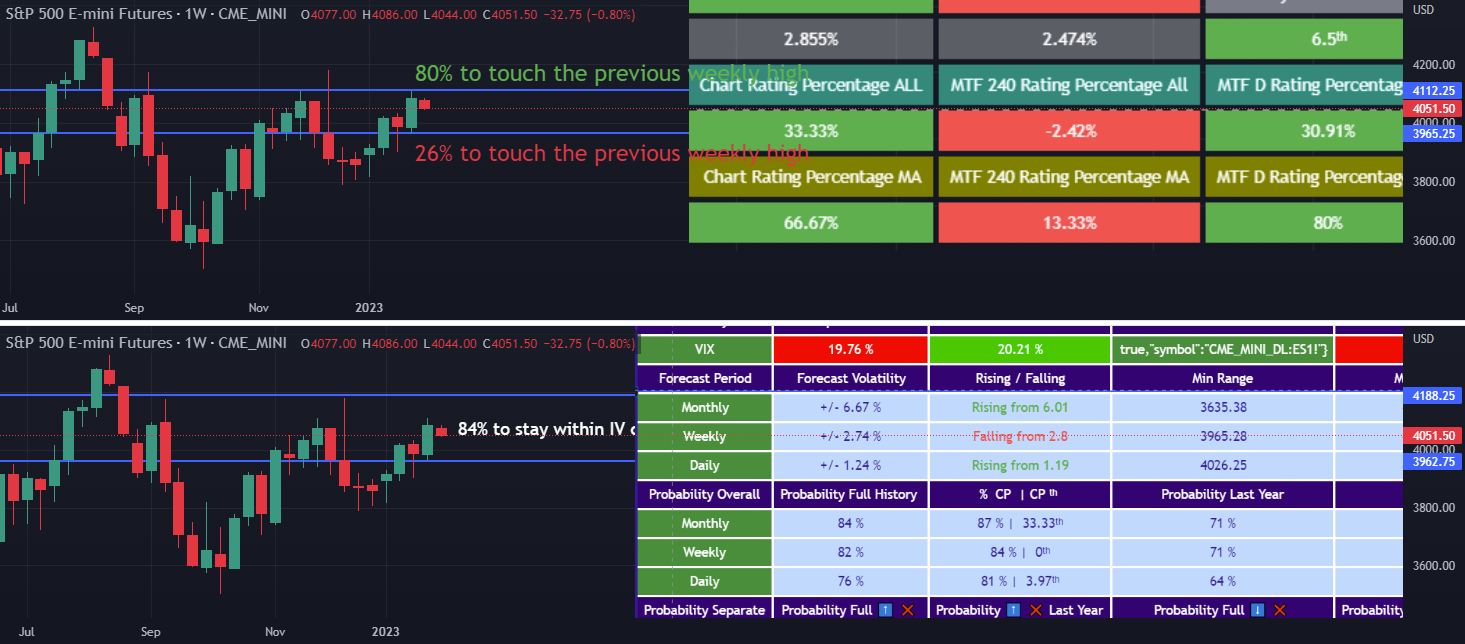

1.$S&P 500(.SPX)$ SP500 Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from VIX we can see that currently the IV for this week is at 19.76%, down from 20.21% last week.

This can be translated in +/- 2.74% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 4188

BOT: 3965

The probability to break this channel(akathe close of the weekly is going to end up either above/below this channel) is at

82% with the last 20 years of data

71% with data since 2022

However, if we were to make a more accurate statement, based on the current percentile of the VIX( from 0 to 10) , we can apply a condition in the filter

to look for scenarios when the volatility were lower than 50 percentile( bottom half). If we were to take this data we can see, that our numbers would be:

84% according to the last 20 years of data

79% according to the data since 2022

Overall we can see an increase in the probability chance, and at the same time more accurate with the current events.

