Multi-leg Option Strategy: Straddles and Strangles (Part 2)

Recap: What are straddles and strangles option strategy?

Straddles and strangles are options strategies that allow an investor to profit from big movement in a stock price, regardless of the direction of price movement.

Both strategy requires BUYING an EQUAL NUMBER of PUT and CALL options with the SAME EXPIRATION DATE.

The difference is that strangle strategy has two different strike prices, whereas straddle strategy has a common strike price. See previous post for Straddle discussion.

When to use Strangle?

Strangles are also used when there is a potential for the stock price to experience wide fluctuations and the trader is unable to determine which direction the stock price might go. However, the reason why traders choose strangle over straddle is to avoid paying the large premium for options with strike price at the money (ATM).

Note that there is no desire to own the underlying stock and there is no need to own the underlying stock with this strategy. This is purely options trading.

How to execute a Strangle?

Each strangle strategy involves a minimum of 2 options contract, 1 BUY PUT and 1 BUY CALL. Every BUY PUT contract must have a corresponding BUY CALL contract. Both PUT and CALL contracts have the SAME EXPIRY DATE, but DIFFERENT STRIKE PRICE.

Strike price selection depends on whether the trade is bias towards the stock being bullish, bearish, or neutral.

Duration of the options should not be too long (ideally no more than 1.5 months) The reason is because a longer expiry contract has higher premium, so more upfront cost and less likely to make a profit.

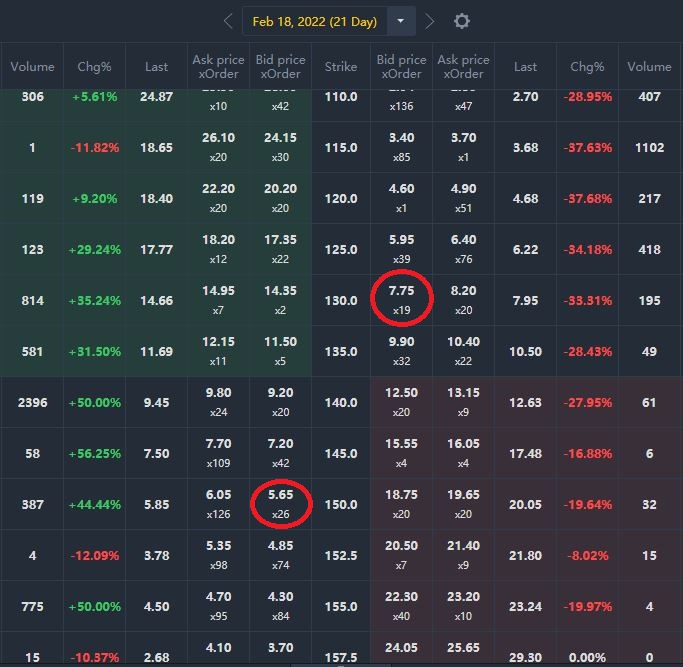

Looking at the screenshot above, the stock price is currently $136. Assuming I am bearish on the stock, I would want to have a PUT option with a strike price closer to the stock price than the CALL option. So in this example, I would buy a PUT option with strike price at $130 and CALL option with strike price at $150. The reason is because assuming the bearish thesis is correct and the stock price falls, it will be easier to be ITM if the strike price is closer to the stock price than if it is further from the stock price. However, the penalty is the higher premium I have to pay upfront. This has to be taken into account in order to compute the profit and loss.

The idea is to pay as little premium as possible so it will be easier to break-even and profit from the trade.

Calculating Profit and Loss for Strangle Strategy?

Using the above example screenshot, the total premium paid is (775+565 = $1340), that would be the maximum loss. This will happen when the stock price at the expiry of the contract is between $130 and $150 dollars. This means that both contracts expires worthless.

