Never grab a falling knife.

Financial markets returned to turmoil on Thursday, with concerns over the Fed's decision hanging over broad markets:

-U.S. stocks fell (fell at the start, rose briefly, and then fell again in shock), and the Dow Jones index fell 173.27 points, or 0.6%, to 30,961.82. The S&P 500 fell 44.66 points, or 1.1%, to 3,901.35. The Nasdaq dropped 167.32 points, or 1.4%, to 11,552.36.

Note: The closing point of the S&P 500 index "3901" is very worthy of attention, which is a fierce battle level between long and short. The index fell to 3900 four times before stabilizing. On Friday, the $3.2 trillion option expired at an exercise price of 3,900 points. Once the S&P 500 index falls below 3900 points, it will trigger an accelerated decline.

-Cryptocurrency was completely sold off, and Bitcoin fell 0.56% to $19,836.15. Ethereum fell 6.20% to $1,504.22.

-The Stoxx 600 index in Europe fell 0.7%.

-US Treasury bonds fell, and the yield of two-year US bonds rose from 3.79% to 3.87%. The yield on 10-year U.S. bonds rose to 3.458% on Thursday from 3.411% on Wednesday, approaching the annual high of 3.482% set in mid-June.

-Gold once hit $1,659, falling for the third consecutive trading day.

-Oil prices plummeted by more than 3%, and the strong US dollar put pressure on oil prices.

-Offshore RMB fell below 7.0. After Tuesday, the market first appeared the expectation that the Federal Reserve would raise interest rates by 100 basis points, which was the root of RMB abandoning 7.0. If the US CPI data does not exceed expectations and the market does not show signs of raising interest rates by 100 basis points, then the 7.0 mark can last at least one month.

-The US dollar index rose slightly and stood firm at 109 level. The default pattern in the money market is to buy dollars unless there is a good reason to sell them.

It is also a familiar scene in the past. Except for the US dollar, US stocks, Bitcoin, national debt, gold, RMB and other positively and negatively related markets are all falling. Now we have entered the stage of "good news is bad news", and the strong economic data may encourage the Fed to continue to raise interest rates quickly.

In fact, there was a false trend in the market the day before Thursday-the US dollar fell, US stocks rose and gold rose, which induced many people to enter the market to bargain-hunting. Yesterday's article "All I See Is False" specifically warned this point-the stagnation of the rise of the US dollar is the action of central banks to defend their currencies, not the trend reversal. We must understand that there is no data to show that the Fed has the conditions to start easing its positions, at least it will still implement active tightening policies.

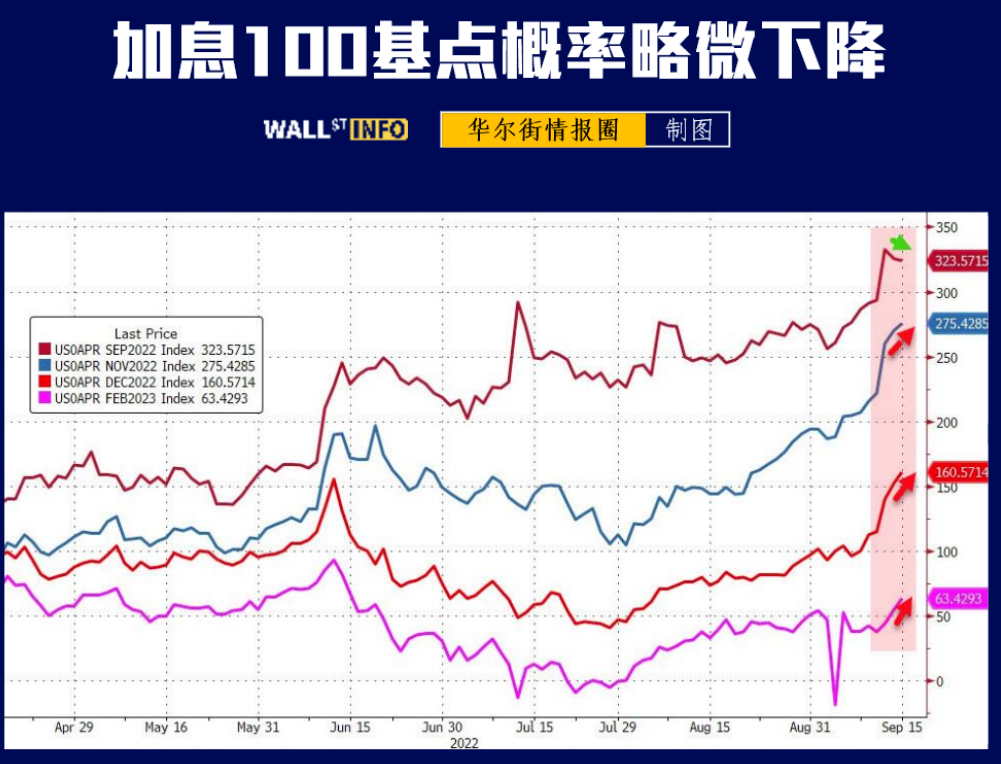

The root of the current market turmoil is that there is no consensus in the market. Whether to raise interest rates by 75 basis points or 100 basis points is still inconclusive. The baseline forecast is still to raise interest rates by 75 basis points, but raising interest rates by 100 basis points must be among the Fed's options, and the signal may come out next week.

$NQ100指数主连 2212(NQmain)$ $SP500指数主连 2212(ESmain)$ $道琼斯指数主连 2212(YMmain)$ $黄金主连 2212(GCmain)$ $WTI原油主连 2210(CLmain)$

Comments

Thank