So we can use this data instead for proper calculation of our trading plan

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

80% to touch the previous weekly high

26% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: -13%Bearish Trend

D Timeframe: +80%Bullish Trend

W Timeframe: +66%Bullish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

2.85% from the open to the close candle for the bullish scenario

2.47% from the open to the close candle for the bearish scenario

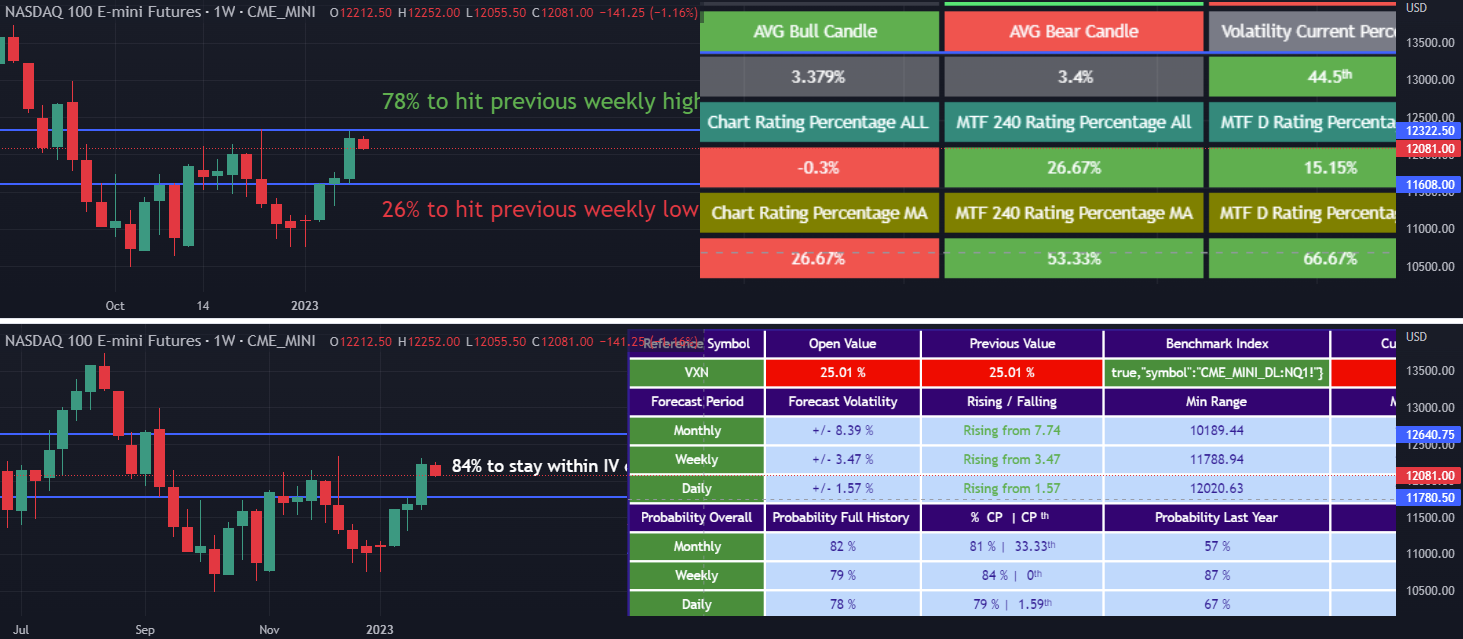

2.$NASDAQ(.IXIC)$ Nasdaq Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from VXN we can see that currently the IV for this week is at 25.01%, equal to last week.

