, sub-optimal cultivation in the United States, low export surpluses carried over inventories). In this case, prices will eventually have to rise to stimulate more planting of crops in the next season and curb demand.

This week, the first batch of Ukrainian wheat from non-Ukrainian ports began to appear in the market; The total Romanian/Bulgarian exports are undoubtedly limited as these countries also need their port infrastructure to export their products.

We don't have much hope for the supply from Ukraine. Before Russian wheat enters the world market, there are still a lot of problems to be solved, such as whether international companies that may be engaged in Russian wheat trading will be sanctioned, and how much war risk premium ships that enter the port to load will have to pay.

Our main concern is that the exact implementation of the Black Sea export program is still unknown. The next two months will determine the size of American crops, which will be affected by the weather. The weather in July has the greatest influence on corn yield, while the weather in August will be an important determinant of soybean yield.

Abandoned area is still unknown, because late sowing may lead to an increase in abandoned area. However, the size of abandoned cultivation area will significantly affect the total yield.

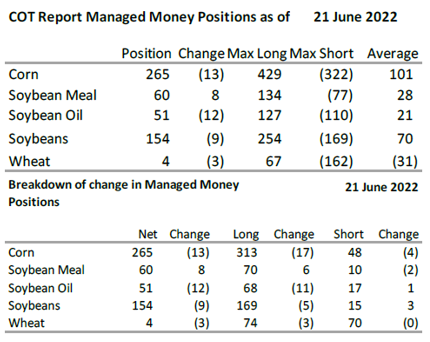

Managing net fund positions significantly reduces long exposure to almost all products, as was evident from last week's price movements. If the recession-induced price decline continues, we expect a similar reduction next week. However, the fundamentals of cereals and oilseeds remain supportive, so we expect some long positions to remain even after possible liquidation.

Grain

Driven by the pressure of harvest in the United States, wheat prices are lower. In addition, the news that Bulgaria/Romina may export some Ukrainian wheat also increased the price pressure. However, in our view, a limited amount of wheat of Ukrainian origin is exported or may be exported.

Without Russia's massive exports, wheat prices will have to rise to a higher level. Once harvest pressures end and global markets fully absorb the recession, wheat prices could rise again.

Our long position proposal was blocked. However,Once the decline caused by the recession is over, we stillIt is recommended to do more wheat.

Corn prices also fell on optimism about Black Sea exports. The surplus of global corn exporters is still very low, and the United States must obtain above-average corn production, otherwise corn prices will rebound from the current level.

We still have similar views on corn, because there has not been a fundamental change. In addition, corn demand for feed and ethanol remains strong. Therefore, we are still biased upward, because the long-term weather forecast reduces the possibility that corn yield will be higher than the trend.

Oilseed complex

The improved weather forecast will undoubtedly help push down soybean prices this week. However, there is still a long time before the soybean yield is determined. In addition, soybean oil prices have been pushed down due to the decline in crude oil prices, and soybean prices are also under pressure.

Initial crop conditions were highly good/excellent, but it is too early to determine final yield estimates based on these crop conditions.

Because Dakotas are severely affected by rain during sowing, the critical area of abandoned land may have a greater impact on soybeans. In the coming months, the price of oilseed compounds will continue to be affected by energy prices and weather.

Trading ideas

Corn: We make a profit and stop loss in our current position. Once the liquidation is over, traders should look for opportunities to buy again.

Wheat: This position is also stopped. Once the price tends to be stable, you can do more WZ.

Soybean: There is no new trading idea, and the trading range strictly implements stop-gain and stop-loss

$ZCmain(ZCmain)$ $ZSmain(ZSmain)$ $CLmain(CLmain)$ $ESmain(ESmain)$ $GCmain(GCmain)$

Comments