23Q3 Performance Review

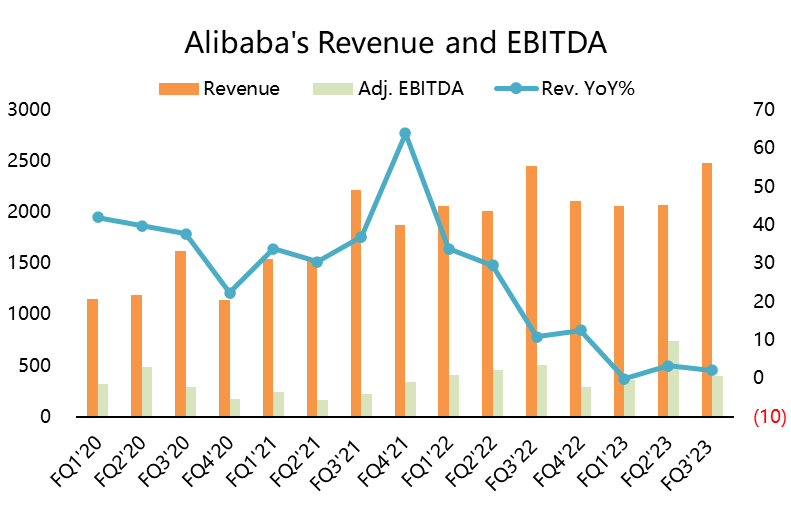

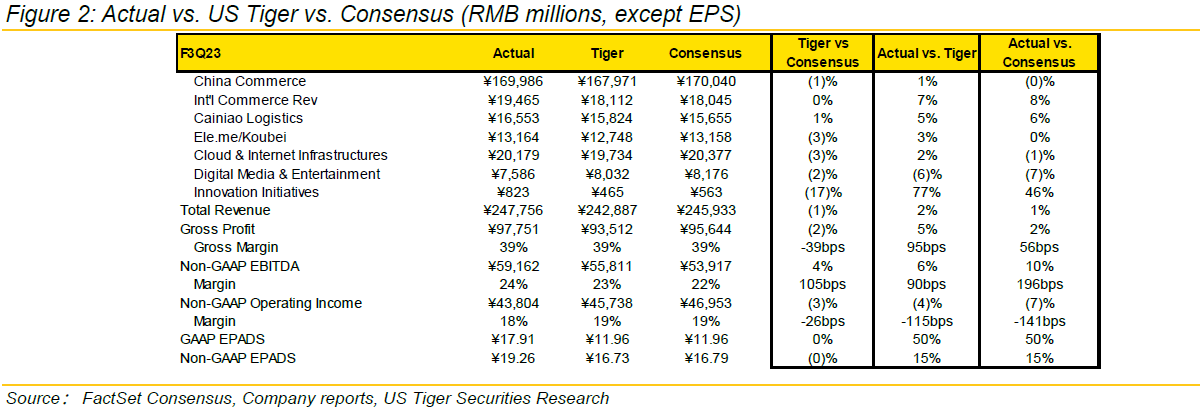

$Alibaba(BABA)$ announced its results in the Q3 quarter of fiscal year 23 (as of December 31, 22). Revenue 247.8 billion RMB (+2.1% YoY), roughly meet market expectations; Adjusted EBITA 52 billion yuan (+16% YoY), beat consensus by 13.3%; Net Income contribute to shareholders 46.8 billion yuan (about 6.788 billion US dollars); EPADS adj. is 19.26, both beat market consensus.