This can be translated in +/- 3.47% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 12640

BOT: 11788

The probability to break this channel(akathe close of the weekly is going to end up either above/below this channel) is at

If we were to make a more accurate statement, based on the current percentile of theVXN( from 0 to 10) , we can apply a condition in the filter

to look for scenarios when the volatility were lower than 50 percentile( bottom half). If we were to take this data we can see, that our numbers would be:

84% according to the last 20 years of data

100% according to the data since 2022( I would recommend the 87% instead)

So we can use this data instead for proper calculation of our trading plan

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

78% to touch the previous weekly high

26% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: +53%Bullish Trend

D Timeframe: +66%Bullish Trend

W Timeframe: -26%Bearish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

3.37% from the open to the close candle for the bullish scenario

3.4% from the open to the close candle for the bearish scenario

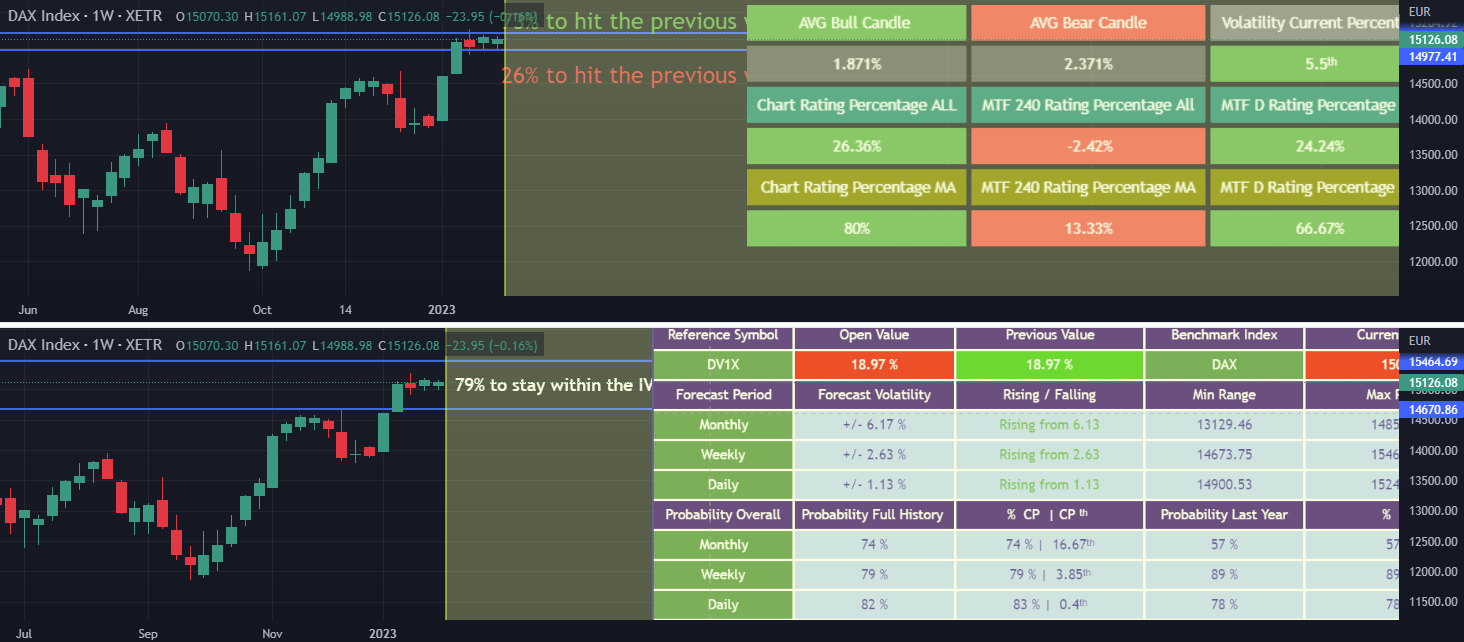

3.DAX Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from VDAX we can see that currently the IV for this week is at 18.97%, equal to last week.