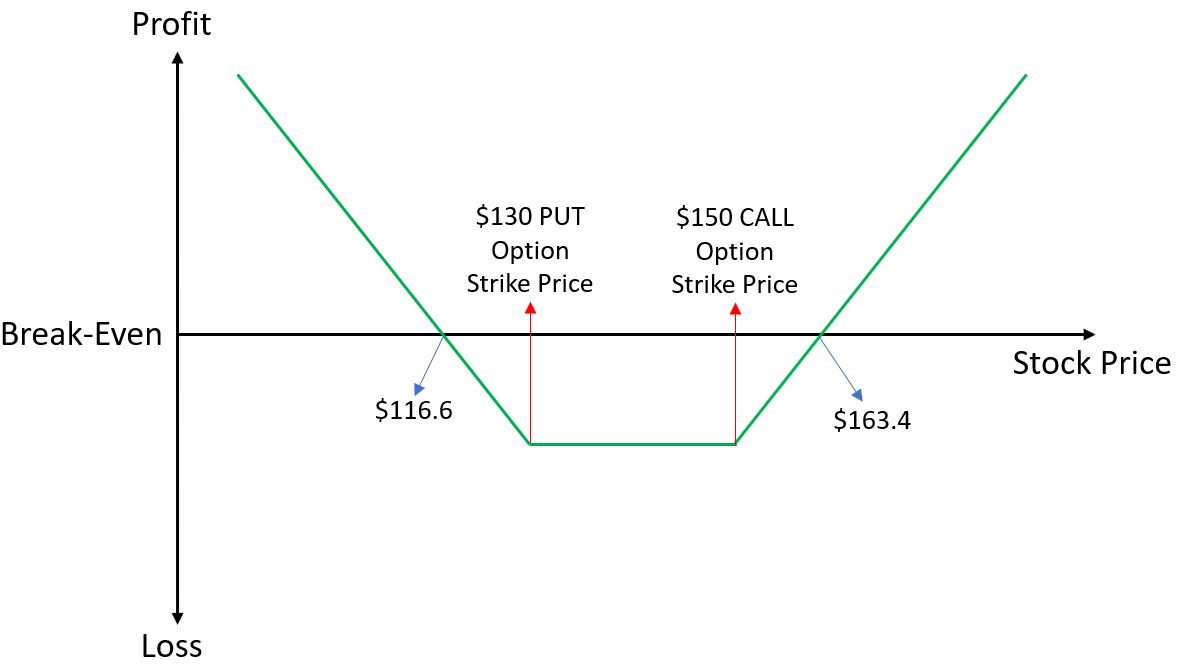

In order to break-even, the price must either rise or fall enough to offset the total premium paid. Assuming we let the option reaches its expiry date, there will be 0 extrinsic value. Only the intrinsic value remains. The intrinsic value is the difference in the stock price and the strike price. This means that the stock must move at least $13.4 dollars from $130 OR $150 to break-even, so the stock price would either be $116.6 or $163.4 on expiry.

In order to profit, the stock must move lower than $116.6 or higher than $163.4 on or near expiry.

See the graph above for a better visualisation. Note that this is for this example at the time i captured the screenshot. As the market moves, the premium changes. If you calculate by percentage, the stock must go down by at least 14.26% or up by at least 20.14% just to break even. To profit, it must move more than 20.14% up or 14.26% down. Unless the trader is very sure that the stock is that volatile and the stock can move by more than this amount, it would not be beneficial to use the strangle. The trader can also choose to close the options early if the anticipated profit is achieved. There is no need to wait till expiry.

Things to pay attention to when executing a Strangle?

1. Strangle involves a minimum of 2 BUY contracts. This means that the option premium is paid first. Maximum loss will occur when the price stays range-bound within the strike price of the PUT and the CALL option contracts (Both contracts expire worthless). See graph for profit and loss.

2. Both contracts should become valid within a short period of time. Otherwise, the stock price will have moved and the option premium will no longer be the same. This means that there is a potential for the total option premium to increase, resulting in more money having to be paid up front and more difficult to profit. In more extreme cases, the stock price might have moved beyond the range the trader wants it to be in, resulting in even higher premium to be paid up front because one of the option could have become ITM (In The Money) instead.

3. The longer the expiry date, the more expensive the contracts become, and a higher upfront cost. The strategy is typically used when the earnings report release are near or some major announcements are to be made by the company soon. The idea is to pay as little premium as possible so it will be easier to break-even and profit from the trade, therefore, the duration of the options should be no more than 1.5 months.

4. One strategy is to observe the implied volatility of the option. A lower implied volatility means a smaller premium, so traders will monitor the implied volatility and enter a position when the implied volatility is low. Typically, as the company is due to release its earning report, the implied volatility will increase.

In Demystifying Options part 13, I will be discussing Diagonal Puts..

Always remember.. If you do not understand what is happening, do not blindly follow and execute the trade!

Comments