There is no doubt that for a long time to come, the source of global market fluctuations will come from the US bond market.

Just last week Powell warned

After "the Federal Reserve will adopt restrictive monetary policy to curb high inflation for a period of time and will not relax monetary conditions prematurely",

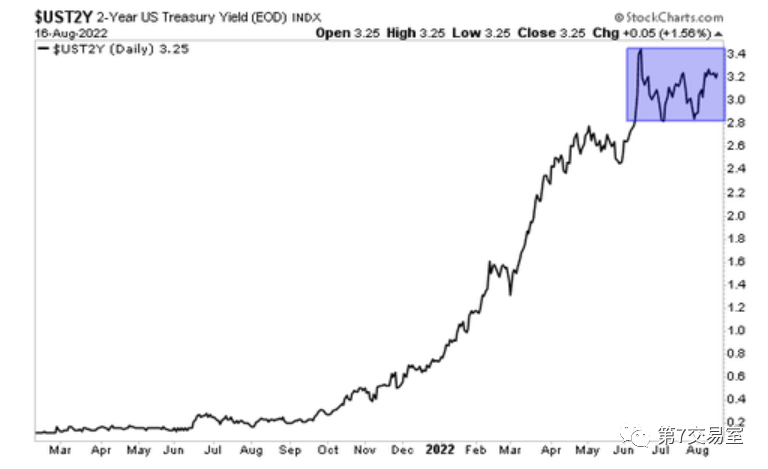

The two-year US bond yield immediately rose above 3.4%, reaching the highest level since the global financial crisis. This key change has become a very obvious signal light for the future US stock market crash.

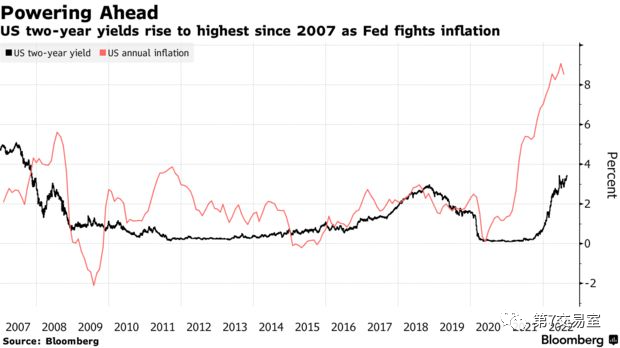

Obviously, Even though the yield of US bonds has soared in the past two years, The short-term interest rate increase triggered by the Federal Reserve has lagged far behind the inflation rate increase, and the current market divergence lies in: Does the Federal Reserve really dare to raise the interest rate to a position where it will exert continuous pressure on inflation and keep it for a long time before the inflation rate peaks and falls?

This will be the core logic of the rise and fall of US stocks in the future, so we can see that the three major indexes of US stocks began to plummet at almost the same time, driven by the soaring yield of 2-year US bonds on Friday.

Friday intraday review: The key change is here

In less than 20 minutes of Powell's speech, the most important and most anxiously awaited statements by traders appeared, which were concise and equivalent to fulfilling market expectations. No new information points have been released.

Let's see how clear he is:

"It is possible to adopt restrictive monetary policy for a period of time to curb high inflation, and will not relax monetary conditions prematurely, which may cause families and businesses to suffer more economic pain."

"Restoring price stability requires maintaining a restrictive policy stance for a period of time."

Powell seems to have given up guiding the market and controlling expectations, but is being guided and controlled by market expectations. Of course, he also seems to disdain to play some word games to make the market guess like Bernanke,

Last Monday, we predicted the sharp drop of US stocks in the past two weeks, and reminded everyone that Powell would probably dispel the market expectation of cutting interest rates in early 2023. Moreover, the market has clearly expected this and has fully priced it.

With this risk landing, US stocks went out of the classic trend of buying expectations and selling facts, and returned to the downward trend again,

Just before the annual meeting of the central bank last Friday, We reminded that from the deviation between the trend of US stocks and bond markets at that time, it can be seen that US stocks are probably pricing Powell's speech will not exceed the expected hawks, so they rose slightly to test the 20-day moving average, but the bond market has been falling continuously, and the yields of 10-year and 2-year US bonds have been soaring in the past two weeks to be high before testing.

Just after this risk landed, the trend of US stocks and US bonds returned to the same again.

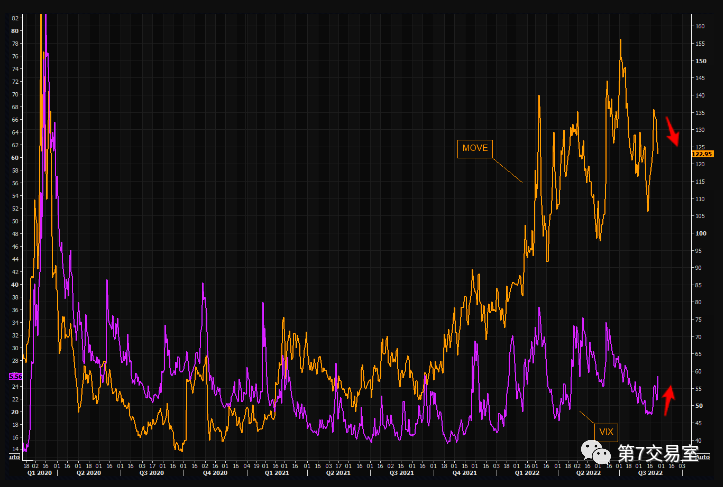

Let's look at the comparison of implied volatility between bond market and stock market. The volatility index MOVE of bond market is much higher than VIX index of stock market, so the bearish sentiment of bond market is much higher than that of stock market.