This can be translated in +/- 2.63% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 15466

BOT: 14673

The probability to break this channel(akathe close of the weekly is going to end up either above/below this channel) is at

79% with the last 20 years of data

89% with data since 2022

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

73% to touch the previous weekly high

26% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: -13%Bearish Trend

D Timeframe: +66%Bullish Trend

W Timeframe: +80%Bullish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

1.87% from the open to the close candle for the bullish scenario

2.37% from the open to the close candle for the bearish scenario

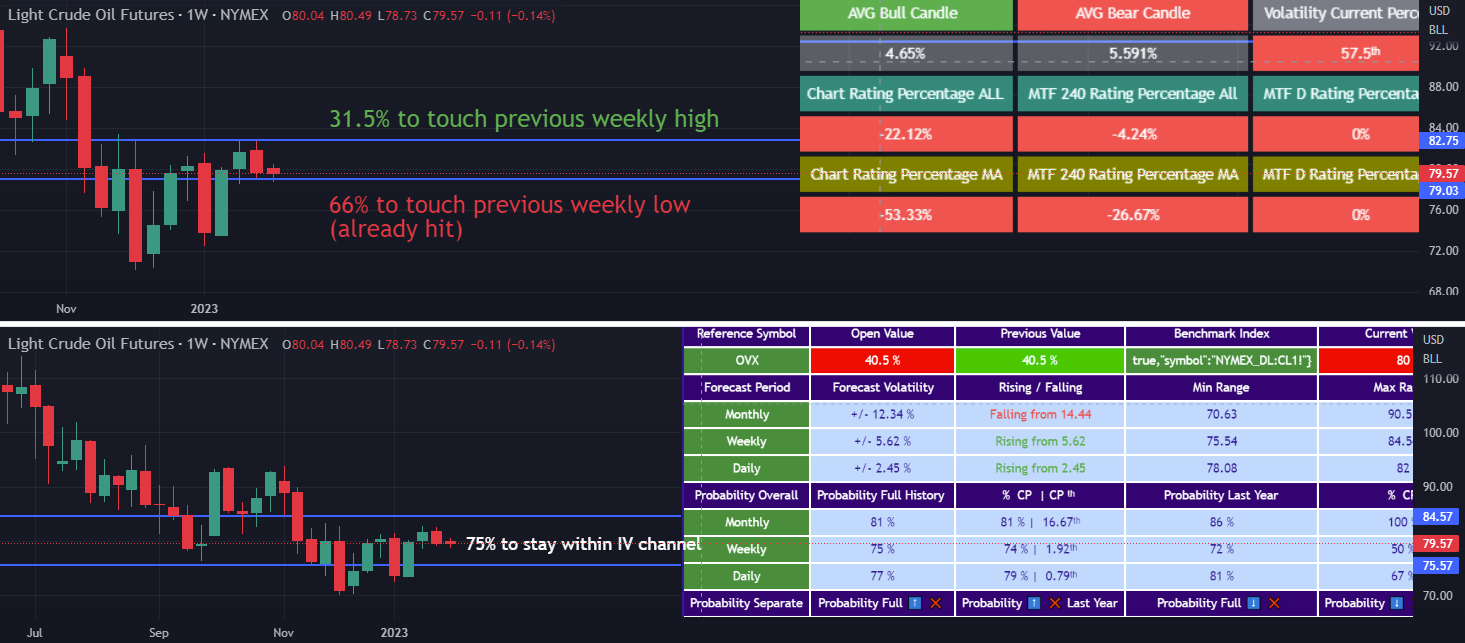

4.$Micro WTI Crude Oil - main 2303(MCLmain)$ Crude Oil Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from OVX we can see that currently the IV for this week is at40.5%, equal to last week.

This can be translated in +/- 5.62% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 84.54

BOT: 75.54

If we were to make a more accurate statement, based on the current percentile of the OVX( from 0 to 10) , we can apply a condition in the filter

to look for scenarios when the volatility were lower than 50 percentile( bottom half). If we were to take this data we can see, that our numbers would be:

74% according to the last 20 years of data

50% according to the data since 2022( I would recommend the 72% instead)

So we can use this data instead for proper calculation of our trading plan

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

31.5% to touch the previous weekly high

66% to touch the previous weekly low(already hit)