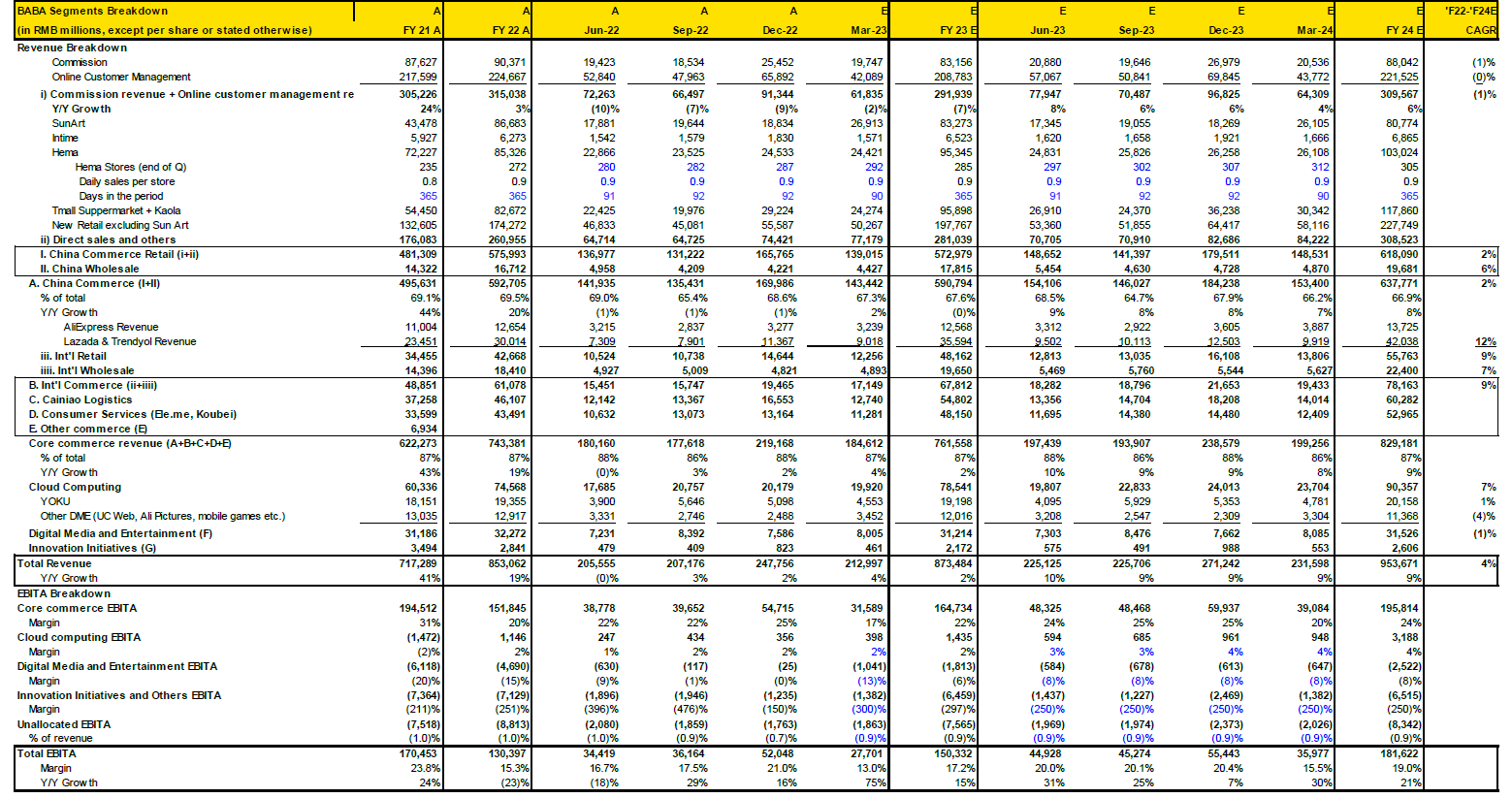

Due to soft demand and logistics disruptions related to COVID, physical GMV on Taobao and Tmall declined mid-single-digit y/y in the Dec. quarter (vs. low-single-digit decline in Sep. quarter). Similar to the previous quarter, due to a higher return rate (primarily on COVID related fulfillment disruptions), CMR declined 9% y/y.

For the March quarter, the mgmt. indicates GMV growth was worse than Dec. quarter (mid-single-digit decline) through the end of Chinese New Year, but started to recover and has resumed growth since the Lantern Festival (Feb. 5). Moreover, with logistics returning to normal, the company expects the gap between GMV and CMR to narrow. Overall, the company is confident in achieving CMR growth in '23.

Investment Highlights

Core Merchandise Revenue, by fierce competition and pandamic. Due to the disturbance of demand, pandemic and supply chain. Taobao Tmall, once a cash cow, has experienced a decline in GMV and liquidity. As the main source of cash flow of the company, it has a great impact on profit margin and free cash flow.

Pandemic brings short-term uncertainty, however, competitors have brought greater long-term pressure. The launch of Douyin's e-commerce page cannot constitute the migration of users' habits in the short term, but the goal to become a "super App" has become more and more obvious.

Consumption is beginning to recover in March quarter. Although the management expects Q4 GMV to still have a mid-single digit decline, CMR is expected to positive growth in CY2023.

Other business. Direct sales grew 10%, primarily driven by Freshippo and Alibaba Health. Int'l Commerce growth accelerated 14pts to +18% y/y, 7%/8% above Tiger/Street, driven by Trendyol. Cainiao +27% y/y and was 5%/6% above Tiger/consensus, as strength comes from both domestic and cross-border businesses, with domestic mainly driven by the service model upgrade. Local consumer services grew 6% y/y on higher average order value of Ele.me.

Alibaba Cloud's growth rate continued to decline, with a year-on-year increase of 3% to 20.2 billion RMB. Decline of public service industry is obvious, but consumption industried is expected to recover in Q4.

Profits. Non-GAAP EBITDA 6%/13% above Tiger/Street. Gross profit margin was 95bps/56bps above Tiger/Street. By segment, China Commerce's EBITA margin was 34% in F3Q, flat y/y. Consumer Services' EBITA margin was (24%), up from (41%) a year ago. Cloud's EBITA margin was 2%. Cainiao EBITA margin improved to 0% from (1%) a year ago. Overall EBITA margin was 21.0%, up 2.5 pts y/y, vs. +3.5pts in F2Q.

Other highlights. Paid GMV of M2C products on Taobao Deals grew over 35% y/y. Freshippo delivered double-digit same store sales growth. Trendyol order growth was strong in the Dec. quarter.

Estimate revisions. F4Q revenue largely unchanged. Decreasing F4Q EBITDA by 2%, on 31bps lower margin. FY24 revenue largely unchanged.

Valuation. Our $120 (unchanged) price target is based on 14.6x CY23E non-GAAP EPS of $8.20. 14.6x is seven turns lower than the five-year average of 22x given the slowdown in revenue and profit growth.

Risks: 1) Antimonopoly regulation risk: China might impose more antimonopoly regulations on big Internet platforms, including BABA, which might have a negative impact on its revenue/profit outlook; 2) Foreign company risk: US has passed the Holding Foreign Companies Accountable Act, which requires more disclosures by Chinese companies listed in the US and might impact their listing status; 3) Data security risk: China is tightening the data security rules and might restrict companies with sensitive data from listing overseas; 4) VIE risk: China might also tighten the use of a VIE (Variable Interest Entity), a corporate structure most Chinese Internet companies use to attract foreign capital and list overseas; 5) Macro risk: BABA as the biggest eCommerce platform in China, is subject to economic and consumption slowdown; and 6) Competition risk: BABA is competing on multiple fronts and investments might not pay off.

Comments