After Powell's speech, the volatility of the bond market declined, the VIX began to rise, and the difference between the two began to converge. This suggests that stock market pricing is trying to catch up with bond market pricing, and the price of US debt has begun to peak after a period of decline Signs of stability.

So from this perspective, the decline of US stocks does not seem to be over.

2-year US debt has become the anchor of recent asset price changes

If you haven't realized the importance of the 2-year US bond yield, take a look at this statistic:

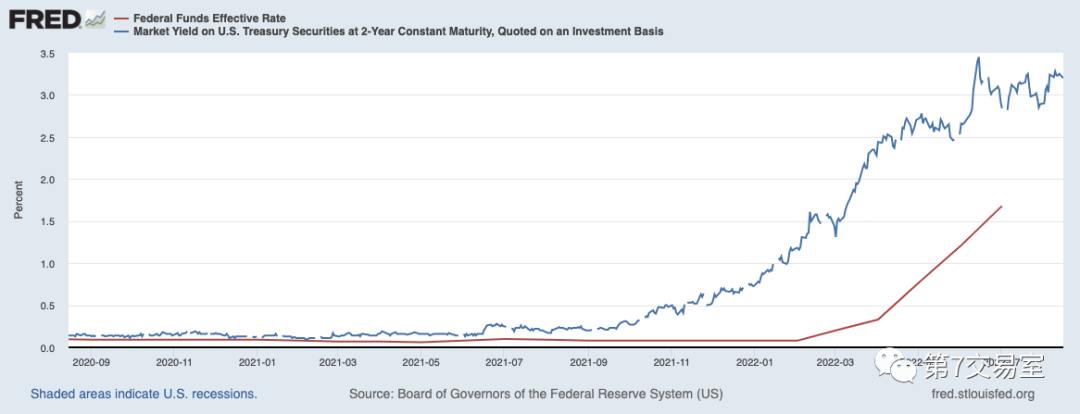

The valuation of interest rate increase by US bond yield in two years should be at least one year ahead of the actual interest rate increase by the Federal Reserve.

Moreover, the gap between the two is widening, and the target price that the bond market thinks can provide continuous pressure on prices is at least about 3.5%, which is just the target price for raising interest rates in 2023 in the bitmap.

But at present, the Fed's interest rate hike (red line) still lags far behind this valuation.

If we compare the 2-year US bond yield with S&P, we will find how sensitive US stocks are to the change of the 2-year US bond yield!

It was not until the yield began to level off recently that US stocks began to stabilize and rebound, all of which were driven by the yield of US bonds!

It can be seen that the yield of 2-year US bonds suddenly soared sharply. What does it mean to break through the previous high of 3.4% means that there is still room for US bonds to go down, and the space for US stocks to fall begins to expand again as the yield breaks the top!

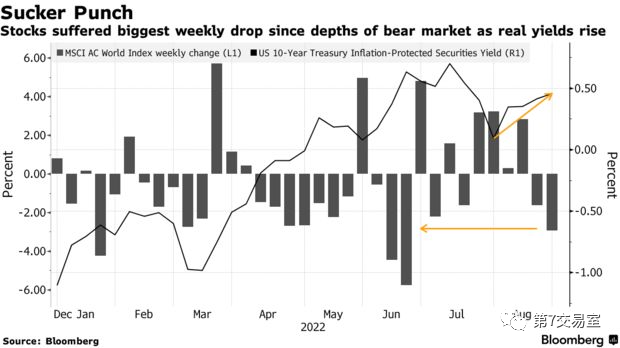

In fact, not only the changes in US stocks will be affected, but the stock markets of the whole world are being driven by the changes in US bond yields.

Looking at the comparison chart between the change of real yield of 10-year US bond yield after excluding US inflation rate (black) and the change of MSCI global stock index Zhou Du (gray), we can see the contagion of this sentiment at a glance.

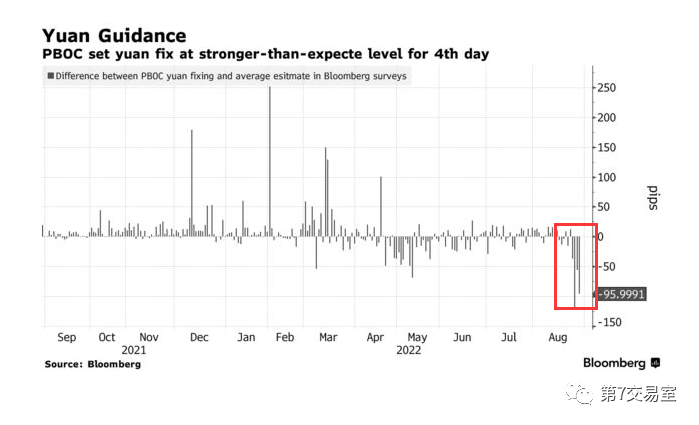

Recently, under the suppression of the rising US dollar, the global non-US currencies started a new round of decline, the exchange rate of RMB also approached to break through the support, and the offshore RMB approached to break through the 6.9 mark.

Therefore, the central mother has been worried about it in the past few days. She has been setting a guide price far exceeding the speculative market in the onshore market, and after some intervention, she has stabilized the exchange rate. This degree of deviation has been the largest in several years:

This is also the reason why we are not optimistic about the breakthrough of chinese stocks in the recent stage. For the specific deep logic and the rise and fall cycle of A shares, you can look back at our previous sharing.

$E-mini Nasdaq 100 - main 2209(NQmain)$ $E-mini Dow Jones - main 2209(YMmain)$ $E-mini S&P 500 - main 2209(ESmain)$ $Gold - main 2212(GCmain)$ $Light Crude Oil - main 2210(CLmain)$

Comments