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: -26%Bearish Trend

D Timeframe: 0%Bearish Trend

W Timeframe: -53%Bearish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

4.65% from the open to the close candle for the bullish scenario

5.6% from the open to the close candle for the bearish scenario

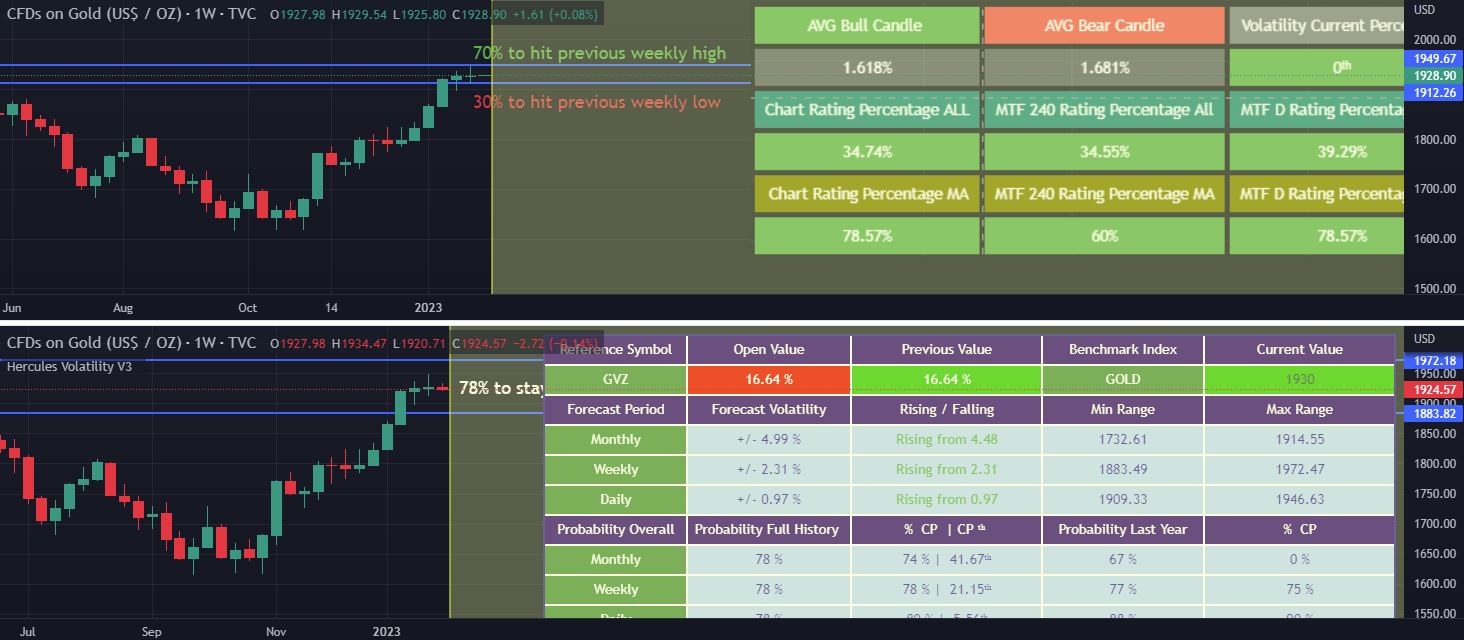

5.$E-Micro Gold - main 2304(MGCmain)$ Gold Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from GVZ we can see that currently the IV for this week is at 16.64%, equal to last week.

This can be translated in +/- 2.31% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 1972

BOT: 1883

If we were to make a more accurate statement, based on the current percentile of th GVZ( from 0 to 21) , we can apply a condition in the filter

to look for scenarios when the volatility were lower than 50 percentile( bottom half). If we were to take this data we can see, that our numbers would be:

78% according to the last 20 years of data

75% according to the data since 2022

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

70% to touch the previous weekly high

30% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: +60%Bullish Trend

D Timeframe: +78%Bullish Trend

W Timeframe: +78%Bullish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

1.62% from the open to the close candle for the bullish scenario

1.68% from the open to the close candle for the bearish scenario

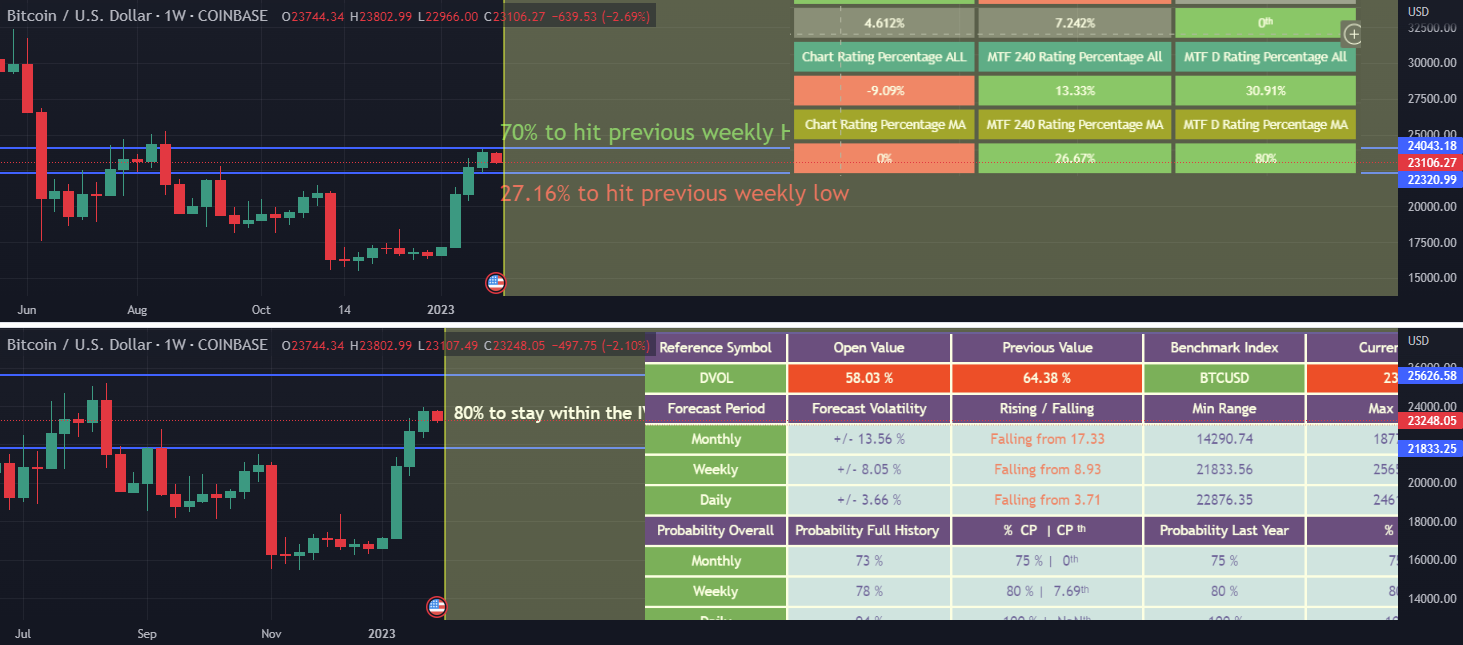

6.BTCUSD Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from DVOL, we can see that currently the IV for this week is at 58.03%, down from 64.38% last week.

This can be translated in +/- 8.05% movement from the open of the candle, which makes the next top/bot channel

TOP: 25655

BOT: 21833

The probability to break this channel(akathe close of the weekly is going to end up either above/below this channel) is at 78%(80% since 2022)

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

70% to touch the previous weekly high

27% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: +26%Bullish Trend

D Timeframe: +80%Bullish Trend

W Timeframe: 0%bullish/bearish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

4.6% from the open candle for the bullish scenario

7.24 from the open candle for the bearish scenario

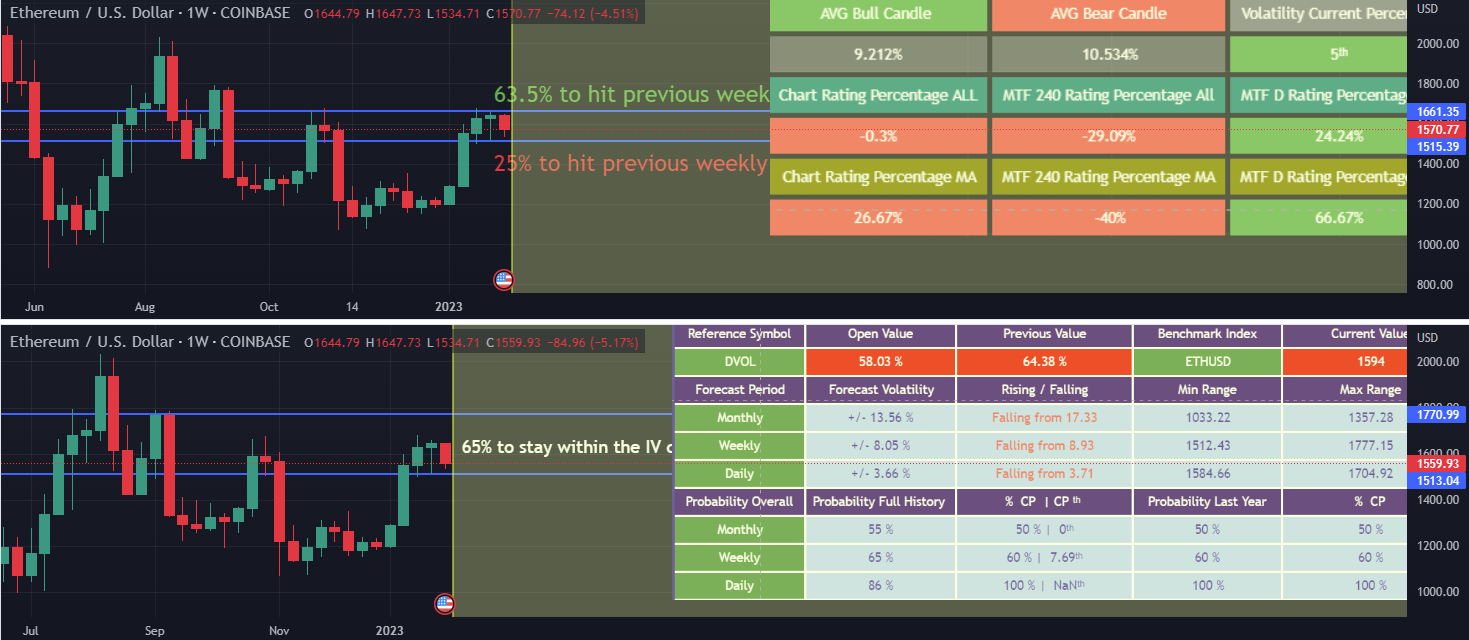

7.ETH Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from DVOL, we can see that currently the IV for this week is at 58.03%, down from 64.38% last week.

This can be translated in +/- 8.05% movement from the open of the candle, which makes the next top/bot channel

TOP: 1777

BOT: 1513

The probability to break this channel(akathe close of the weekly is going to end up either above/below this channel) is at 65%(60% since 2022)

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

63% to touch the previous weekly high

25% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: -40%Bearish Trend

D Timeframe: +66%Bullish Trend

W Timeframe: -26%Bearish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

9.2% from the open candle for the bullish scenario

10.5% from the open candle for the bearish scenario

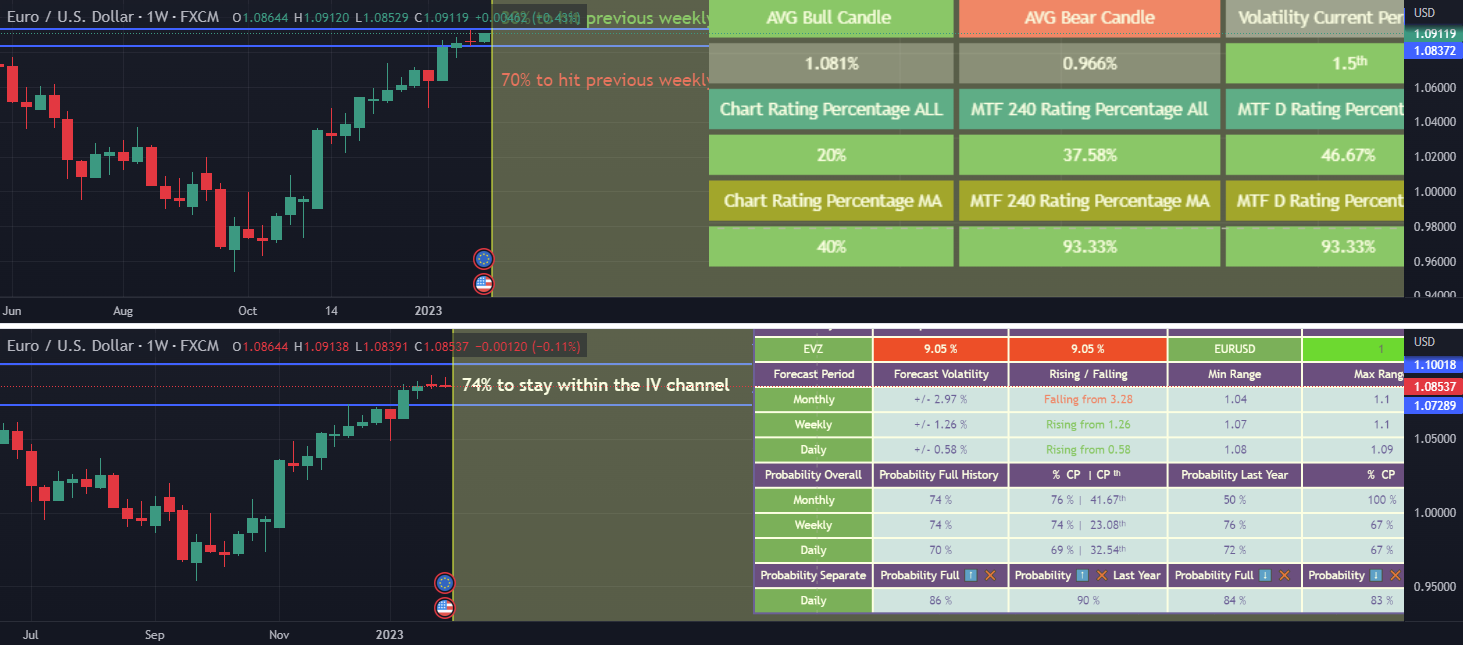

8.EUR/USD Weekly Forecast 30 Jan - 3 Feb 2023

Based on the data from EVZ we can see that currently the IV for this week is at 9.05%, equal to last week.

This can be translated in +/- 1.26% weekly movement from the open of the candle, which makes the next top/bot channel

TOP: 1.10

BOT: 1.073

If we were to make a more accurate statement, based on the current percentile of theEVZ( from 0 to 25) , we can apply a condition in the filter

to look for scenarios when the volatility were lower than 50 percentile( bottom half). If we were to take this data we can see, that our numbers would be:

74% according to the last 20 years of data

67% according to the data since 2022

From the technical rating analysis point of view we can deduct the next information:

Currently there is a :

30% to touch the previous weekly high

70% to touch the previous weekly low

At the same time if we are going to take a look at the moving average rating for different timeframes we can see :

4H Timeframe: +93%Bullish Trend

D Timeframe: +93%Bullish Trend

W Timeframe: +40%Bullish Trend

Lastly on average, based on the current percentile, we can expect that our asset is going to move:

1.081% from the open to the close candle for the bullish scenario

0.966% from the open to the close candle for the bearish scenario

https://www.tradingview.com/chart/GOLD/CXGLPWRO-Gold-Weekly-Forecast-30-Jan-3-Feb-2023/

Comments